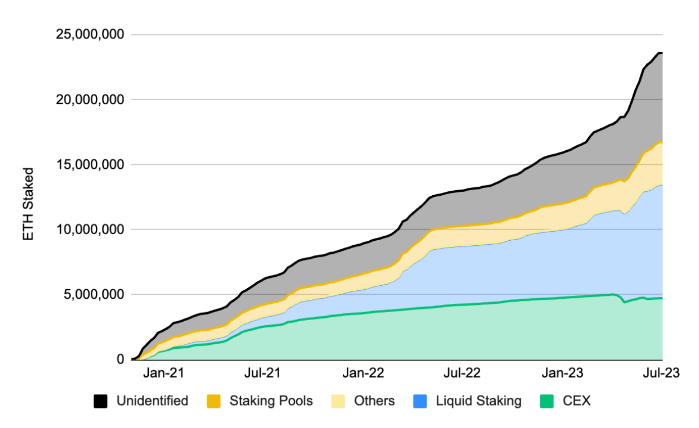

Liquid staking is a decentralized finance (DeFi) subsector that lets users earn yield by staking their tokens without losing their liquidity. It has become the biggest DeFi sector in terms of total value locked (TVL), according to crypto exchange Binance’s Half-Year Report 2023.

Within the report, the crypto exchange highlighted that liquid staking had dethroned decentralized exchanges (DEXs) as the top-ranking DeFi category by TVL as of April 2023.

The staking mechanism was a crucial part of staking Ether (ETH) before the Ethereum Shanghai upgrade when users were unable to freely unstake their ETH. By then, liquid staking tokens (LSTs) provided users with liquidity while they earned yield with their ETH.

On April 13, the Shanghai update went live on the Ethereum mainnet, allowing users to withdraw their staked ETH. Despite this, the report said that liquid staking still continued to grow. “Interestingly, growth continues to be extremely strong post-Shanghai, with liquid staking being the most common way for users to stake ETH,” Binance wrote.

Related: Rapid growth in DeFi-focused Ethereum liquid staking derivatives platforms raises eyebrows

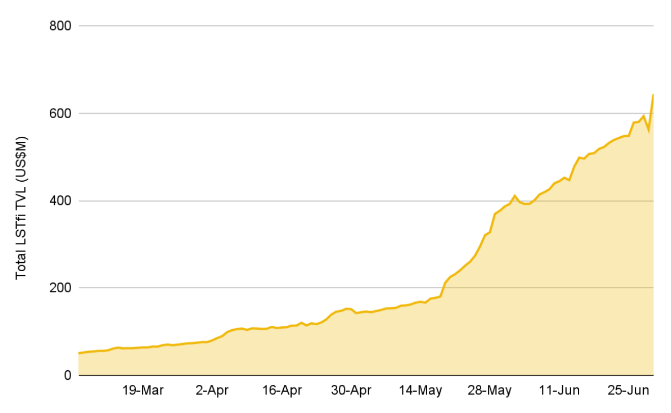

In addition, the Binance report also noted the emergence of the term “LSTfi,” which is also sometimes called “LSDfi.“ The term combines liquid staking and DeFi, with projects like yield-trading protocols, indexing services, and projects allowing users to mint stablecoins using LSTs as collateral categorized as LSTfi protocols.

According to the report, the market is relatively concentrated on the top protocols during its early stages. However, Binance predicted this will change as more new projects emerge under this category in the near future.

While liquid staking has become popular of late, users still need to be mindful of some aspects. In a statement, a Binance spokesperson told Cointelegraph that users need to be wary of some risks associated with liquid staking. This includes exposure to smart contract vulnerabilities, slashing risks and price risks. They explained:

“Liquid staking involves users interacting with an additional layer of smart contract, which might expose them to the potential of bugs in the smart contracts used by liquid staking protocols. Therefore, it is important that users do their own research.”

In addition, the Binance…

Click Here to Read the Full Original Article at Cointelegraph.com News…