Key Takeaways

- Ethereum completed its long-awaited Merge upgrade in September 2022

- Stakers are currently earning approximately 4% APY from their Ether tokens

- 19% of the total Ether supply is staked, the lowest ratio of any of the leading coins

- Staking rewards are divided among stakers, meaning the APY earned decreases as more users stake

- Demand on the network increases gas fees and ultimately contributes to more APY, meaning there are several factors at play when trying to assess where the yield may land

- All in all, it remains up for debate as to where the yield is headed, despite many analysts predicting basement-level yields of 1%-2% are inevitable

The fundamentals of Ethereum were entirely transformed in September 2022 when the Merge went live, the blockchain officially becoming a proof-of-stake consensus. The implications for this are many, however one of the more fascinating aspects is that investors can now earn a yield from staking their Ether tokens.

Let’s dive into how popular staking has been, where it’s trending going forward, and speculate about where the all-important APY may land.

Ethereum stakers are increasing

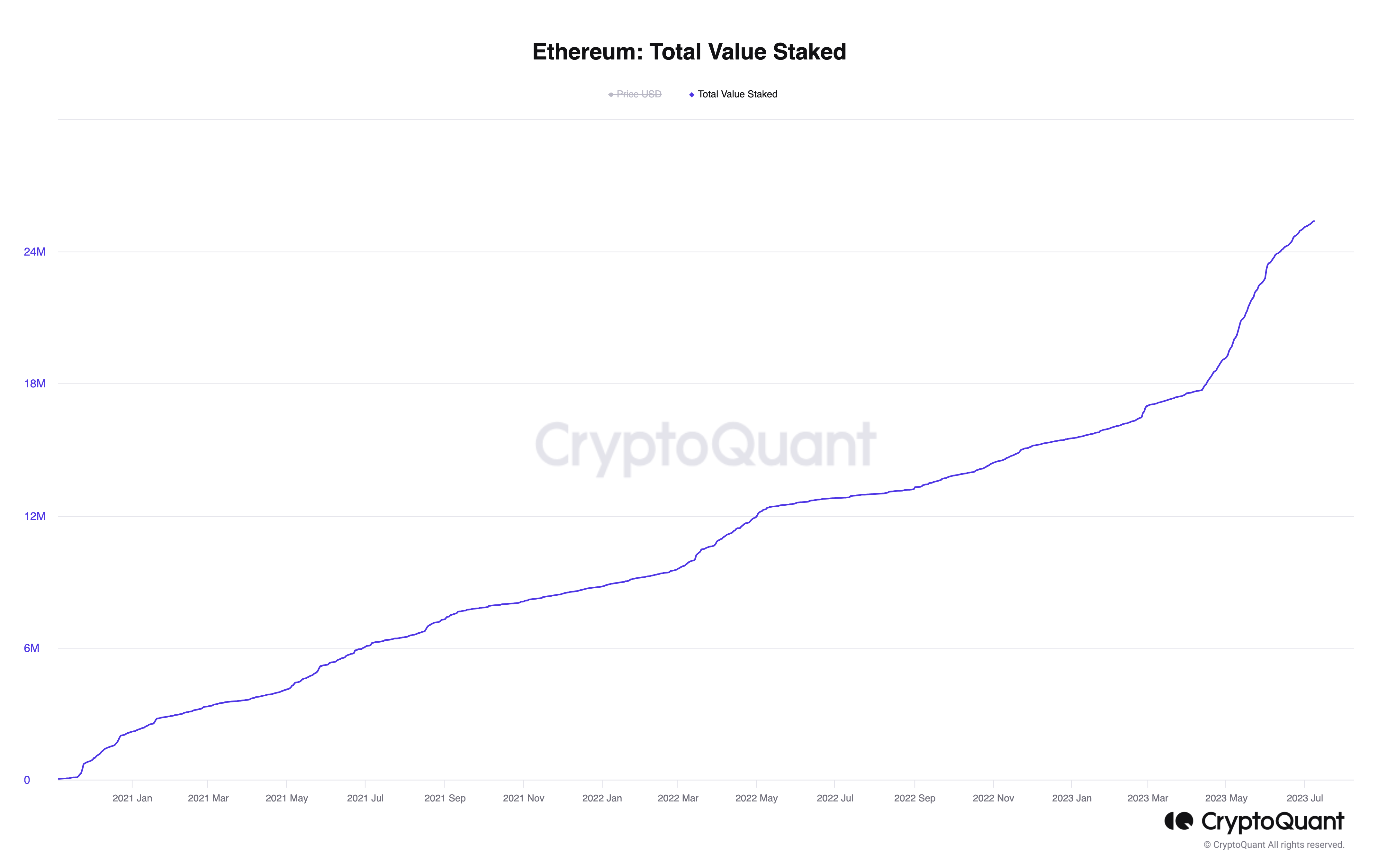

Ethereum staking has proved wildly popular. There is currently almost 18.75% of the total supply staked. The below chart from CryptoQuant shows that not only has the increase been consistent, but the rate of increase has steepened noticeably since the Shapella upgrade in April.

Shapella finally allowed staked Ether to be withdrawn, with some early stakers having had tokens locked up since Q4 of 2020. There was hence some concern that Ether would be withdrawn en masse once the Shapella upgrade went live, the subsequent sell pressure bound to dent the price. Not only has this happened, but staking has only become more popular since the upgrade.

Despite the popularity of Ethereum staking, and the lack of withdrawals sparked by Shapella, the network’s staked tokens as a percent of the total supply still pale in comparison to other proof-of-stake blockchains.

Despite the popularity of Ethereum staking, and the lack of withdrawals sparked by Shapella, the network’s staked tokens as a percent of the total supply still pale in comparison to other proof-of-stake blockchains.

The chart below highlights Ethereum in yellow, its 19% ratio far below the other major proof-of-stake coins. Assessing the rest of the top 10 by staked market cap, these coins average a 53% stake ratio, with only BNB Chain remotely close to Ethereum, sitting at 15%.

If we then shift the chart to assess the total market cap of the staked…

Click Here to Read the Full Original Article at CoinJournal: Latest Bitcoin, Ethereum & Crypto News…