Bitcoin (BTC), the pioneering cryptocurrency that sparked a global revolution in digital assets, operates on a unique monetary policy. One of the defining features of Bitcoin is its halving event, which occurs approximately every four years.

This article will explore the economics behind Bitcoin’s halving, examining its effects on price movements and market sentiment. By understanding these factors, investors and enthusiasts can gain valuable insights into the cryptocurrency’s market behavior.

Related: How does the monetary supply affect cryptocurrencies?

What is a Bitcoin halving?

A Bitcoin halving, also known as a “halvening,” refers to the predetermined reduction in the rate at which new BTC are created. It is programmed into the Bitcoin protocol and occurs every 210,000 blocks, which is roughly every four years. The halving event halves the block reward, reducing the number of newly minted Bitcoin awarded to miners.

Supply and demand dynamics

A Bitcoin halving directly impacts the supply and demand dynamics of the cryptocurrency. By reducing the rate at which new BTC enters the market, halving effectively reduces the available supply. As the supply decreases, assuming demand remains constant or increases, basic economic principles suggest that the price of Bitcoin should rise.

Supply and demand is the basic economic principle supporting a price increase in response to Bitcoin’s halving. The law of supply and demand states that prices tend to increase when a commodity’s supply declines, and demand either stays the same or rises. The Bitcoin halving slows the rate of new Bitcoin creation and market release.

As a result, there are fewer newly created BTC available for purchase. The diminished supply produces a scarcity effect, which might push the price upward if demand for Bitcoin stays the same or rises.

Bitcoin’s controlled supply is a key factor contributing to its value proposition. The total supply of Bitcoin is limited to 21 million coins, and the halving mechanism gradually reduces the rate at which new BTC are produced until the maximum supply is reached. This scarcity aspect, coupled with the increasing recognition and adoption of Bitcoin, can create a perception of limited availability and drive up demand, thereby impacting the price.

Historical price movements

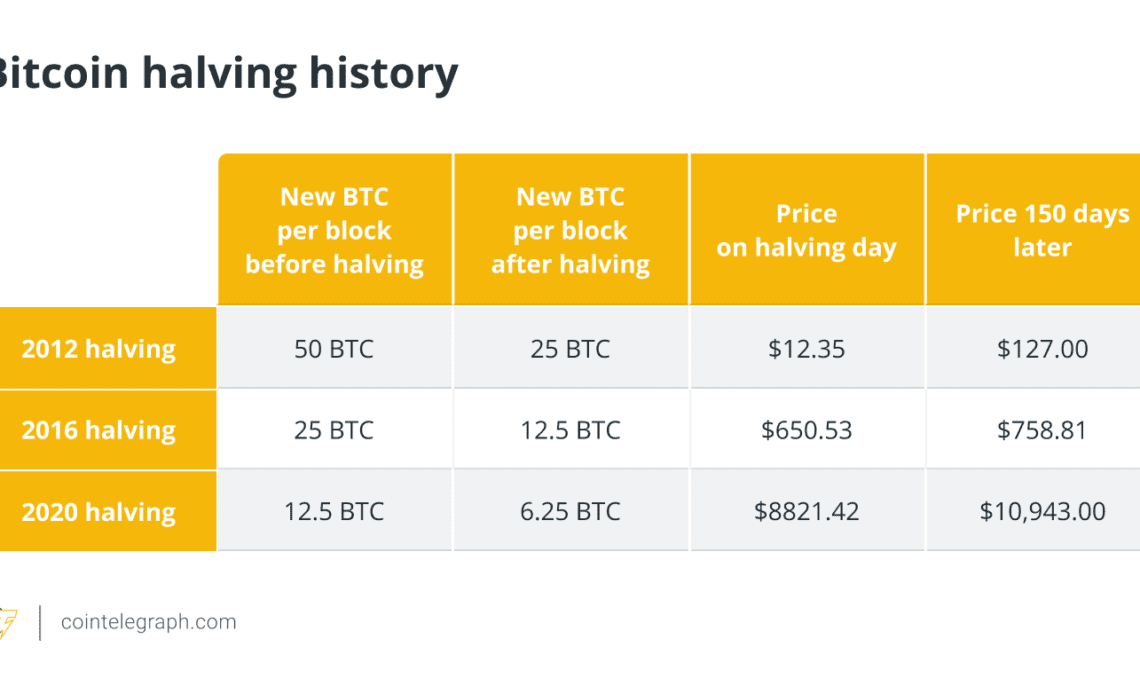

Halving events have frequently been associated with increases in the price of Bitcoin, with significant upward momentum both before and after previous halvings. For example,…

Click Here to Read the Full Original Article at Cointelegraph.com News…