Key Takeaways

- Crypto volatility has been dropping all year, with Bitcoin’s volatility now at three-year lows

- Volume is also dropping, as the calm markets are not welcomed by traders

- Despite downward-trending volatility, crypto remains highly volatile when compared to other asset classes

Crypto markets are known for violent volatility, capable of both spiking and collapsing in the blink of an eye.

Thus far this year, however, that hasn’t been the case. Volatility has been trickling steadily downward across the space. Assessing the realised volatility of Bitcoin over a rolling one-month window, the metric is currently at a three-year low.

This comes despite Bitcoin having had a bumper year thus far, the asset currently up 76%, treading water around the $30,000 mark. In the past, Bitcoin has oscillated wildly, but this run-up from the low of $15,500 late last year has been distinguished by a steady climb rather than the turbulent ups and downs we have come to expect.

The pattern is not unique to the world’s biggest crypto, either – volatility is falling across the board. The easy way to illustrate this is by looking at Ether. Historically, the price of ETH has been more volatile than BTC, but the divergence has narrowed this year, and Ether is now trading with similar volatility to its big brother.

This relative calm in crypto markets is good on one level, given one of Bitcoin’s most-cited criticisms is its extreme volatility, which most agree it will need to overcome should it ever take the status of a reputable store of value.

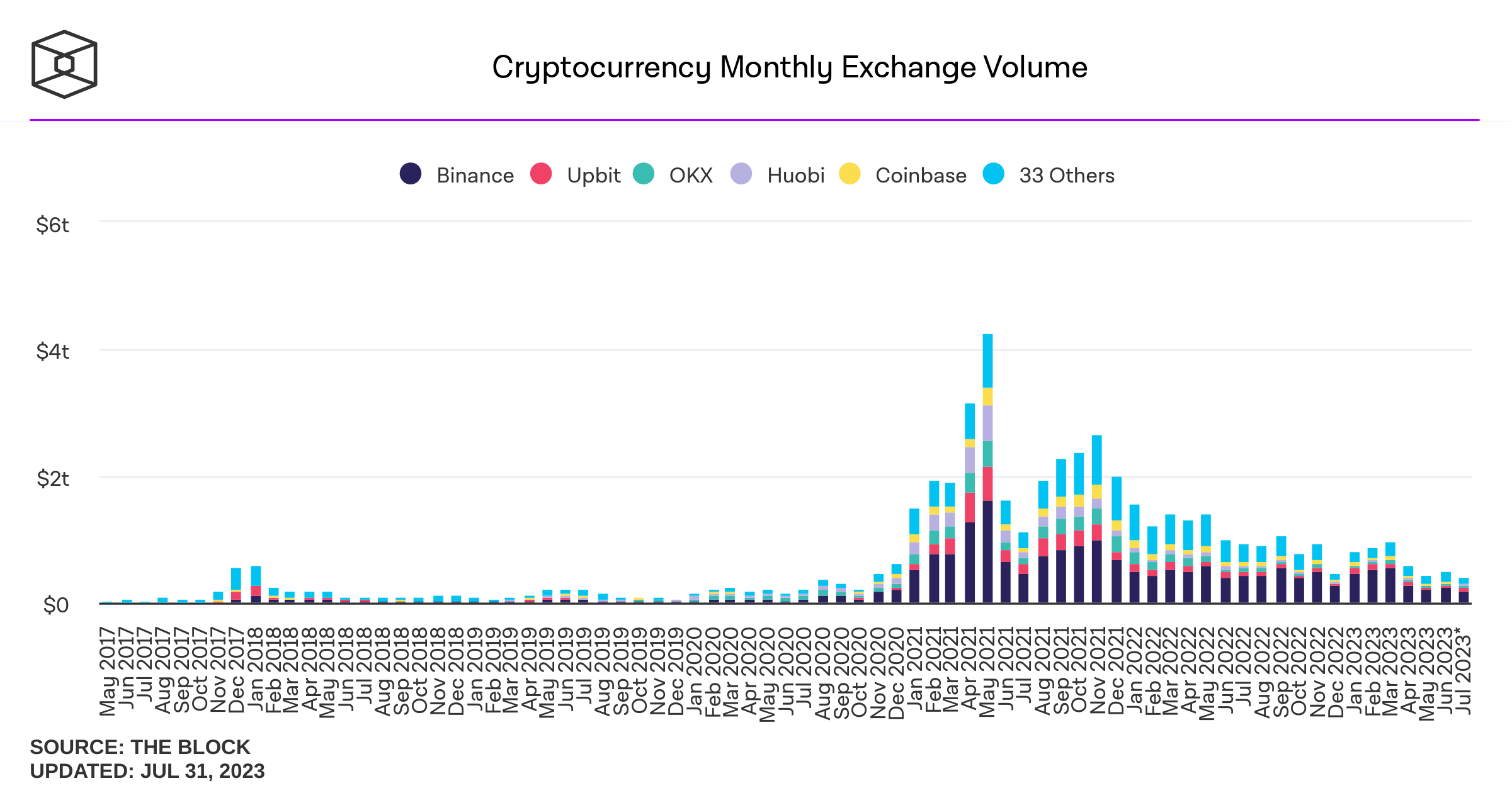

Not everyone is a winner, though. Traders rely on volatility and hence these serene times are not exactly a boon. If we look at spot trading volume, the drawdown has been steep. Granted, there are myriad factors at play here, including regulation, a drawdown in prices, lockdowns ending, scandals (FTX and the SEC lawsuits) and so on, but the lack of volatility is not helping.

The below chart from The Block shows quite how far spot volume has fallen.

Even derivatives trading volume, which had been more stout, has fallen off since April – likely a better gauge for traders than assessing spot volume. Liquidity is not as much of a concern in derivatives markets as it has become in spot markets, but the last few months have begun to see some thinning out there, too.

While the…

Click Here to Read the Full Original Article at CoinJournal: Latest Bitcoin, Ethereum & Crypto News…