Key Takeaways

- Bitcoin dominance measures the ratio of the Bitcoin market cap to the cumulative cryptocurrency sector market cap

- It is currently at 58%, the highest mark since April 2021

- Market dynamics are changing as institutions consider Bitcoin, while rest of crypto market still struggles amid tight monetary policy environment

- Regulatory clampdown has also declared many tokens as securities, while Bitcoin appears to be carving out its own niche

The Bitcoin market is never boring.

Having said that, the year 2023 has (thus far at least) has not thrown up mayhem on the scale of what we saw in past years. In 2022, Bitcoin freefell as the world transitioned to tight monetary policy, while scandals such as the Terra collapse and the staggering deception at FTX coming to light. This came after the pandemic years of 2020 and 2021, when crypto surged into mainstream consciousness, Bitcoin printing dizzying gains and inspiring dinner table conversation around the globe as to what this mysterious Internet money was all about.

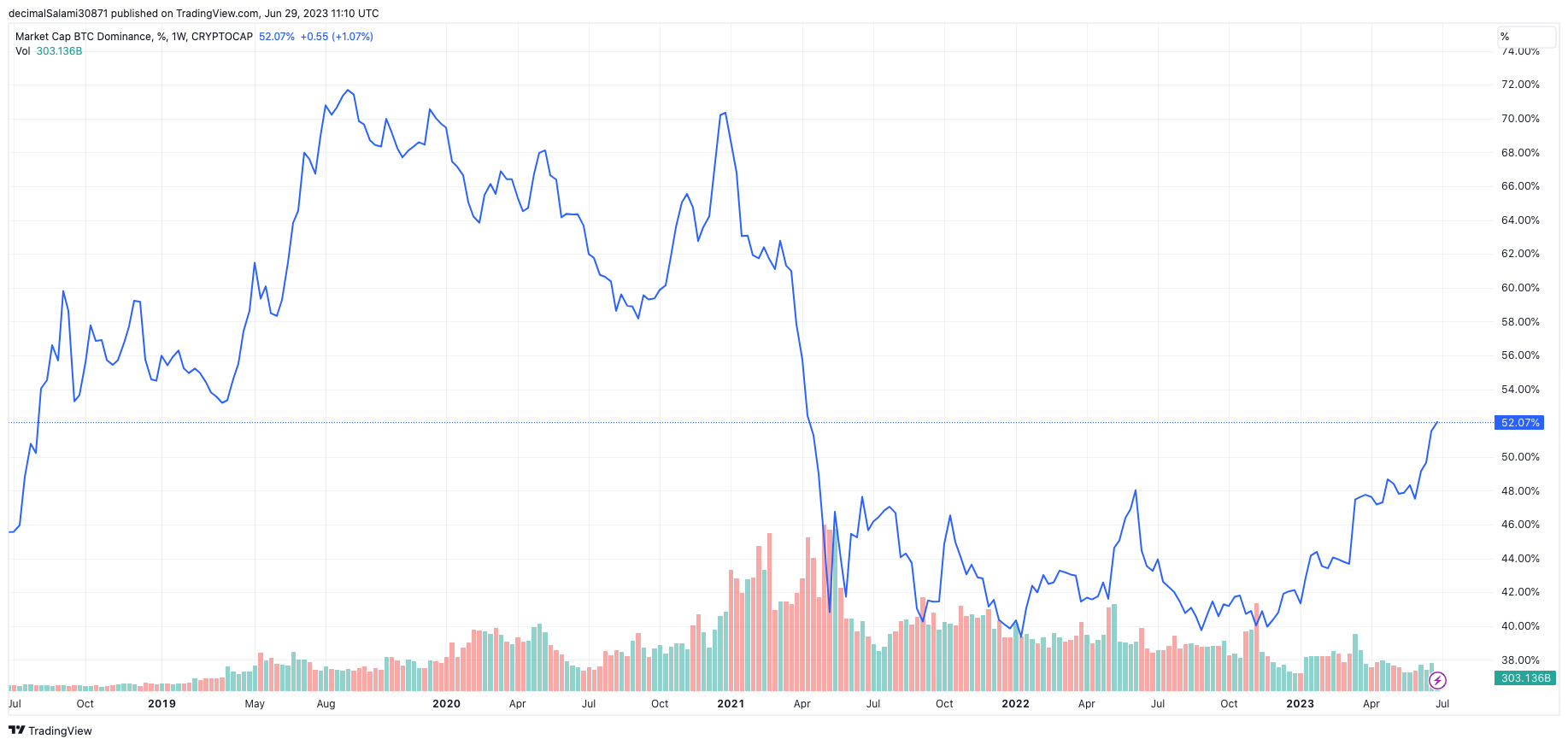

So, 2023 cannot match the scale of that drama. But there is something very intriguing happening to the market dynamics of Bitcoin, at least relative to other cryptocurrencies. Bitcoin dominance, which measures the ratio of the Bitcoin market cap to the cumulative market cap of all cryptocurrencies, is at its highest level in over two years, at 52%. In other words, 52% of the cryptocurrency market cap, currently at $1.18 trillion, is Bitcoin.

Dominance fell in the years 2020 and 2021

Dominance fell in the years 2020 and 2021

The above chart shows that Bitcoin opened the year 2020 with a dominance of about 70%. Over the course of the next 365 days, it bounced around a bit and trickled down to the high 50s. However, it was the final quarter of 2020 when Bitcoin began to make serious moves, rising from $10,000 to $28,000. In this time period, the dominance ratio rose from 59% back to 70%, where it closed at, approximately the same dominance ratio it opened the year at twelve months earlier.

The following year, 2021, saw altcoins catch up. Bitcoin’s dominance plunged like a stone, falling quicker than it ever had before. The wider cryptocurrency market exploded as stimulus cheques, lockdown-driven Robinhood trading and basement-level interest rates pushed capital into anything and everything remotely connected to a blockchain.

The total cryptocurrency…

Click Here to Read the Full Original Article at CoinJournal: Latest Bitcoin, Ethereum & Crypto News…