The Bitcoin (BTC) futures’ premium has reached its highest level in 18 months on July 4. But traders are now questioning whether the derivatives metrics indicate “excessive excitement” or a “return to the mean” after a prolonged bear market.

BTC price gains capped by regulators, macroeconomics

Bitcoin’s price has been trading in a narrow 4.4% range since June 22, oscillating between $29,900 and $31,160 as measured by its daily closing prices. The lack of a clear trend might be uncomfortable to some, but that is a reflection of the opposing drivers currently in play.

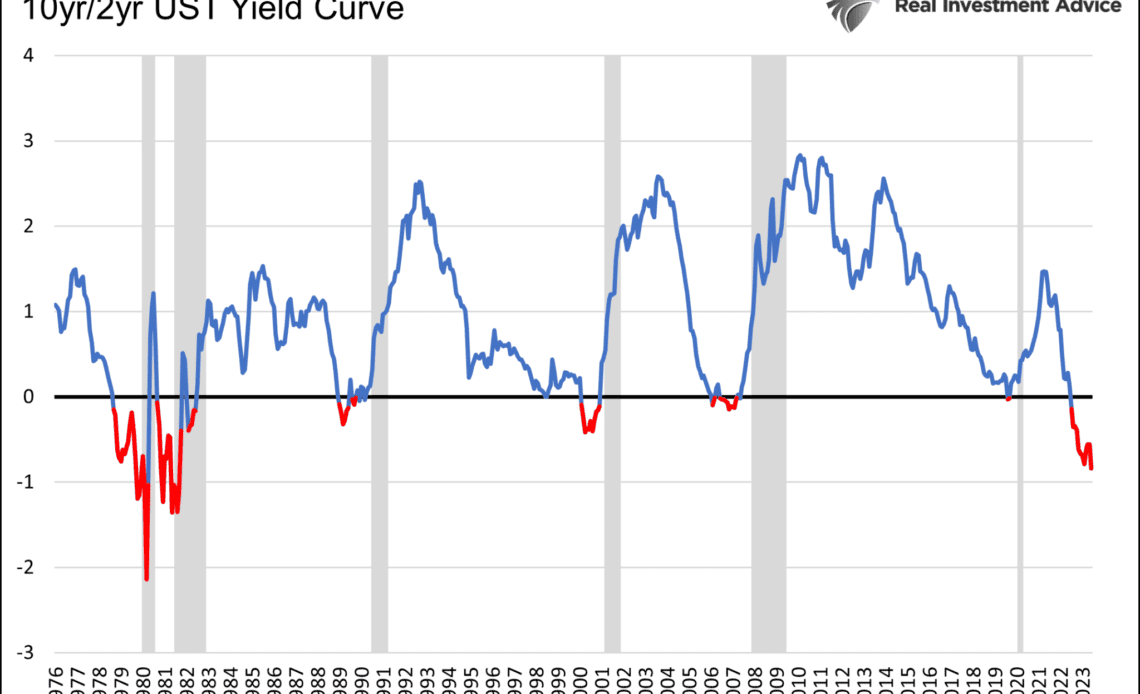

For instance, investor sentiment was negatively affected by the historic reversion of the U.S. Treasury yield curve, which reached its highest level on record.

The closely monitored inverted spread between the 2-year and 10-year Treasury notes has reached its highest level since 1981, standing at 1.09%. The phenomenon known as yield curve inversion, when shorter-dated Treasury notes trade at higher yields than longer-dated notes, typically precedes economic recessions.

Related: Fed pauses interest rates, but Bitcoin options data still points to BTC price downside

On the other hand, signs of strength in the U.S. economy have reportedly driven investors to price in the possibility of further interest rate increases by the central bank to keep inflation under control.

In addition to these macroeconomic distortions, cryptocurrency regulation has also been at the center of investors’ attention as of late. Here are just some recent examples:

- Kraken exchange was required by the U.S. District Court for the Northern District of California to provide details of users who engaged in transactions exceeding $20,000 within a calendar year;

- Thailand’s Securities and Exchange Commission banned crypto lending services, thus prohibiting crypto platforms from offering any form of return on deposited crypto by customers;

- The Monetary Authority of Singapore announced new requirements for crypto service providers to hold customer assets in a statutory trust by year-end.

So investors are probably now asking: Does Bitcoin have the strength to break above the $31,000 resistance? Of course, one must take a potential economic recession and the increasing regulatory clampdown measures around the world into account first.

Luckily, Bitcoin futures’ contract premiums can provide some clues for traders about the market’s next move for reasons discussed below — as…

Click Here to Read the Full Original Article at Cointelegraph.com News…