Ether price is down today, and several data points are beginning to suggest that further downside could be in store.

On July 24, Ethereum (ETH) experienced a drop close to its monthly low, reaching $1,825, amid Bitcoin’s negative price action, as uncertainty loomed over macroeconomic conditions and a potential whale sell-off.

Several on-chain and technical indicators point to further downside in ETH prices. However, the extent of this downward movement could be limited, considering the profit levels of existing holders and decrease in its liquid supply.

ETH on-chain analysis suggests more downside

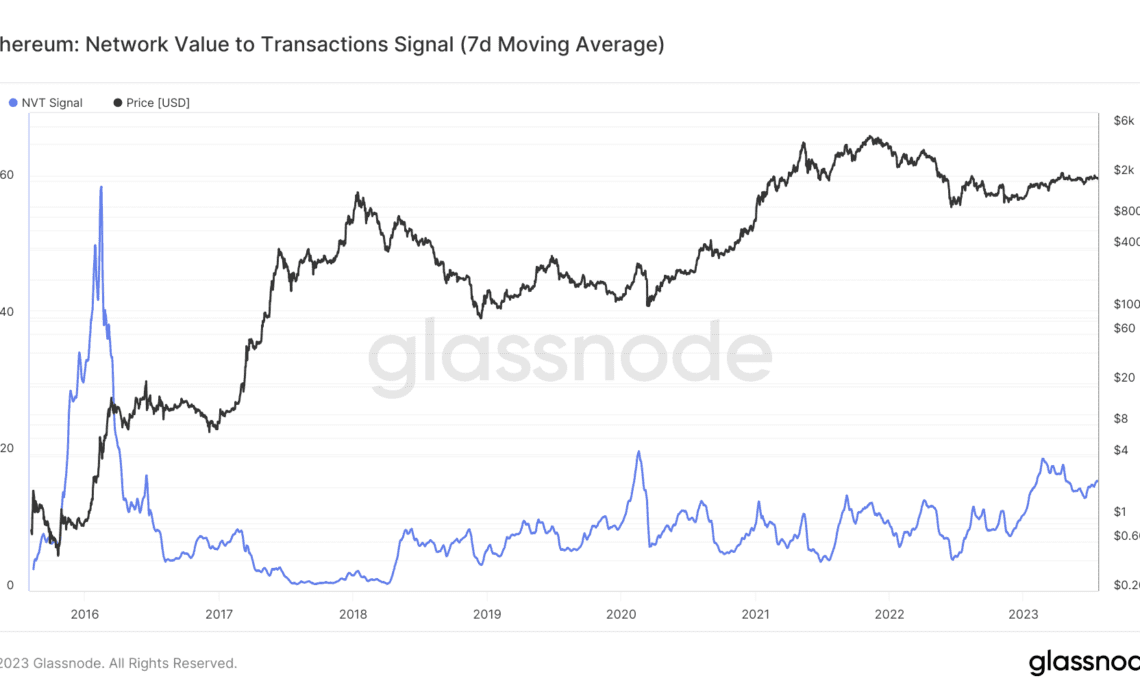

Since the beginning of 2023, Ethereum’s network value to transaction value (NVT) metric has indicated that the asset may have been overpriced.

Glassnode’s NVT signal gauges the relative value of the Ethereum network by comparing the market price to the volume of on-chain transactions. A higher NVT reading implies that ETH could be trading at a premium.

The NVT chart from Glassnode reveals that the metric typically fluctuates between 80 and 30. However, at the start of 2023, it surged to three-year highs of 120 and has maintained higher levels since then. This suggests that either a pullback in price or an increase in Ethereum’s on-chain activity would be necessary to trigger a reset in this metric.

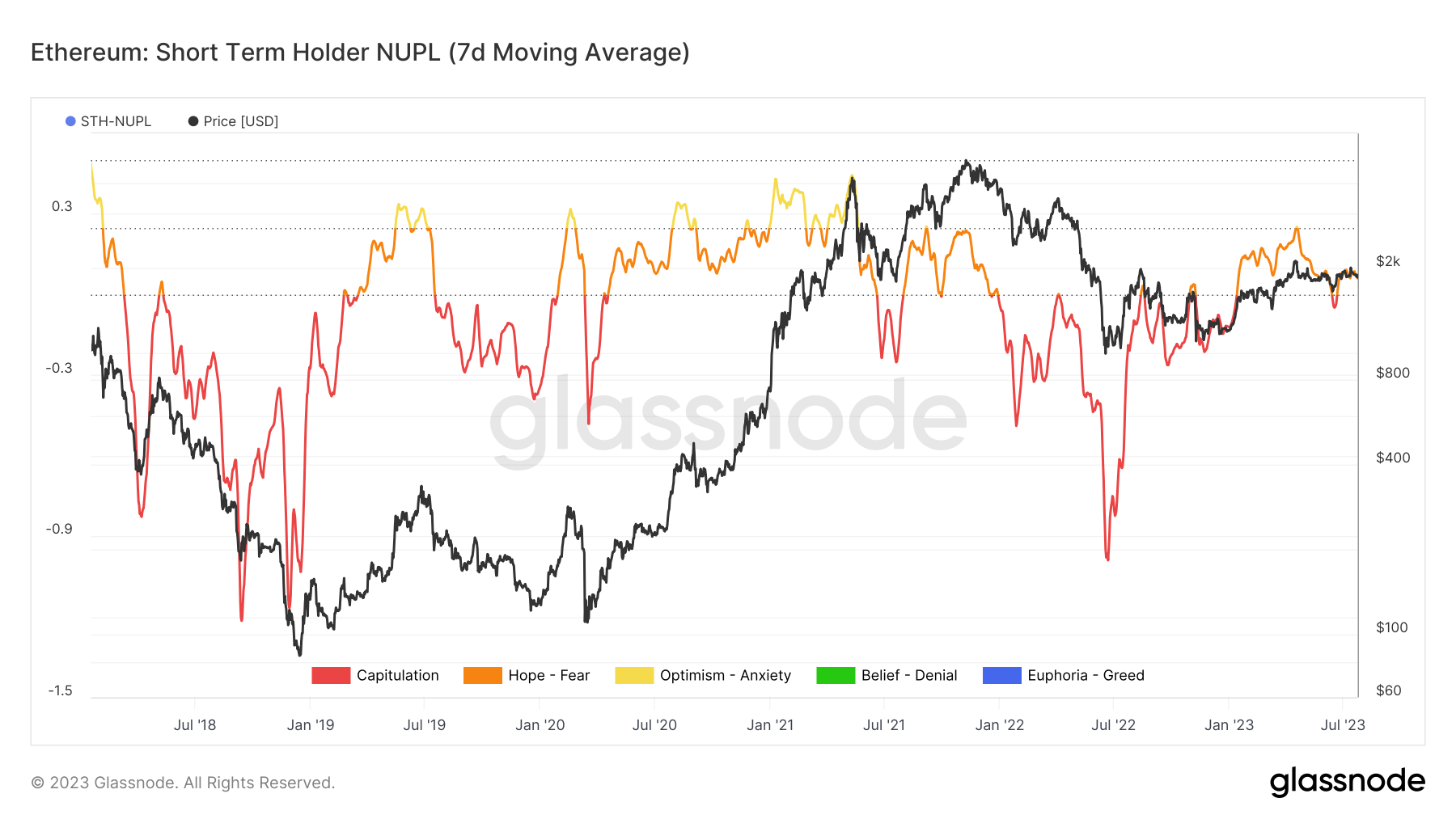

Nevertheless, the profit-levels of short and long-term holders suggest that the downturn could be restricted.

Ether’s negative price action usually reverses when the net unrealized profit/loss (NUPL) metric of short-term holders is negative, meaning short-term holders are in losses. It causes some weak hands to panic sell, allowing buyers to scoop up coins at a cheaper price.

Currently, the short-term NUPL ratio is close to neutral levels. However, there’s room for some downside based on historic levels.

The realized profit/loss metric which evaluates the relative profitability of ETH transfers paints a similar picture. On-chain analytics firm Santiment wrote in its latest analysis that “the ratio of on-chain transaction volume in profit to loss is still favoring profit takes” but not by much.

Santiment analyst Brian Quinlivan added:

“If ETH drops a bit more from here and threatens the $1,700-$1,800 level again, panic sells would come pouring in to justify the buys.”

Similarly, the NUPL ratio of long-term holders is also ranging near 2019…

Click Here to Read the Full Original Article at Cointelegraph.com News…