[the_ad id="1637"]

[ad_1]

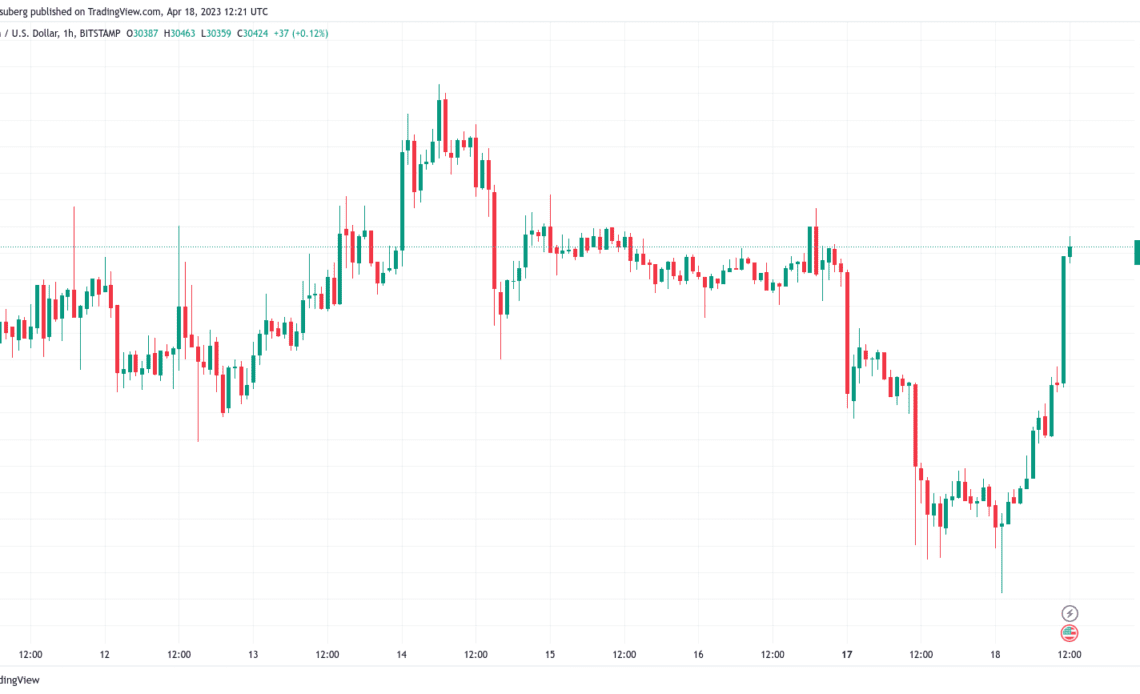

Bitcoin (BTC) returned above $30,000 on April 18 as volatility preceded the day’s Wall Street open.

Bitcoin erases intraday losses

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as the pair suddenly added $500, delivering daily gains of more than 3%.

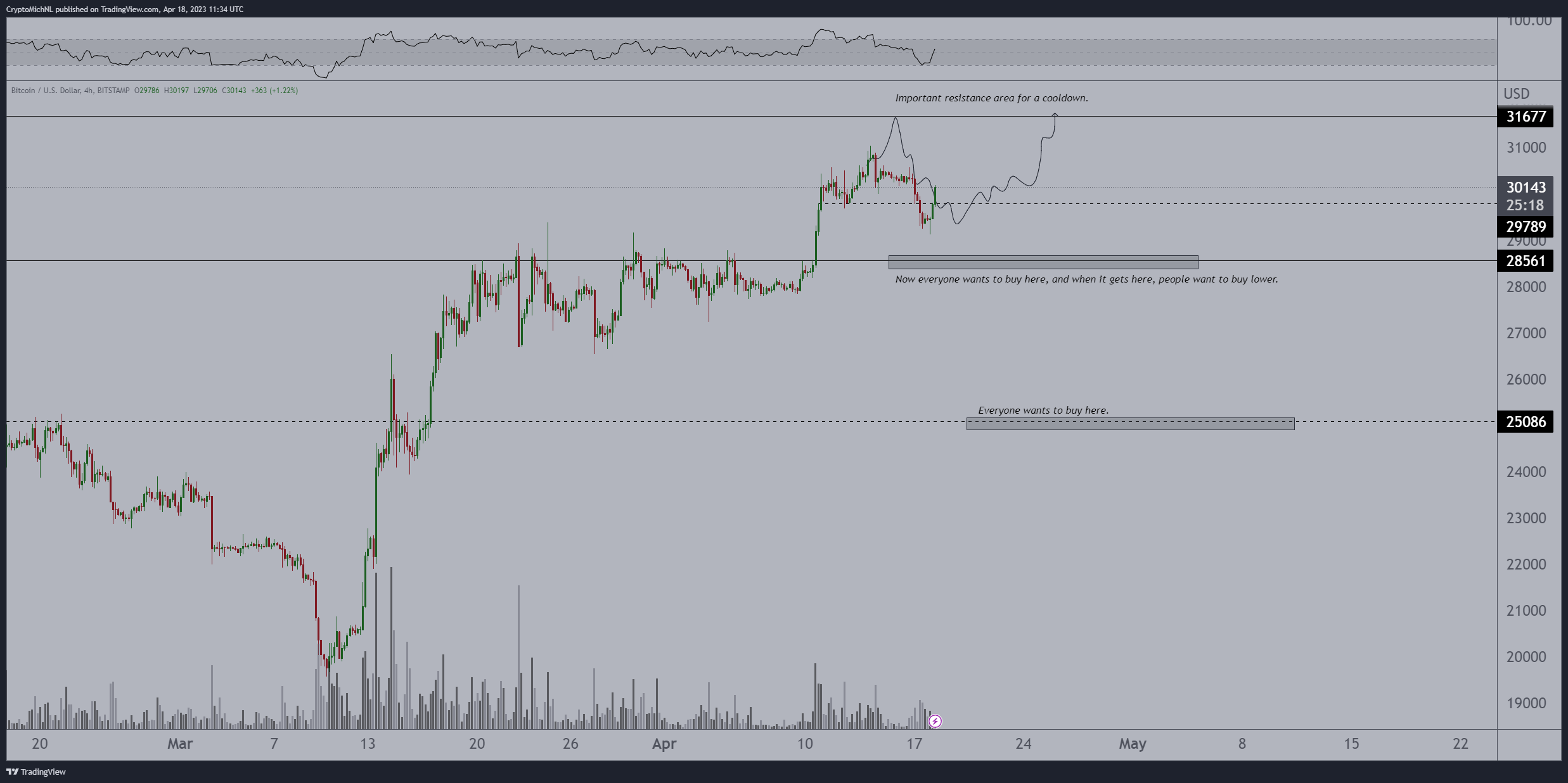

The pair had previously worried traders, who watched as $30,000 support looked set to remain as longer-term resistance.

The fact that #BTC went for another retest of the Higher High in a short space of time was a cause for concern

Ultimately, $BTC Daily Closed below Higher High & now may be turning it back into resistance

Needs to Daily Close above the HH to regain bullishness#Crypto #Bitcoin https://t.co/zMNvuNjxRH pic.twitter.com/HbsJJ0xszL

— Rekt Capital (@rektcapital) April 18, 2023

Before crossing the $30,000 mark, Binance order book activity was a focus for monitoring resource Material Indicators, which identified bid liquidity moving closer to spot price.

“Some has already started moving closer to the active trading zone. Watching to see if more of it follows or if price drops back into the $28s to fill,” part of accompanying commentary read.

A subsequent update indicated that the largest class of high-volume traders, so-called “mega whales,” was responsible for the upward momentum.

#FireCharts shows about $50M in #BTC bid liquidity laddered from the $29k-$28k range that aims to get filled. Some has already started moving closer to the active trading zone. Watching to see if more of it follows or if price drops back into the $28s to fill pic.twitter.com/TvAtL3MU0i

— Material Indicators (@MI_Algos) April 18, 2023

Reacting to the latest BTC price action, Michaël van de Poppe, founder and CEO of trading firm Eight, was optimistic.

“There we go for Bitcoin. Breaks through $30K, which means that we’re back in the range,” he tweeted alongside a chart showing key levels.

“Most preferred a retest at $29.7K would suit continuation towards new highs and towards $40K.”

Further volatility was meanwhile a possibility on lower timeframes ahead of the Wall Street open.

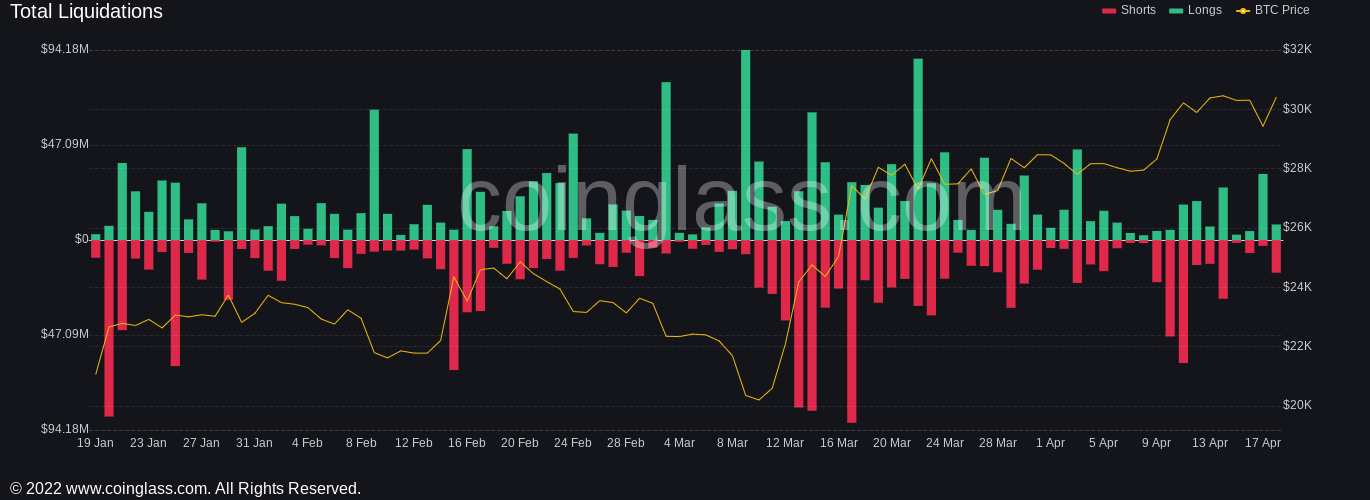

Those banking on further downside were already feeling the pressure, with data from Coinglass showing $16 million of BTC short liquidations on the day.

Ethereum leads altcoin rebound

Altcoins also felt the benefit of the sudden Bitcoin turnaround, with…

Click Here to Read the Full Original Article at Cointelegraph.com News…

[ad_2]

[the_ad id="1638"]