The Chicago Mercantile Exchange (CME) introduced its Bitcoin (BTC) futures contract in December 2017. This was around the same time that BTC had reached an all-time high of $19,800, but by late 2018 the price had dropped to $3,100. Investors in cryptocurrencies quickly learned that CME derivative contracts allowed them to make bullish bets with leverage, but also enabled them to bet against the price, a practice known as shorting.

Historically, the Securities and Exchange Commission (SEC) has rejected Bitcoin exchange-traded fund (ETF) proposals due to concerns about manipulation on unregulated exchanges. The growing significance of CME’s Bitcoin futures market might address this issue and recently, Hashdex has even requested a Bitcoin ETF that relies on Bitcoin’s physical trades within the CME market.

Professional traders often use BTC derivatives to hedge risks. For instance, one can sell futures contracts while simultaneously buying BTC using borrowed stablecoins using margin. Other examples include selling longer-term BTC futures contracts while purchasing perpetual contracts could help benefit from price discrepancies over time.

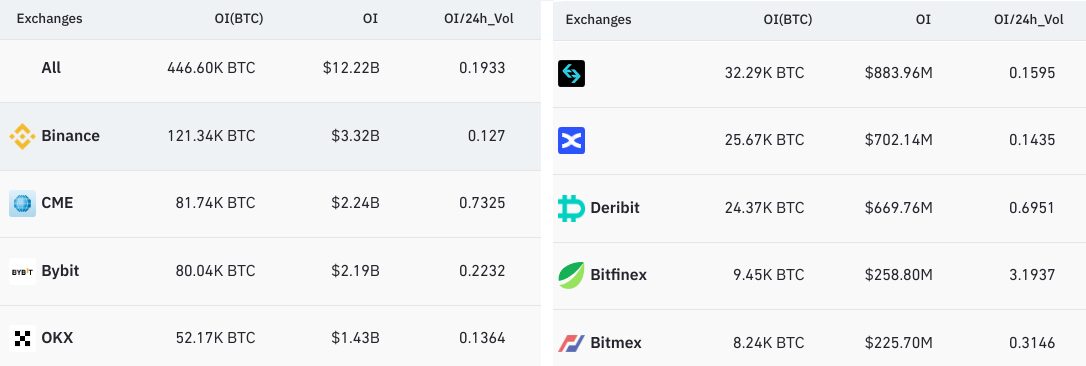

CME overtook Bybit to become the second largest BTC futures market

CME has played a key role in the Bitcoin futures market since 2020, amassing an impressive $5.45 billion open interest by October 2021. However, over the following years, the gap widened as CME’s Bitcoin futures market reached $1.2 billion in January 2023, trailing behind exchanges like Binance, OKX, Bybit and Bitget.

More recently, Bitcoin price dropped by 12.8% between Aug.16 and Aug. 17, leading to a $2.4 billion reduction in the aggregate futures open interest. Notably, CME was the only exchange unaffected in terms of open interest. As a result, CME became the second-largest trading platform on Aug. 17, with a $2.24 billion BTC open interest, according to data from Coinglass.

It’s worth noting that CME exclusively offers monthly contracts, which differs from perpetual or inverse swap contracts, the most traded products on crypto exchanges. Additionally, CME contracts are always cash-settled, while crypto exchanges provide contracts based on both stablecoins and BTC. These distinctions contribute to the difference in open interest between CME and crypto exchanges, but there’s more to the story.

CME futures show discrepancies relative to crypto exchanges

Aside from differences in contract settlement and the…

Click Here to Read the Full Original Article at Cointelegraph.com News…