Bitcoin (BTC) is fighting for the bull trend as the new week begins as the market acts within a crucial zone.

After closing the weekly candle at just below $27,000, BTC/USD is attempting to cement support as a stubborn trading zone holds.

The stakes are already high — last week saw a flash dip below $26,000 and two-month lows for Bitcoin, making traders fearful of a larger bearish breakdown to come.

While this has not materialized, nerves remain on both shorter and longer timeframes.

Where is price action likely headed next? A relatively cool week of macro triggers means less chance of volatility from external sources.

Add to that the upcoming difficulty adjustment taking it to yet another all-time high, and the case could well be made for upside continuation.

Cointelegraph takes a look at some of the major BTC price factors affecting the week ahead.

Bitcoin price weekly close offers mixed signals

After clinching a weekly close at around $27,930, Bitcoin is already headed higher, reaching $27,550 overnight, data from Cointelegraph Markets Pro and TradingView shows.

While encouraging, the close nonetheless marked Bitcoin’s weakest since mid-March – something popular trader and analyst Rekt Capital is keenly aware of.

In part of Twitter analysis on the day, he warned that $27,600 was now the level to flip to support.

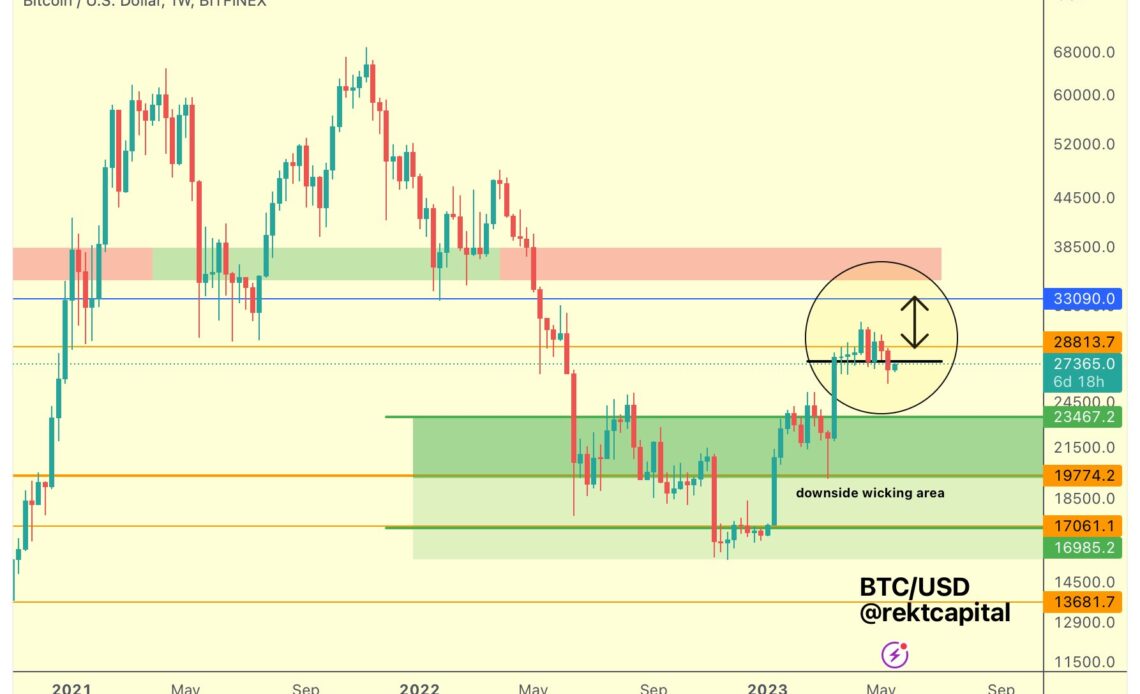

“First, BTC failed to reclaim the $28800 level on the Weekly (orange). And then $BTC Weekly Closed below $27600, failing to hold it as support (black),” he summarized alongside a chart showing recent weekly-timeframe events.

“Turn $27600 into resistance and this could enable further downside into the low $20000s.”

That perspective reinforces existing warnings from the weekend, and adds to a small group of well-known pundits still entertaining the possibility of a significant BTC price retracement.

Continuing, however, Rekt Capital now sounded more upbeat about Bitcoin overall, looking beyond the current correction and its potential target.

“Bitcoin has already broken its Downtrend. Now it’s all about continuing the new Uptrend,” another tweet reasoned.

“Whether a retest is needed or not is the question. But history suggests the mid-term to long-term outlook looks bullish.”

On weekly timeframes, the key trend line looming large thus remains the 200-week moving average (WMA), which at $26,200 has already received its first retest.

Click Here to Read the Full Original Article at Cointelegraph.com News…