The double-digit percentage gains for XRP (XRP) this month may have reached the exhaustion point, reflecting the trends elsewhere in the cryptocurrency market.

This follows the euphoria surrounding Ripple’s partial win versus the U.S. Securities and Exchange Commission, resulting in bullish calls for as high as $15 in the coming months.

$15 is reasonable I believe over 18 months or so.

If they IPO and time it correctly, could be up to $35 imo.

Make no mistake… it may not go that high… but $XRP IS breaking an all time high this cycle save some sort of pointless, vindictive SEC appeal. (Low chance) https://t.co/rrMCuOacrE

— Ben Armstrong (@Bitboy_Crypto) July 19, 2023

Nonetheless, fractal analysis of XRP’s recent candlestick and price momentum patterns hints that a sharp market correction is not off the table, particularly if history repeats.

XRP price fractal preceded 65% decline

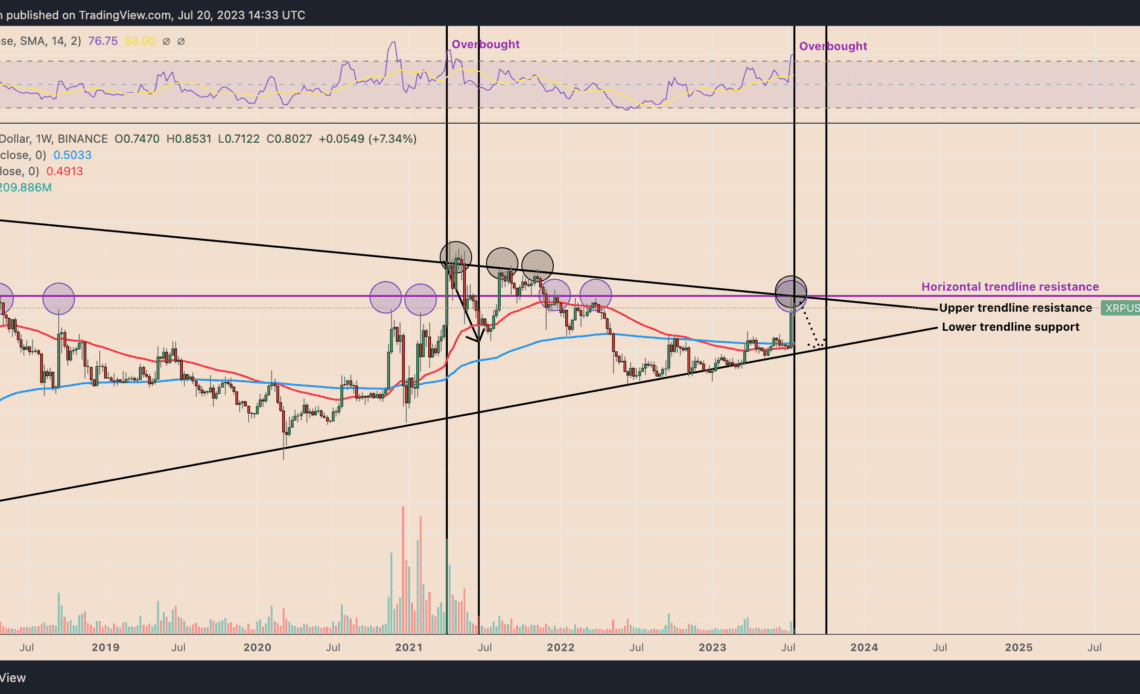

Notably, certain XRP market signals preceded a 65% price decline in Q2, 2021. These are now flashing again, namely the multi-year descending trendline resistance and an “overbought” relative strength index (RSI), as illustrated below.

The descending trendline resistance (marked as “upper trendline resistance” in the chart above) has limited XRP’s upside since January 2018. This price ceiling is helped by another horizontal trendline resistance (purple) near $0.93.

Overall, the resistance confluence, coupled with an overbought RSI, now raises XRP’s risks of a market correction. In this case, XRP price will likely fall toward the lower trendline support near $0.52 by September, down almost 40% from current price levels.

Related: Chair Gensler says SEC reaction to Ripple decision is mixed, still under consideration

Interestingly, the downside target appears closer to XRP’s 50-week exponential moving average (50-week EMA; the red wave), which raises the possibility of a bounce around this level. Moreover, the wave support was the local bottom level during the price decline in Q2, 2021.

As of July 20, XRP price is up 70% month-to-date, outperforming the broader crypto market, which rose only 5% in the same period.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Click Here to Read the Full Original Article at Cointelegraph.com News…