Bitcoin’s (BTC) volatility has dropped toward historically low levels thanks to macroeconomic uncertainty and low market liquidity. However, on-chain and options market data alludes to incoming volatility in June.

The Bitcoin Volatility Index which measures the daily fluctuations in Bitcoin’s price shows that the 30-day volatility in Bitcoin’s price was 1.52%, which is less than half of the yearly averages across Bitcoin’s history, with values usually above 4%.

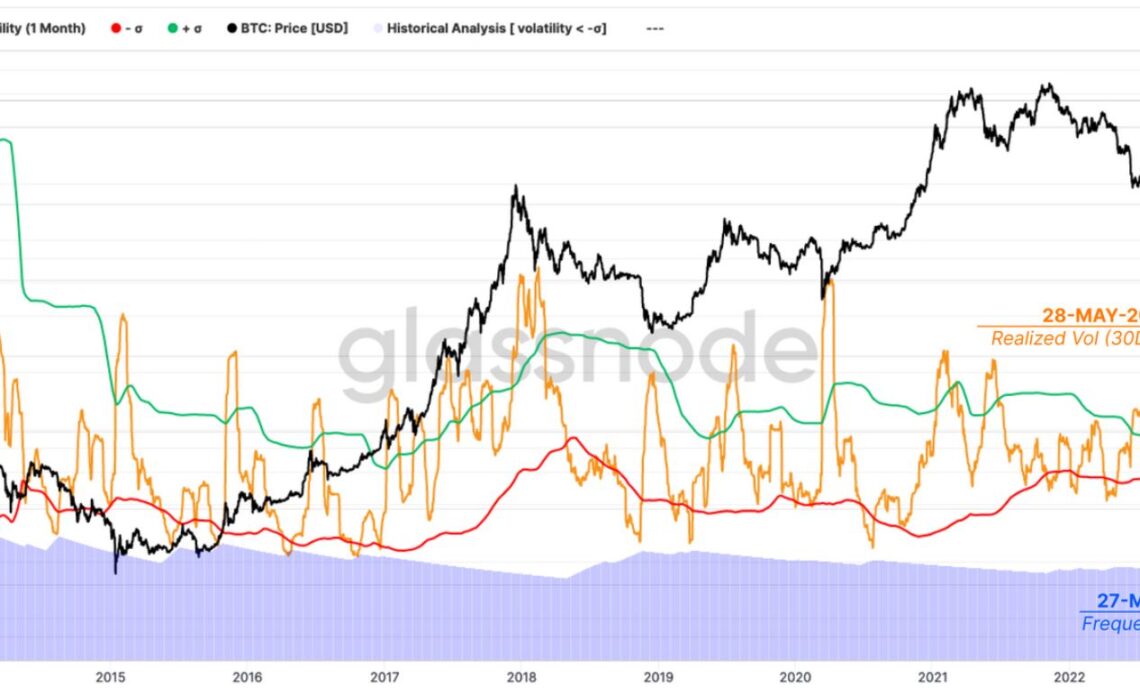

According to Glassnode, the expectation of volatility is a “logical conclusion” based on the fact that low volatility levels were only seen for 19.3% of Bitcoin’s price history.

The latest weekly update from the on-chain analytics firm shows that Glassnode’s monthly realized volatility metric for Bitcoin slipped below the lower bounds of the historical Bollinger Band, suggesting an incoming uptick in volatility.

Long-term Bitcoin holders metric points to a price breakout

The on-chain transfer volumes of Bitcoin across cryptocurrency exchanges dropped to historically low levels. The price is also trading near short-term holder bias, indicating a “balanced position of profit and loss for new investors” that bought coins during and after the 2021-2022 bull cycle, according to the report. Currently, 50% of new investors are in profit with the rest in loss.

However, while the short-term holders reached equilibrium levels, long-term term holders were seen making a move in the recent correction, which underpins volatility, according to the analysts.

Glassnode categorizes coins older than 155 days in a single wallet under long-term holder supply.

The gray bars in the image below show the Long-term Holder (LTH) Binary Spending Indicator, which tracks whether LTH spending averaged over the last 7-days surpasses is adequate to decrease their total holdings.

It shows previous instances when LTH spending increased which was usually followed by a volatility uptick.

Bitcoin’s recent correction saw a minor downtick in the indicator, “suggesting 4-of-7 days experienced a net divestment by LTHs, which is a level similar to exit liquidity events seen YTD.”

The analysts expect a bout of volatility to reach an equilibrium level, where the market moves primarily due to accumulation or distribution of long-term holder supply.

Options markets reaffirm traders’…

Click Here to Read the Full Original Article at Cointelegraph.com News…