The introduction of a spot-based Bitcoin (BTC) exchange-traded fund (ETF) would make the asset more accessible to individual investors and mutual funds. What’s more, unlike a futures-based Bitcoin ETF, a spot-based ETF involves actually buying BTC.

So, will the approval of the first Bitcoin ETF be a bullish event? Not necessarily.

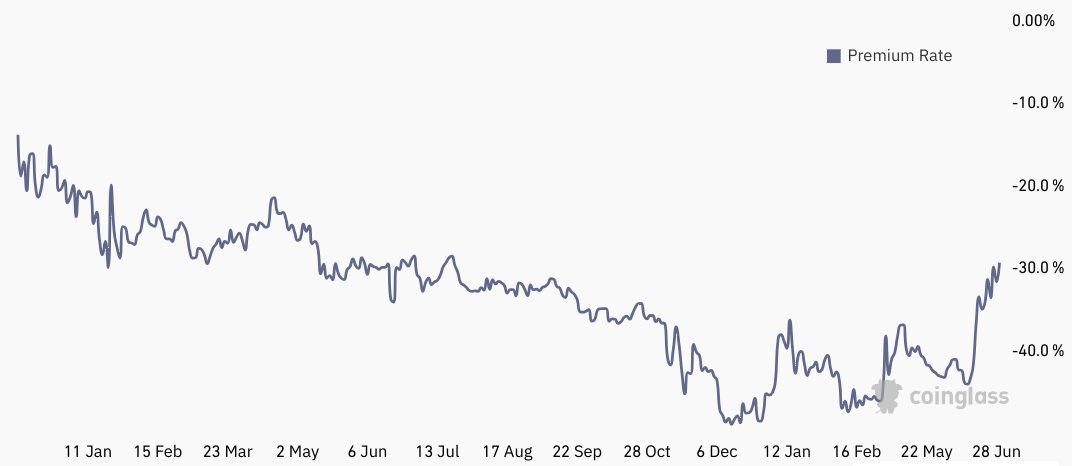

GBTC ‘discount’ remains in the double digits

Over the years, the United States Securities and Exchange Commission (SEC) has rejected every Bitcoin ETF applicant, with the latest denial issued to the VanEck Bitcoin Trust on March 10, 2023.

The SEC concluded that the offer did not have a “comprehensive surveillance-sharing agreement with a regulated market of significant size related to spot Bitcoin.“ Regulators are hesitant to release what many believe would be a more equitable and transparent Bitcoin product.

Investors now question whether the latest bids from ARK Invest and BlackRock to launch spot Bitcoin ETFs might be the solution to Grayscale’s Bitcoin Trust (GBTC), an investment vehicle with shares traded on the stock exchange.

Interestingly, the GBTC “premium” jumped to its best levels in months after BlackRock announced its ETF filing.

But while the potential approval of a spot Bitcoin ETF might seem bullish initially, its consequences for the BTC price can be negative, at least in the short term.

What’s an ETF?

First, an ETF is a form of security that holds diverse underlying investments, such as commodities, stocks and bonds. The ETF may resemble a mutual fund because its issuer pools and manages the given assets.

The most well-known example of this instrument is the SPDR S&P 500 ETF Trust, which tracks the S&P 500 index. State Street manages the mutual fund’s $436 billion worth of assets.

Related: Bitcoin ETF race gets hotter as ARK Invest adds surveillance agreement to application

Buying an ETF grants the investor direct ownership of the fund’s contents, resulting in different tax consequences than holding futures contracts or leveraged positions. While Bitcoin spot ETFs continue to be rejected, identical products have been available for decades for bonds, global currencies, gold, Chinese equities, real estate and oil.

30% GBTC discount is likely justified

The Grayscale Bitcoin Trust — an investment fund with $18.4 billion of assets under management — is currently trading at a -30% discount versus its Bitcoin holdings. This gap…

Click Here to Read the Full Original Article at Cointelegraph.com News…