Bitcoin mining companies outperformed BTC price by a huge margin amid the recent bullish price action in the top cryptocurrency.

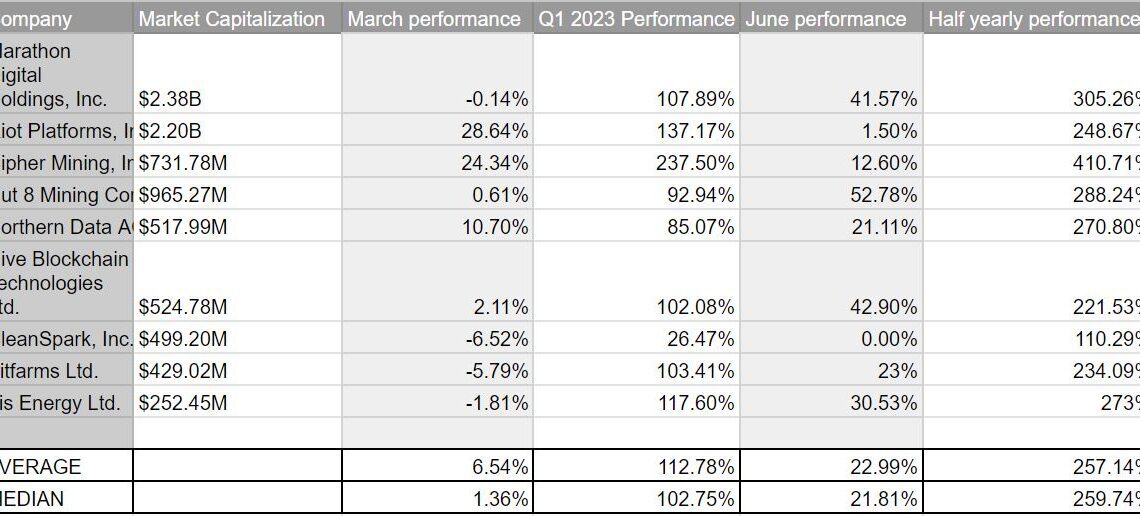

The average year-to-date gains in 2023 across the stocks of top nine public Bitcoin mining firms by market capitalization stood at 257.14%. The figure is almost three times higher than BTC’s gain in the same period.

The higher gains represent the leveraged beta effect that mining stocks enjoy. Leveraged beta suggests that during Bitcoin upside, these stocks outperform. Whereas, when Bitcoin slumps, they face deeper downside risk.

Due to a high levered beta, Bitcoin’s price performance will remain a crucial factor in determining the direction of mining stocks.

The trends within the mining sector show that miners are positioning themselves for the long-term by buying more machines. However, they have yet to exhibit accumulation levels that match previous bull markets, suggesting that the uptrend in the stocks could stall in the medium term.

Multiple mining companies made expansion moves in the past month which added to the positive sentiments and long-term value of the stocks. At the same time, the mining conditions improved with a dip in hashrate and price increase.

However, on-chain data shows miners unloaded a significant portion of their holdings, which could be a sign of a downturn in the near future.

Mining companies make expansive moves

The public companies in the U.S. made aggressive moves in June, signalling long-term strength in the industry.

Hut 8 Mining Corp. (HUT8) merger with US Bitcoin Corp (USBTC) increased its total hashrate to 9.8 EH/s, making it the third largest public mining entity in the U.S. However, it also took a debt of $50 million from Coinbase.

Cleanspark (CLSK) invested $9.3 million to increase its hashrate by almost 1 EH/s.

At the same time, Riot Blockchain (RIOT) entered into a $170 million deal with mining hardware manufacturer MicroBT to nearly double its hashrate capacity by 2024 upon full deployment.

Mining stocks are prepped for a short squeeze

Marathon Digital Holdings is one of the most shorted stocks on Nasdaq with 25.06% of its float shares shorted, per data from Fintel. For reference, values above 10% are considered heavily shorted.

Similarly, Riot Platform’s 14.54% of float shares are shorted—an increase from 13.48% in May and Cipher Mining at 22.32%.

While the rest have between 5%…

Click Here to Read the Full Original Article at Cointelegraph.com News…