Bitcoin (BTC) continues with its sideways BTC price action under $27,000 on May 22 as the bulls and bears find it hard to break the stalemate.

Which way Bitcoin?

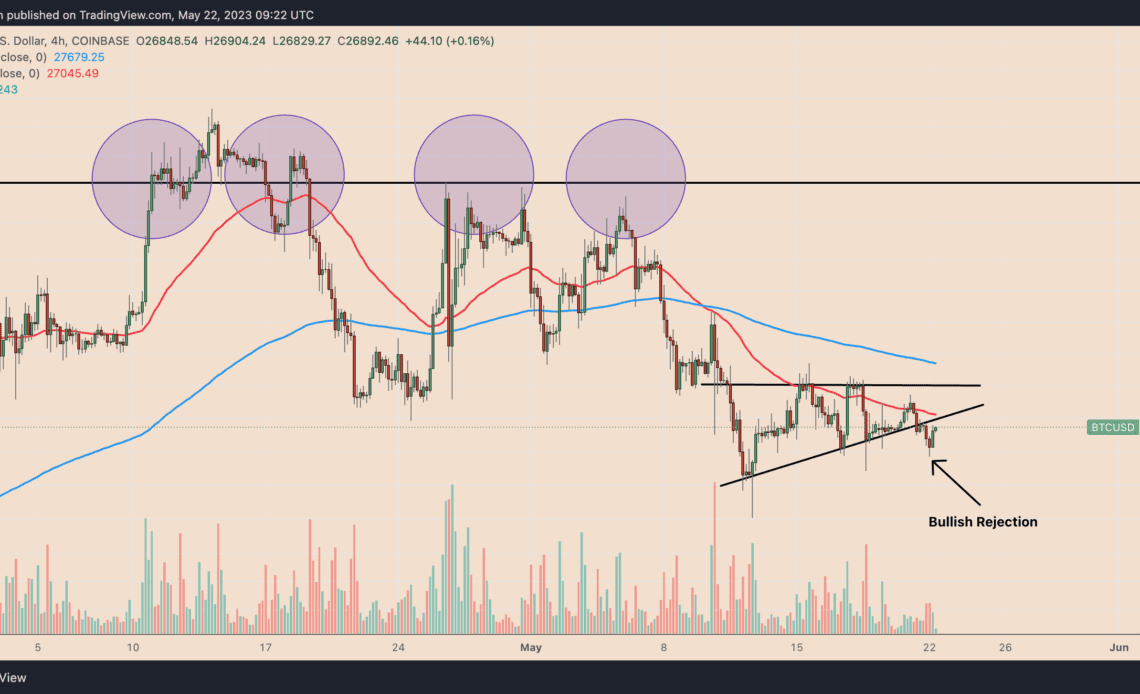

Notably, BTC price has fluctuated inside a narrowing ascending triangle range since May 11, defined by a horizontal resistance around $27,500 and a rising trendline support currently near $26,890.

On May 22, Bitcoin dropped below the support trendline to around $26,550 but recovered quickly afterward to $26,900 — a bullish rejection. Meanwhile, the volumes were relatively lower, suggesting fewer traders participated in the intraday dump-and-pump move.

Overall, these technicals illustrate an ongoing bias conflict among traders. In other words, they are unsure about the direction of Bitcoin’s next price trend with the same amount of buyers and sellers — something that derivatives are also hinting at.

Why is BTC price not moving?

Flat price action in the Bitcoin market can precede periods of extreme price volatility, triggered by big events.

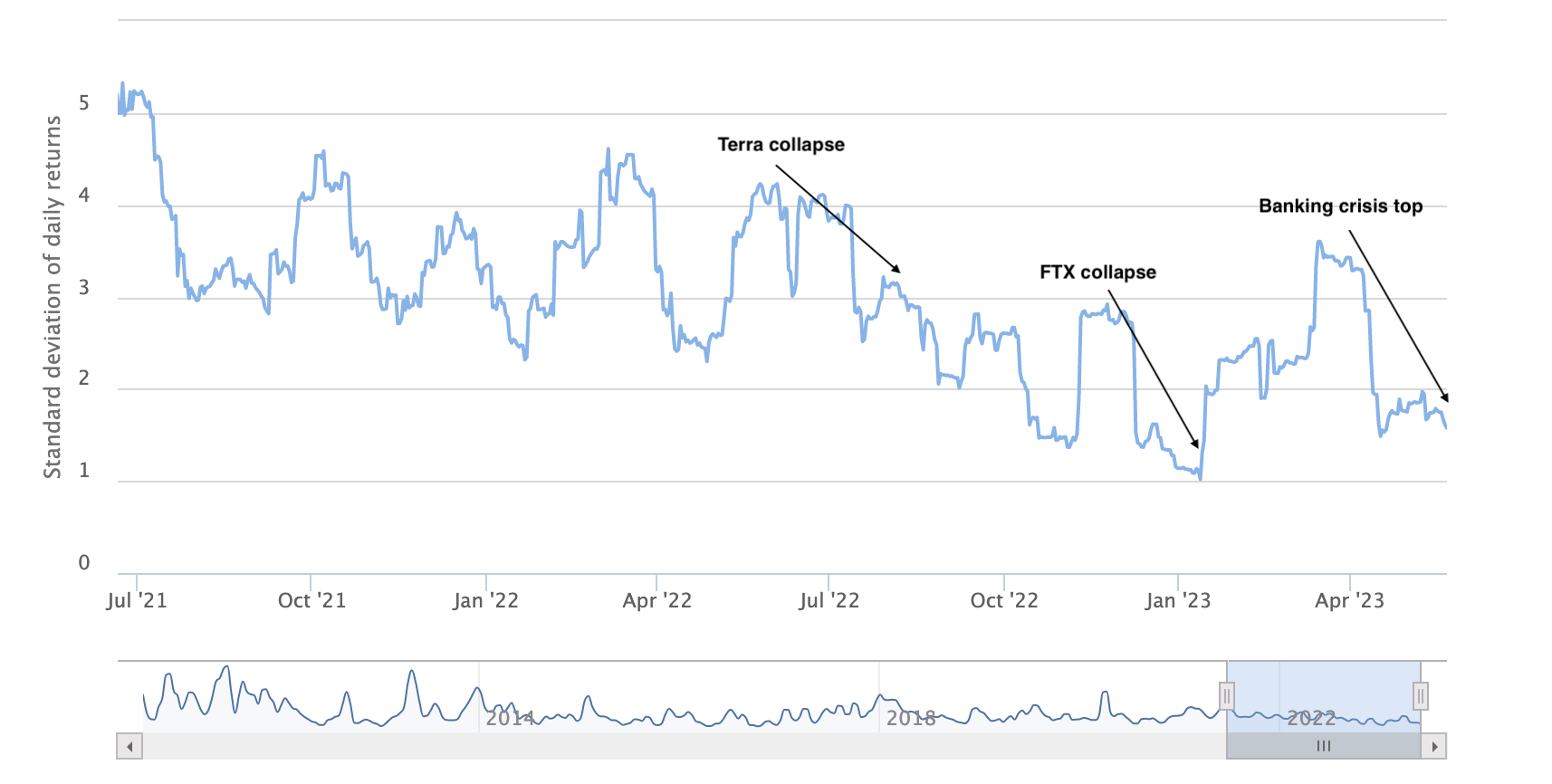

For instance, Bitcoin fluctuated in the $16,000-17,500 range between Nov. 9, 2022, and Jan. 10. 2023, right in the aftermath of the FTX crypto exchange’s collapse. The price attempted to break above and below the range on some days but failed to establish a recovery trend.

The market witnessed a similar flat trend after the sharp BTC price decline led by the collapse of Terra in May 2022. Notably, BTC/USD traded inside the $28,000-30,000 range for almost a month before entering a decisive breakdown stage.

Bitcoin’s flat trajectory in May 2023 has followed the U.S. banking crisis rally two months ago with numerous failed attempts to cross above $30,000, a psychological resistance level.

In other words, Bitcoin traders are waiting for a potential market trigger once again that could decisively push BTC price in either direction.

Related: How do the Fed’s interest rates impact the crypto market?

One major potential event will be the Federal Reserve’s decision on interest rates next month.

Currently, the conflicting outlook on raising interest rates is likely the main factor behind the sideways action of the stocks, including risk assets and cryptocurrencies. In fact, BTC price has seen one of its least-volatile periods since April, historic volatility data shows.

What’s next for…

Click Here to Read the Full Original Article at Cointelegraph.com News…