Crypto exchange Binance, on Thursday, August 3, announced that it would be opening trading for the Bitcoin/First Digital USD (BTC/FDUSD) and Ethereum/ First Digital USD (ETH/FDUSD) trading pairs alongside an updated zero-fee Bitcoin and Ethereum trading with newly added FDUSD stablecoin spot and margin pairs.

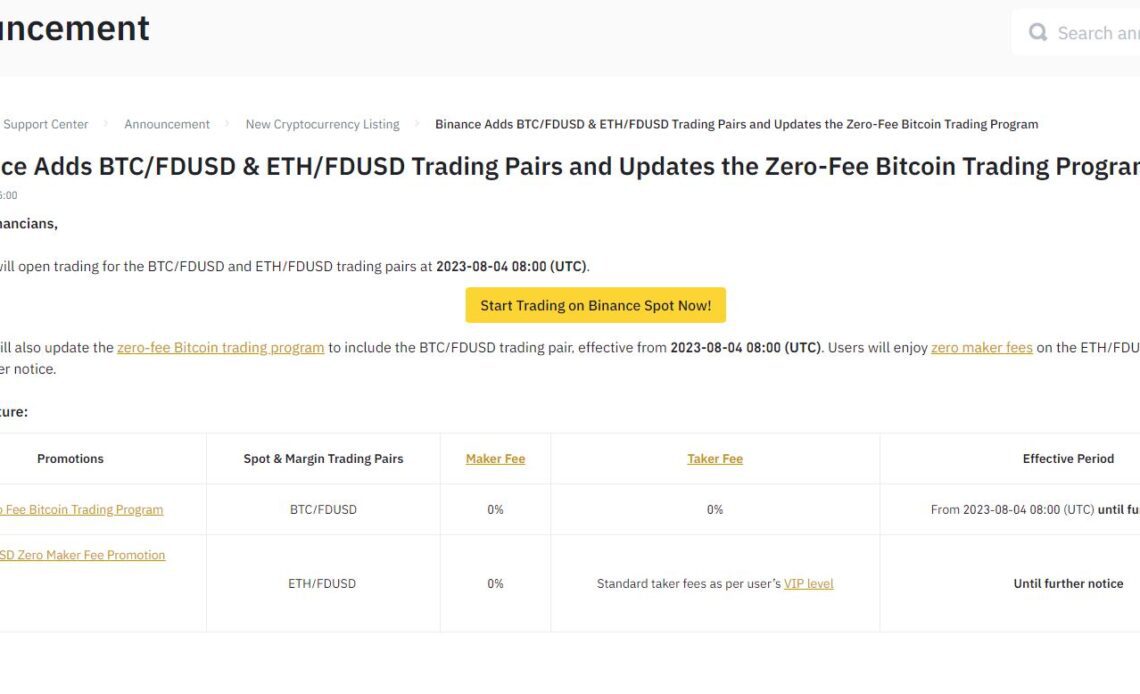

As per the announcement, starting from 08:00 UTC on August 4, users will benefit from zero maker and taker fees for BTC/FDUSD spot and margin trades through the Zero-Fee Bitcoin Trading Program. Additionally, users can trade ETH/FDUSD with zero maker fee, while the standard taker fee will apply based on the user’s VIP level.

The trading volume for BTC/FDUSD spot and margin trading pairs is not included in the VIP tier volume calculation or the Liquidity Providers programs, enhancing the trading experience for users.

“BNB discounts, referral rebates, and any other adjustments will not apply to the BTC/FDUSD spot and margin trading pairs during the promotion.”

The recently introduced stablecoin, FDUSD, scheduled to be listed on Binance on July 26, 2023, at 8:00 am UTC, was postponed until 2:00 pm UTC on July 26 due to FDUSD pairs’ liquidity providers experiencing technical issues.

In March, Binance concluded its zero-fee Bitcoin trading program and BUSD zero-maker fee promotion, shifting to the lesser-known TrueUSD (TUSD) stablecoin from BUSD. This change, along with the removal of Tether (USDT) from the zero-fee program, led to a significant drop in Binance’s market share and trading volumes by over 50%. Consequently, the prices of cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) remained under pressure after the alteration.

Related:Binance’s CZ warns crypto community about emerging scam

First Digital USD is backed by Hong Kong-based custodian and trust company First Digital. The group announced the launch of the United States dollar-pegged FDUSD on June 1. FDUSD’s market cap of $257 million is still low compared to other stablecoins like USDT, TUSD, BUSD and USTC. Thus, it will not have much impact on the crypto market now, but minting new FDUSD amid demand from Binance can cause a significant boost in market cap.

Magazine: Multichain saga screws users, Binance fires 1,000 staff: Asia Express

Click Here to Read the Full Original Article at Cointelegraph.com News…