Key Takeaways

- Regulators are clamping down hard on the US crypto industry, with recent lawsuits announced against Binance and Coinbase

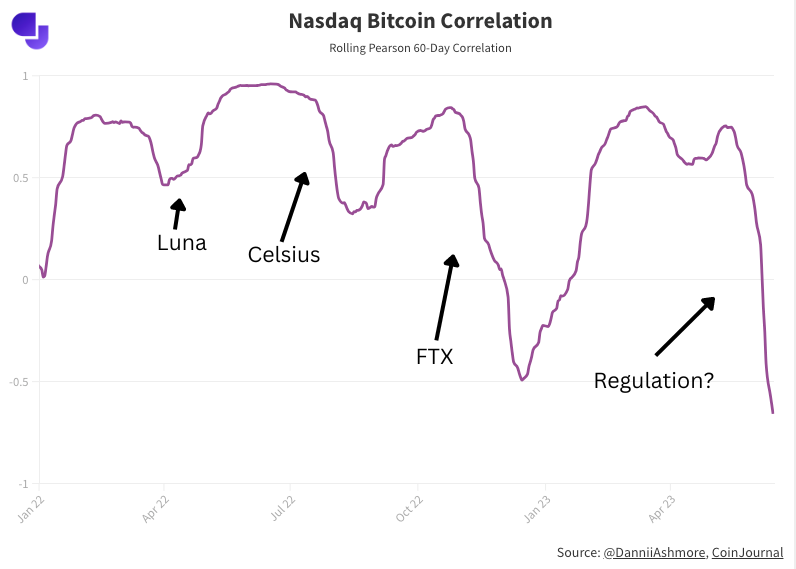

- Bitcoin’s correlation with stocks is at a 5-year low, with the latter soaring but Bitcoin’s price suppressed by concerns around future of industry in US

- Exchanges have seen net outflows for 33 days in a row, but size of withdrawals are not particularly notable

- Binance is seeing the largest withdrawals, 7.3% of its balance heading for the exit doors

- Allegations against Binance go beyond securities violations which most centralised companies are facing

Binance’s war with the SEC goes on. As does Coinbase’s. As does, well, the entire cryptocurrency space, which suddenly faces a regulatory threat that feels existential for the crypto industry in the US.

The market has responded, unsurprisingly, by selling. Bitcoin dipped below $25,000 for the first time in three months last week, before bouncing back to where it currently trades at $26,500.

More notable, however, was that this came amid a time when the stock market is soaring. As I detailed in depth last week, the correlation between stocks and Bitcoin is now at a 5-year low. This is similar to the dip in correlation we saw in November when FTX collapsed while the stock market surged off softer-than-expected inflation numbers.

In such a way, while Bitcoin’s price decline seems minor on the face of things, it is underperforming relatively as the rest of the market is red hot.

In such a way, while Bitcoin’s price decline seems minor on the face of things, it is underperforming relatively as the rest of the market is red hot.

Bitcoin on exchanges

But beyond price, how are markets reacting? Are people again concerned about storing their assets with these centralised exchanges?

Well, looking at the total amount of Bitcoin sitting in these exchanges, there has been net outflows for 33 days in a row. That is the longest streak since November 2022 amid the FTX scandal.

The scale of withdrawals is not the same, however. Back in November, the last time we saw a consistent stream of net withdrawals, FTX was exposed as insolvent (and fraudulent) with $8 billion of customer assets gone. Fear was extreme and the entire market panicked, concerned that other exchanges could follow. Bitcoin ran for the exit doors, much of it sent straight to cold storage (or sold for cash).

While the current developments are concerning for crypto in their own way, there appears to be no fear that customer assets…

Click Here to Read the Full Original Article at CoinJournal: Latest Bitcoin, Ethereum & Crypto News…