Crypto mining firm CleanSpark is moving forward with its aggressive infrastructure expansion in the United States by acquiring two Bitcoin (BTC) mining facilities in a $9.3 million cash deal.

According to a June 21 announcement, CleanSpark entered into a definitive agreement to purchase two turnkey Bitcoin mining campuses in Dalton, Georgia. In turnkey Bitcoin mining, users can buy an assembled, configured, and optimized Bitcoin mining rig to use on mining farms.

The facilities will host over 6,000 Antminer S19 XPs and S19J Pro+s, which are expected to add about 1 exahash per second (EH/s) to CleanSpark’s hashrate after the deal. According to Zach Bradford, CEO of CleanSpark, the newly acquired infrastructure will enable the company to reach its target of 16EH/s by the end of the year.

The purchase follows several acquisitions by CleanSpark in recent months, despite a slump in BTC mining profitability during the bear market. In April, the company announced the purchase of 45,000 Antminer S19 XP rigs for $144.9 million, which is expected to add 6.4 EH/s of mining power.

In February, CleanSpark added 20,000 new Antminer S19j Pro+ units to its portfolio for $43.6 million, expected to bring 2.44 EH/s to its computing power. A few weeks earlier, the company announced a $16-million expansion at its Georgia facility with 15,000 new rigs.

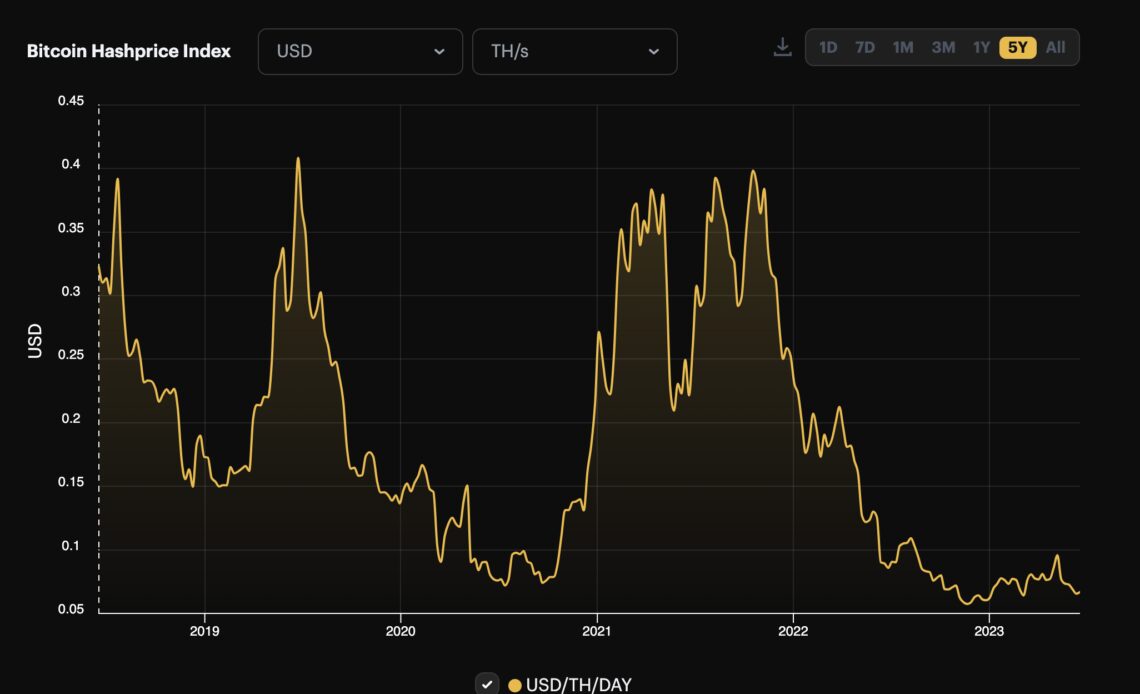

The ongoing expansion overlooks the declining profitability of Bitcoin mining, which has dropped to $0.066 per TH/s per day at the time of writing, down from its $0.40 peak in June 2019, according to data from Hashrate Index.

With the fast-paced fleet expansion, CleanSpark anticipates being well-positioned for next year’s Bitcoin halving, expected between April and May 2024. The next halving will reduce Bitcoin block rewards to 3.125 BTC.

Bitcoin’s price has historically spiked post-halvings thanks to a cut in the cryptocurrency’s supply as demand remained steady. “We continue to make use of opportunities created by current market conditions to prepare for next year’s bitcoin halving,” CleanSpark CFO Gary Vecchiarelli said.

Magazine: Bitcoin is on a collision course with ‘Net Zero’ promises

Click Here to Read the Full Original Article at Cointelegraph.com News…