Bitcoin (BTC) has gone silent over the weekend. CryptoQuant CEO Ki Young Ju said in a recent post on X (formerly Twitter) that Bitcoin’s velocity has declined to a 3-year low. He said this could either be considered positive as whales were holding on to their positions or negative because the transfer to new investors was not happening.

The range-bound action continues to perplex investors about the next possible trending move. In that regard, there was a positive commentary from JPMorgan analysts who said that Bitcoin’s downtrend could be ending. They believe that the declining open interest in Bitcoin futures contracts on the Chicago Mercantile Exchange suggests that the long liquidation is over.

As Bitcoin decides its next move, select altcoins are showing signs of strength. These altcoins could turn negative if Bitcoin’s range resolves to the downside but if Bitcoin turns up or stays in a range, then they may offer a short-term trading opportunity.

Let’s study the charts of the top-5 cryptocurrencies that may move up in the near term and identify the levels that need to be crossed for the bulls to take charge.

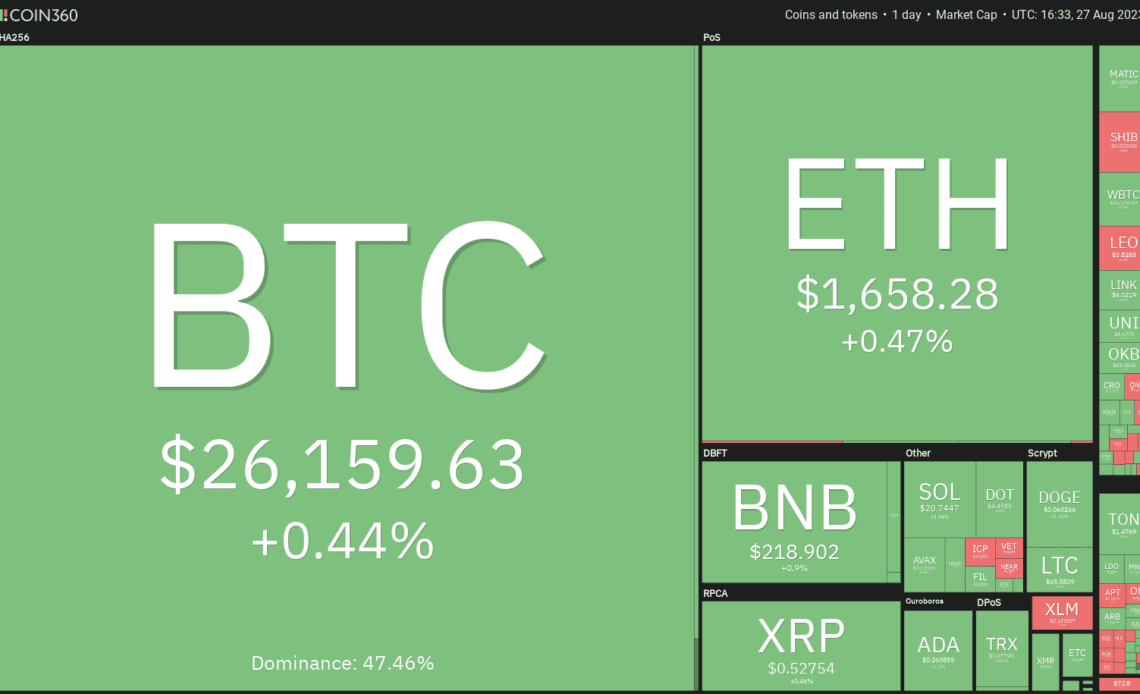

Bitcoin price analysis

Bitcoin formed an inside-day candlestick pattern on Aug. 26, indicating indecision between the bulls and the bears about the next directional move.

The downsloping 20-day exponential moving average ($27,222) and the relative strength index (RSI) in the oversold zone indicate that bears are in command. However, the bulls are unlikely to give up without a fight. They will try to defend the $24,800 level with all their might.

The BTC/USDT pair may start a stronger recovery if buyers thrust the price above the 20-day EMA. That could open the doors for a possible rally to the 50-day simple moving average ($28,888).

If bears want to strengthen their position, they will have to pull the price below $24,800. If they do that, the pair could start a downtrend to $20,000.

The 20-EMA is flattening out and the RSI is near the midpoint on the 4-hour chart. This suggests a balance between supply and demand. If the price crumbles below $25,700, the pair could fall to $25,166 and then to $24,800.

On the contrary, if the pair sustains above the moving averages, it will signal that the bulls have absorbed the selling. There is a minor resistance at $26,314 but if this crossed, the pair could climb to $26,610 and…

Click Here to Read the Full Original Article at Cointelegraph.com News…