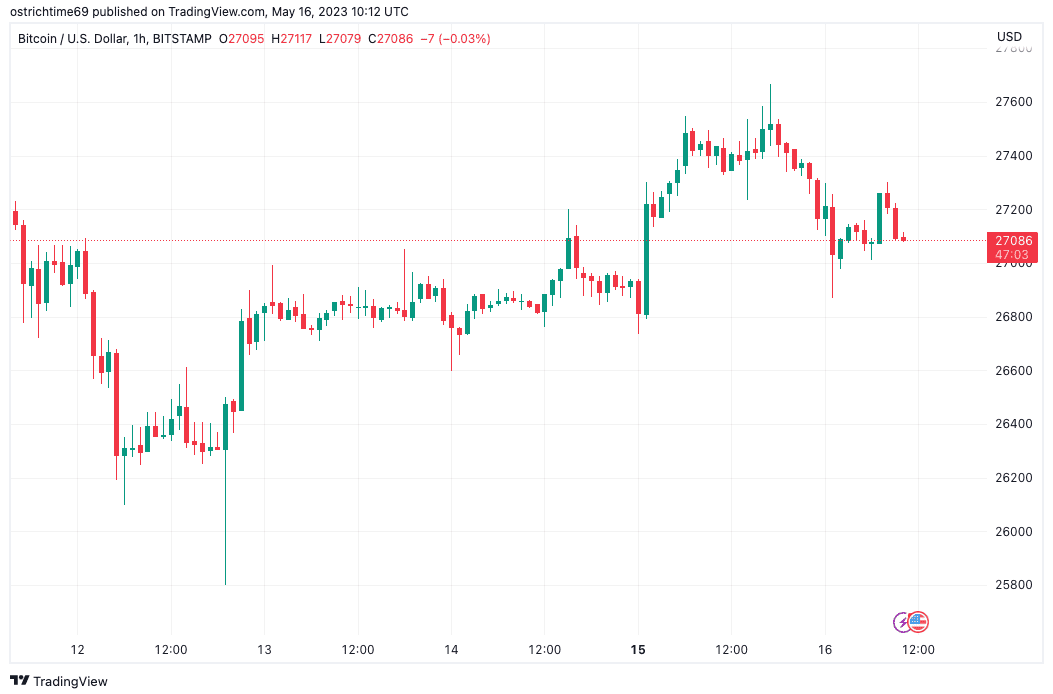

Bitcoin (BTC) surfed $27,000 on May 16 as traders stayed buoyant about upside continuation.

$24,000 BTC price still in play, says trader

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD still focusing on the $27,000 mark, having dipped to $26,870 after the daily close.

Still lacking direction, traders hoped that the pair would either attempt to exit its current narrow range or touch more significant levels up or down.

For popular trader Crypto Ed, potential targets included the “gap” in CME futures created at the weekend.

“It’s really on the lower timeframe where the action is now; higher timeframe is not really exciting,” he summarized in his latest YouTube update on the day.

The CME gap to the downside lies between $26,500 and $26,800 — just below the overnight lows.

Crypto Ed continued that a bounce after the gap could take BTC/USD back to its range highs at $28,800, but that a downside “possibility” left $24,000 in play.

Other market participants were equally cautious, with trader Jackis describing Bitcoin as “very hard to read” under current circumstances.

“My personal take is we will have Weekly continuation and Daily breakdown,” he concluded in Twitter analysis on the day.

To that end, the chances of higher levels to come on weekly timeframes remained despite the current pullback.

“Important to note, that the weekly structure remains bullish & that whether from here or should any deeper pullback come is a potential HL in a bullish trend which should lead to a break of 31K until proven otherwise,” Jackis explained.

Analyst warns over debt ceiling volatility

Elsewhere, macro considerations increasingly began to include the unfolding debt ceiling crisis in the United States.

Related: Digital asset market shrinks as fund outflows reach $200M: CoinShares

With the June 1 deadline for potential default rapidly approaching, markets were already feeling the pressure, trader Skew suggested.

“Lack luster price action primarily due to US debt ceiling becoming a probable crisis, however getting closer to the June 1 deadline,” he tweeted about the U.S. dollar index (DXY).

“Implications will be what big funds are eyeballing into late may (raised or suspended). Expect heightened volatility & waning liquidity in coming weeks, especially around the deadline period.”

DXY, traditionally but not exclusively…

Click Here to Read the Full Original Article at Cointelegraph.com News…