Bitcoin (BTC) is struggling to reclaim its psychologically-important level at $30,000 as analysts predict that choppy accumulation may last for months.

Bitcoin soared to a new yearly high of over $31,800 on July 13, driven by optimism surrounding the potential approval of exchange-traded funds (ETFs) in the United States and Ripple’s landmark legal victory in its case against the U.S. Securities and Exchange Commission (SEC) regarding the classification of XRP as a security.

However, five days after the pump, BTC closed below $30,000 as buyers struggled to push the price back above the crucial support level.

Despite Bitcoin’s price showing weakness in the short-term, historical on-chain movements and empirical data suggest that the worst days of the bear market are likely behind.

Long-term holders are unmoved, but short-term investors could sell

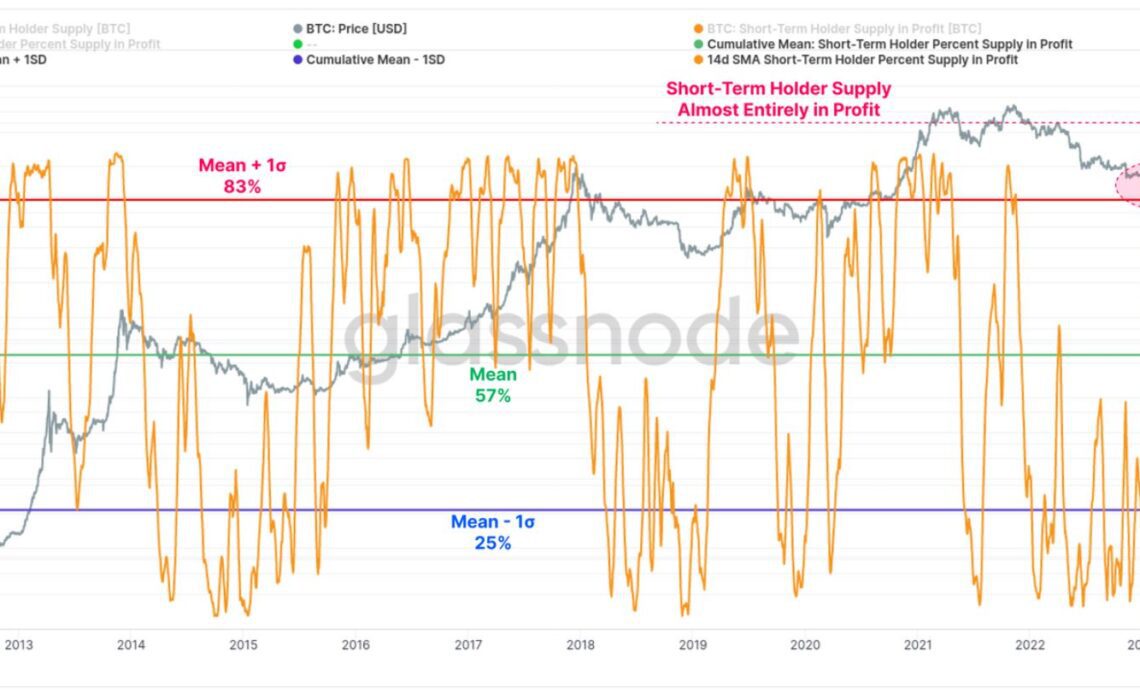

Glassnode’s latest report shows that Bitcoin’s price action in the first half of 2023 was mainly dominated by short-term investors.

According to Glassnode, 88% of short-term holders’ supply is in profit as this “cohort is becoming increasingly likely to spend and take profits.”

The short-term holder’s profit spiked significantly after BTC took off from $25,000 after BlackRock’s ETF filing instilled optimism among buyers.

The metric met with resistance as its reading surpassed the 90% market with Bitcoin’s break above $31,000, suggesting that almost all short-term holders are in profit. A correction in BTC is required in the short-term to reset this metric for further gains.

However, despite the price surge in the first half of 2023, long-term investors refrained from selling. The net realized profit/loss metric reflects a noticeable difference in the levels of profit booking between the bullish phase and the current market conditions.

Glassnode’s analyst wrote, “this reflects the first sustained profit regime since April 2022” which is “similar in scale to both the first half of 2019, and also late 2020.”

While selling pressure from long-term holders is minimal and the asset has witnessed on-chain positive accumulation since the start of July, the profit levels of short-term holders induce the risk of further correction.

Investors anticipate the Bitcoin halving pump

Despite the current price action, many investors and analysts still expect Bitcoin upcoming block reward…

Click Here to Read the Full Original Article at Cointelegraph.com News…