Bitcoin (BTC) staged a fresh breakout attempt into July 11 as the battle for yearly highs stayed hot.

$31,000 reappears in BTC price “leverage crunch”

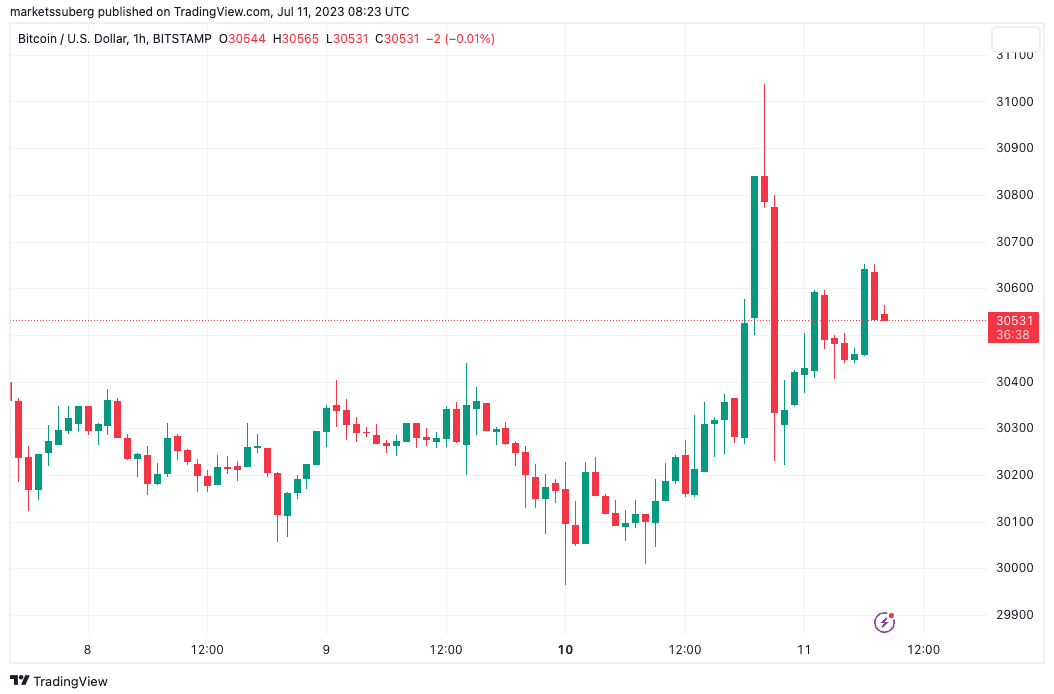

Data from Cointelegraph Markets Pro and TradingView showed BTC price briefly passing $31,000 before the July 10 daily close.

In a copycat move, seemingly with last week’s snap higher for inspiration, BTC/USD managed to approach resistance before momentum waned, subsequently falling back over $800.

Some form of continuation did set in thereafter, and at the time of writing, Bitcoin traded around $30,500.

For Michaël van de Poppe, founder and CEO of trading firm Eight, the overnight move had all the hallmarks of a “leverage crunch.”

“The markets just continues chopping,” he told Twitter followers in his latest update.

“Bitcoin had a leverage crunch in the past 24 hours, taking out all the highs & going back to the start in one go. The only difference between now and Thursday? No new lows have been made. $30,200 supporting. Don’t get chopped out!”

Popular trader Crypto Daan compared recent behavior with the “Bart Simpson” style chart features from before, where BTC price would spike to a plateau and hold there, only to retrace the full run later. Currently, however, Bart has been replaced with a structure reminiscent of the Burj Khalifa.

#Bitcoin In previous cycles we had “Bart Moves”.

This time around we’re getting “Burj Khalifas” everywhere. pic.twitter.com/87S0axbKWF

— Daan Crypto Trades (@DaanCrypto) July 10, 2023

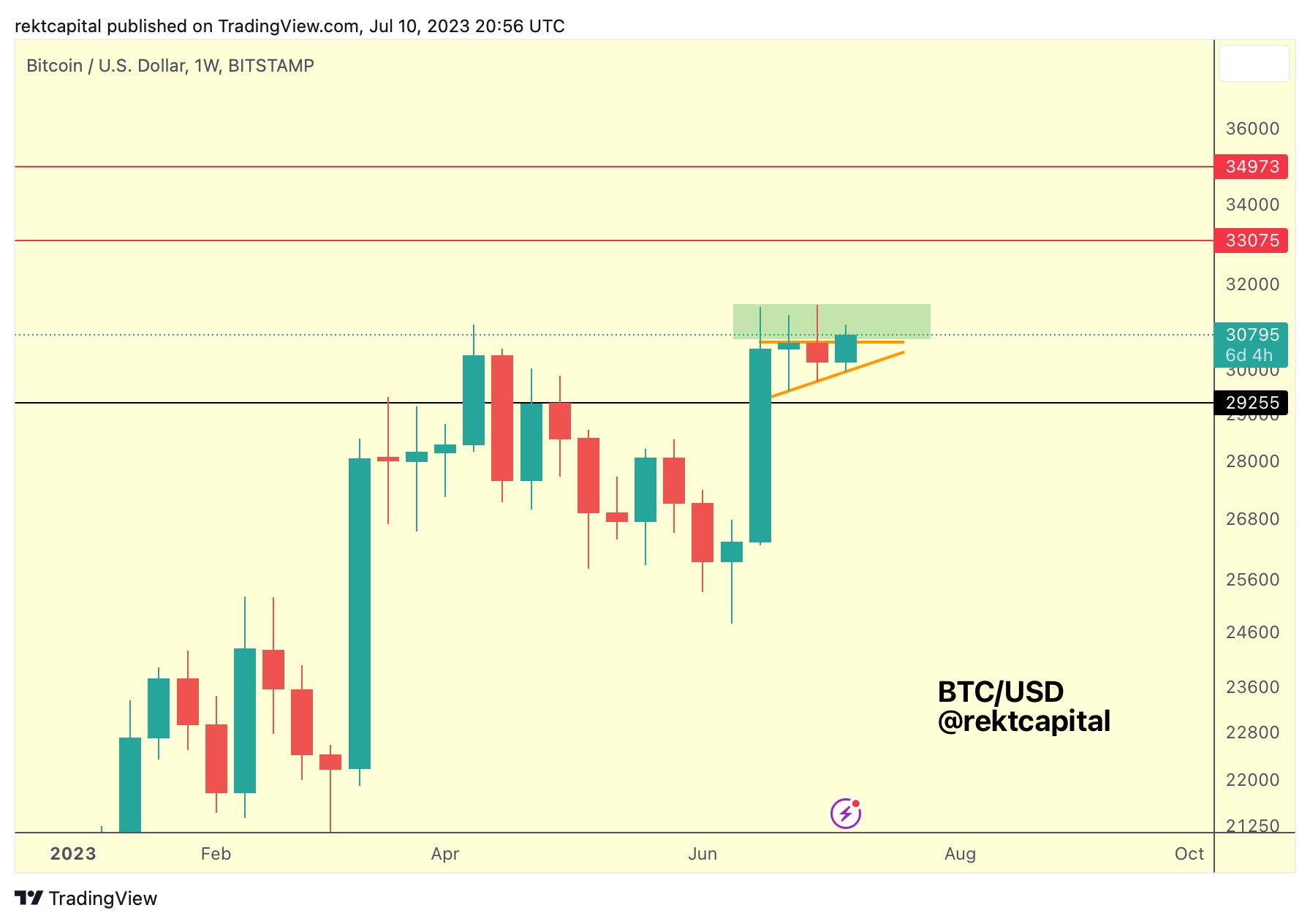

Trader and analyst Rekt Capital meanwhile flagged $30,600 as the level to flip.

“BTC is now pressing past the ~$30600 Ascending Triangle resistance. But it’s key to note that $BTC has pressed past this level before only to form an upside wick,” he said during the overnight run to $31,000.

“So BTC needs to turn the ~$30600 into support in the coming days for BTC to confirm its breakout.”

“Re-accumulation” as usual

Bitcoin nonetheless remained in a familiar range in play for multiple weeks.

Related: CPI meets low BTC supply — 5 things to know in Bitcoin this week

In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode suggested that this was characteristic of Bitcoin price cycles.

“Bitcoin data often displays strangely repetitive patterns cycle after cycle. In the 2021-22 cycle, the $30k…

Click Here to Read the Full Original Article at Cointelegraph.com News…