Ether (ETH) price plunged 7% between June 14 and June 15, reaching its lowest level in three months and impacting investors’ view that the altcoin was en-route to turning $2,000 to support.

It is worth noting that the $1,620 bottom represents a $196 billion market capitalization for Ether, which is higher than PetroChina’s $186 billion, and not far from chipmaker AMD’s $198 billion.

Being the 66th largest global tradable asset in the world is no small feat, especially considering that the cryptocurrency is merely 8 years old and does not return any kind of direct profit for the project’s maintenance. On the other hand, securities enjoy the benefits of corporate earnings and eventual government subsidies, so perhaps investors should be concerned by the recent price drop from Ether.

Ether price pressured succumbs to regulation and lowered network activity

Regulatory pressure helped to subdue investors’ appetite for Ether as the Securities and Exchange Commission (SEC) proposed a rule change regarding the definition of an exchange. Paul Grewal, chief legal officer of the Coinbase exchange, has pushed back against the proposed change, claiming that it violates the Administrative Procedure Act.

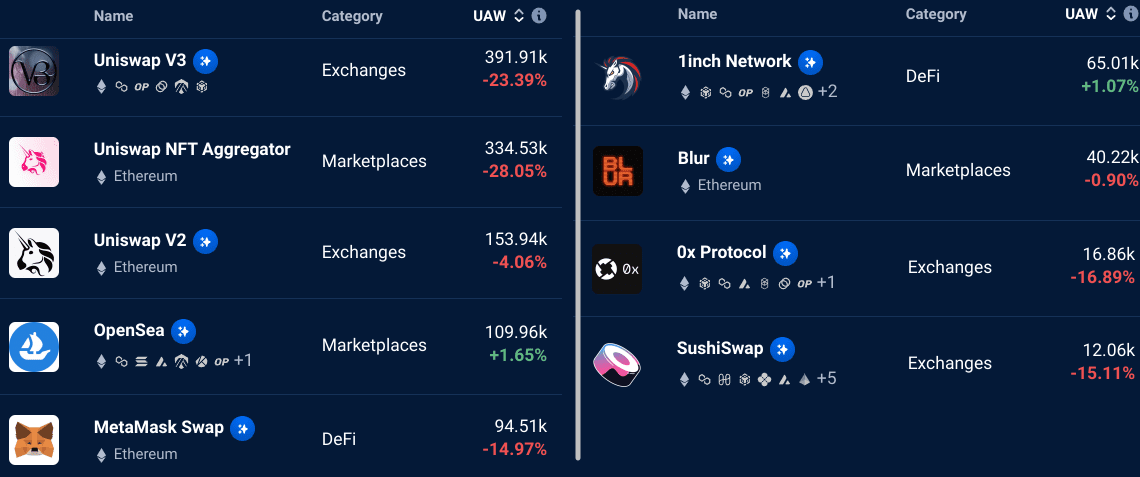

More concerningly, decentralized applications (Dapps) usage on the Ethereum network failed to gain momentum despite gas fees plummeting by 75%. The 7-day average transaction cost dropped to $4 on June 14, down from $16 one month prior. Meanwhile, Dapps active addresses declined by 18% in the same period.

Notice that the decline happened across the board, affecting decentralized finance (DeFi), NFT marketplaces, gaming and collectibles alike. Curiously, the total value locked (TVL), which measures the deposits locked in Ethereum’s smart contracts, declined by a mere 2% versus mid-May to 14.6 million ETH, according to DefiLlama.

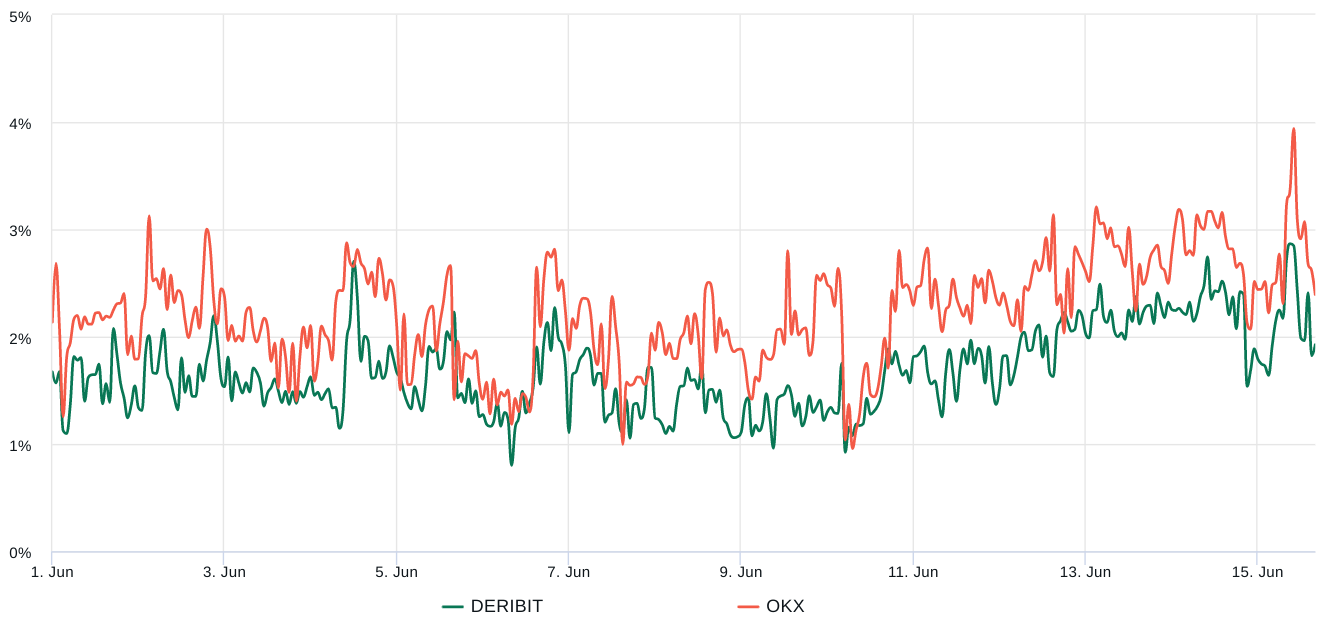

To analyze the odds of Ether’s price breaking below the $1,650 support, one should check for a reduced ETH futures premium and increased costs for protective put options.

Ether quarterly futures are popular among whales and arbitrage desks. However, these fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement.

As a result, ETH futures contracts in healthy markets should trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

Click Here to Read the Full Original Article at Cointelegraph.com News…