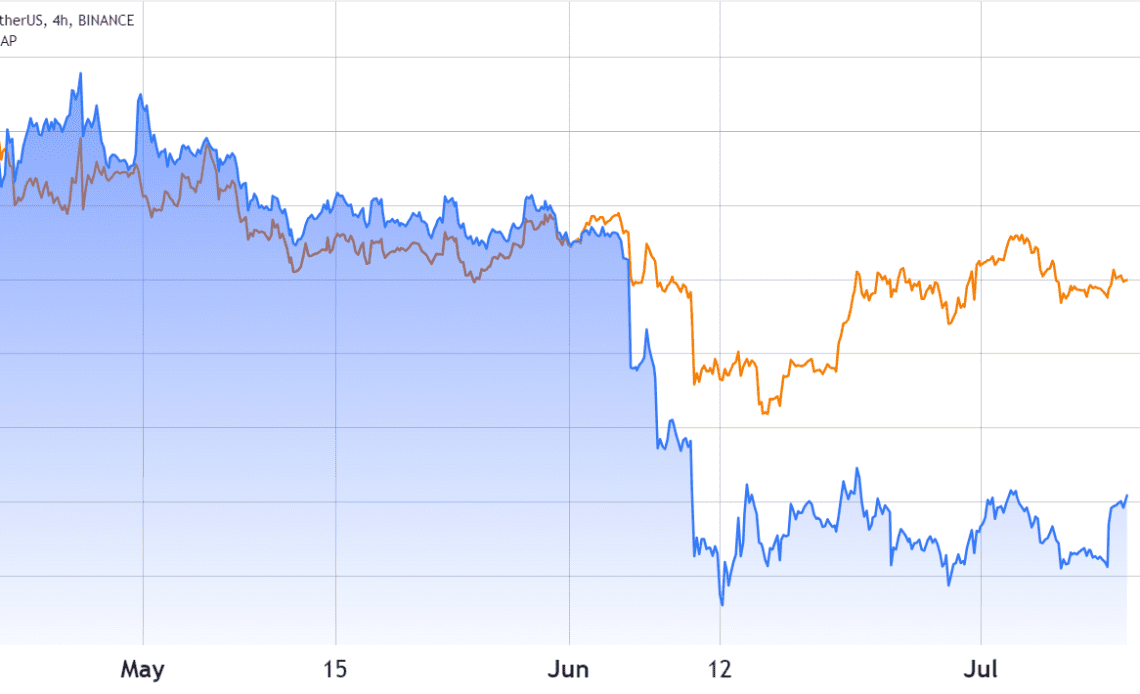

The price of BNB token has experienced a 24.5% decline over the past 90 days, despite a 7% gain between July 10 and July 11. BNB has performed worse than the overall altcoin market, indicating that the underlying cause for the bearish momentum persists.

It is highly likely that the correction in BNB’s price can be attributed to the lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against Binance exchange and its CEO Changpeng “CZ” Zhao on June 5, as the decoupling coincides with that event.

To gain a more comprehensive understanding of the situation, analyzing derivatives contracts provides valuable insights into the positions of whales and market makers.

Is the recent BNB price rally sustainable?

This analysis should highlight whether the surge above $245 on July 11 is supported by an improvement in sentiment or a balanced demand for leverage through BNB derivatives.

Price is undoubtedly the most important metric for understanding traders’ sentiment, but it does not encompass all possibilities. For instance, between August 2022 and September 2022, BNB outperformed the altcoin market by 19%.

Regardless of the rationale behind BNB’s rally in 2022, one might conclude that the recent 90-day negative 24.5% performance represent a reversion to the mean, as investors no longer believe the premium is justified.

While no metric is flawless, one should begin by examining the open interest in BNB futures markets to gain a broad overview of the demand for leverage during the recent underperformance.

BNB futures open interest rose, but is it bullish?

In futures markets, long and short positions are always balanced, but a higher number of active contracts, or open interest, is generally positive as it allows institutional investors, who require a certain market size, to participate. Moreover, a significant increase in the number of contracts in play typically indicates increased trader involvement.

Notice how the BNB futures open interest surged from $355 million on July 5 to the current $476 million, approaching its highest levels in 18 months. This data leaves no doubt about the demand increase for leverage using futures contracts.

The previous peak in open interest, at $490 million, occurred on November 5, 2022. Interestingly, on that very…

Click Here to Read the Full Original Article at Cointelegraph.com News…