Bitcoin (BTC) enters the last full week of July on an uncertain footing as $30,000 becomes resistance.

In what promises to be an exciting — but perhaps nerve-racking — week for traders, BTC price action is staring down a combination of volatility triggers.

Chief among these is the United States Federal Reserve’s decision on interest rates, this headlining an important slew of macro data releases.

Some hope that these alone will be enough to shake Bitcoin out of its month-long trading range, in which it has barely moved from the $30,000 mark. The market has so far offered little by way of cues as to where it might head next.

That said, traders have become impatient, and increasingly believe that BTC/USD will ultimately break down from current levels to head toward $25,000 or even lower.

Cointelegaph takes a look at the main factors in the debate over BTC price performance as July comes to a close.

BTC price tags $29,000 in bearish start to week

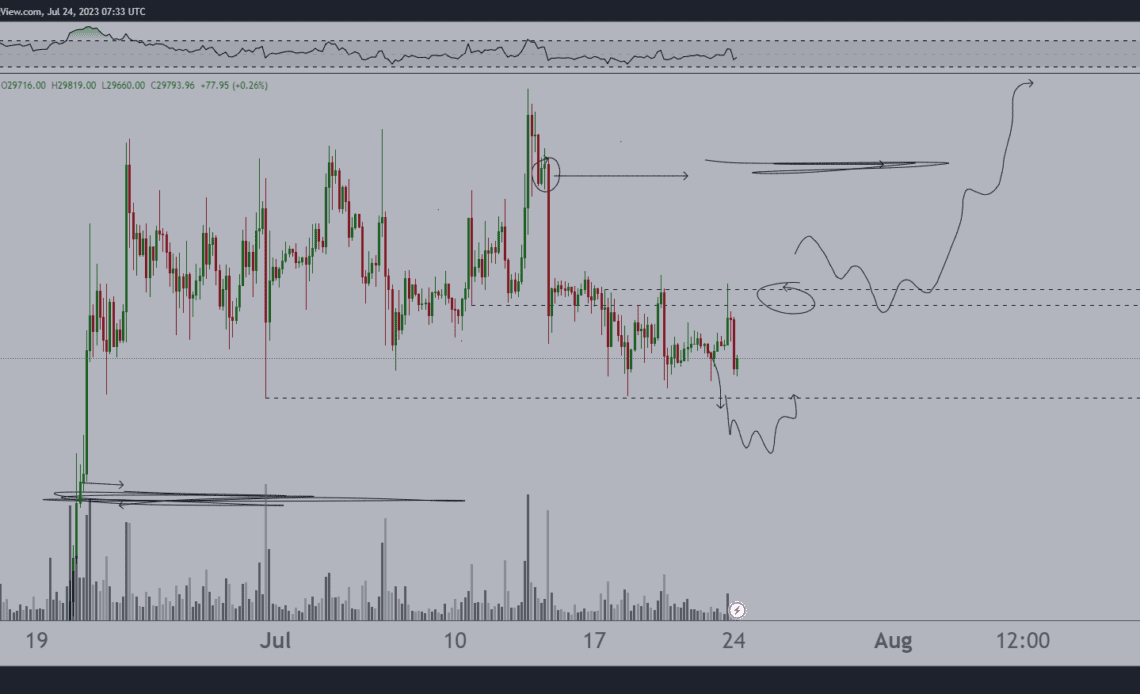

Bitcoin delivered a classic volatility burst into the July 23 weekly close, giving bulls a glimpse of $30,000 support potentially returning.

This was short lived, however, and with hours still left to go until the weekly candle close, BTC/USD retraced its last-minute gains to end the week at almost exactly $30,000.

Overnight price action was weaker still, and at the time of writing, Bitcoin was headed toward $29,000, per data from Cointelegraph Markets Pro and TradingView.

Overall, however, the all-too-familiar range continues to endure.

As the weekend came to a close, Michaël van de Poppe, founder and CEO of trading firm Eight, highlighted what he called the “crucial area” for bulls to break through.

“The crucial level didn’t break for Bitcoin, so we’ll continue the sideways chop,” he continued on the day.

“The scenarios remain the same; – Longs above $30,200-30,400 – Longs when we get to $29,000.”

Popular trader Daan Crypto Trades noted that the spike to $30,300 had effectively opened up and already closed a CME futures gap.

“Don’t fall for the weekend deviations,” he told Twitter followers.

A cautiously optimistic take on the past month’s range came from fellow trader Credible Crypto, who suggested that Bitcoin could avoid more significant losses.

“For the last 30 days price has been within a tight range and aggregate OI has oscillated between 2 key levels,” he summarized….

Click Here to Read the Full Original Article at Cointelegraph.com News…