The price of Ether (ETH) faced strong resistance at $1,920 after a 17.5% rally between June 15 and June 22. Several factors contributed to the limited upside, including worsening macroeconomic conditions, the regulatory cryptocurrency environment and weaker demand for decentralized applications (DApps) on the Ethereum network.

ETH price faces macroeconomic headwinds

On June 26, a federal judge denied a motion from Binance that could have stopped the United States Securities and Exchange Commission (SEC) from issuing public statements related to the case.

In addition, in its mid-year outlook, HSBC Asset Management’s report warned of an economic downturn in the U.S. in the fourth quarter, followed by a “year of contraction and a European recession in 2024”. The report also noted that “corporate defaults have started to creep up.”

Finally, International Monetary Fund chief economist Gita Gopinath told CNBC on June 27 that central bankers should “continue tightening” by keeping interest rates high for longer than expected.

Ethereum network demand, gas fees drop

Usage of DApps on the Ethereum network failed to gain momentum as gas fees dropped 60%. Notably, the seven-day average transaction cost dropped to $3.7 on June 26, down from $9 four weeks prior.

DApp active addresses also declined by 27% in the same period.

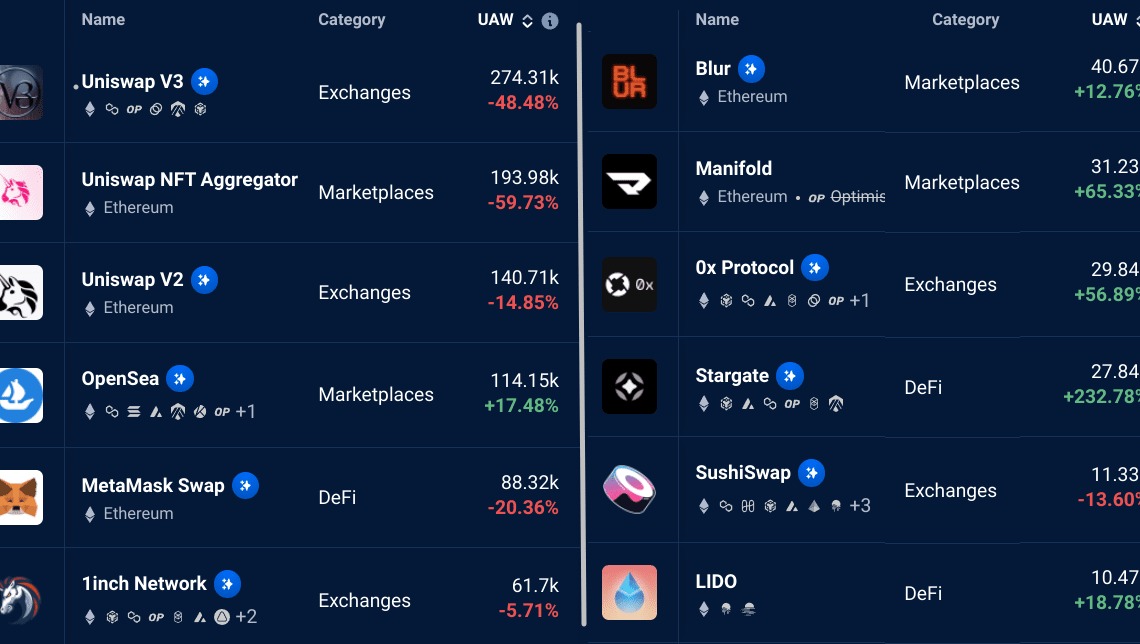

A large chunk of the decline was concentrated on Uniswap and MetaMask Swap, while most nonfungible token (NFT) marketplaces saw a surge in their unique active wallets (UAW).

Despite Uniswap NFT Aggregator’s lackluster performance, the sector faced a decent influx of users on OpenSea, Blur, Manifold, LooksRare and Unick.

More concerningly, however, is that the total value locked (TVL) — measuring the deposits locked in Ethereum smart contracts — reached its lowest level since August 2020. The indicator declined by 6.9% between April 28 and June 28 to 13.9 million ETH, according to DefiLlama.

ETH price rally not supported by derivatives markets

So how are professional traders positioned for the next ETH price move? Let’s look at Ether futures to gauge the odds of ETH/USD breaking above the $1,920 resistance.

ETH quarterly futures are the preferred instruments of whales and arbitrage desks. However, these fixed-month contracts usually trade at a slight premium to spot markets, as they demand an additional fee to postpone settlement.

As a result, in healthy markets, ETH futures contracts…

Click Here to Read the Full Original Article at Cointelegraph.com News…