Binance announced in May that it would delist so-called “privacy coins” such as Monero (XMR), Zcash (ZEC) and others in several countries, including France, Italy, Spain and Poland. The decision underscored the reality that some companies might step over their own feet to ban privacy tech — even where it is legal — out of a combination of risk aversion and compliance confusion.

Some Monero users have long advocated for keeping their tokens off exchanges, emphasizing that on-exchange transactions undermine user privacy by requiring personal identification data. And yet listing privacy coins on exchanges has its merits: It facilitates new user adoption, bolsters liquidity and contributes to price momentum.

European Union regulators recently enacted two significant crypto legal frameworks: Markets in Crypto-Assets rules and a Travel Rule. These mandates necessitate the collection of user data and identification information for withdrawal recipients. While these regulations might seem burdensome, privacy coin users and exchanges listing privacy coins can, in fact, comply.

Related: Are we still mad at MetaMask and ConsenSys for snooping on us?

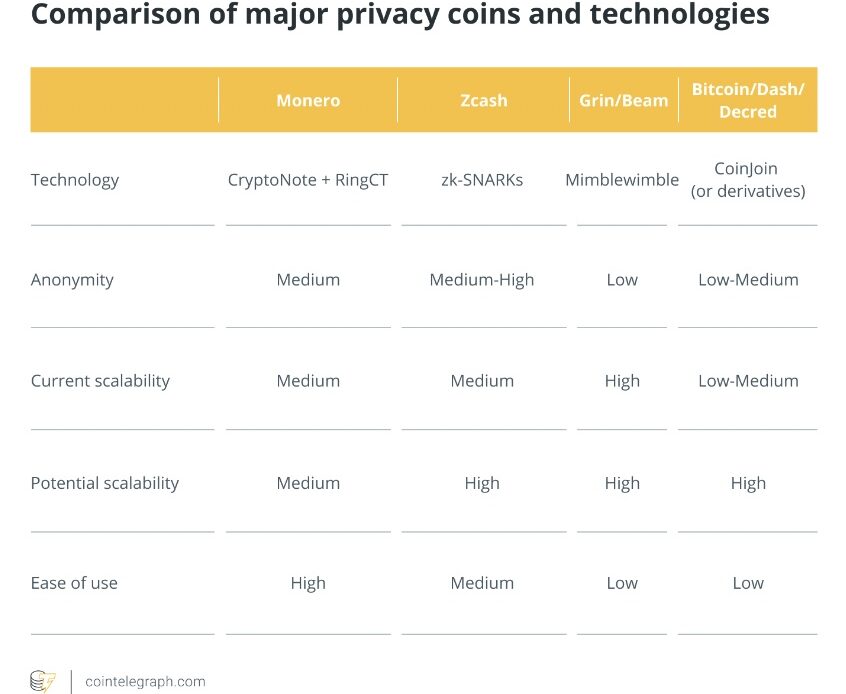

Take Zcash, for instance. It offers a transparent send function and an option to privately share view keys in shielded transactions. Monero provides a similar view key feature. Discussions are underway among EU officials about a potential ban on privacy coins, but this is still in the early stages.

Binance’s overreaction is not a result of any clear regulatory mandate, and its actions also seem internally inconsistent. It delisted Secret’s SCRT governance token, which is not private itself but can be traded for a private coin. In contrast, Litecoin (LTC), which has a privacy feature, has not been delisted.

These actions from Binance might be less about European regulators’ demands and more about its unique circumstances. For instance, Binance is currently embroiled in a legal dispute with the Commodity Futures Trading Commission over alleged failures to uphold requisite Anti-Money Laundering measures.

Even in countries where privacy coins are banned outright, like the United Arab Emirates, savvy users can acquire them via virtual private networks to access peer-to-peer transfers or decentralized exchanges. Platforms like Sideshift.ai for Zcash and Bisq for Monero serve as gateways to these privacy coins. While such methods ensure privacy coins’ survival during prolonged periods of bans, they may slow the…

Click Here to Read the Full Original Article at Cointelegraph.com News…