Bitcoin (BTC) spiked higher prior to the April 12 Wall Street open as United States inflation data outperformed market forecasts.

CPI offers “great inflation print” for risk-on bulls

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it neared new ten-month highs on Bitstamp.

Widely-predicted volatility entered immediately following the release of Consumer Price Index (CPI) data for March. This broadly conformed to expectations, with the year-on-year increase undercutting assumptions by 0.2%.

“The all items index increased 5.0 percent for the 12 months ending March; this was the smallest 12-month increase since the period ending May 2021,” an accompanying press release from the U.S. Bureau of Labor Statistics confirmed.

This was nonetheless enough to spark some optimistic upside on crypto markets ahead of the Wall Street open, with potential further upside in line with equities to come.

Markets commentator Tedtalksmacro called the result a “great inflation print for the bulls.”

U.S. CPI

Headline +5.0 YoY (Est. +5.2%)

Core +5.6% YoY (Est. +5.6%)

As expected, with headline coming in slightly lower than forecast.

— tedtalksmacro (@tedtalksmacro) April 12, 2023

With CPI known as a classic catalyst for “fakeout” price action, however, market participants urged caution.

Popular analytics resource Skew predicted that the “market will hunt liquidity like every other CPI day,” with significant moves apt to spark liquidations on exchanges.

“CPI overall says slowing inflation CPI core says sticky inflationary conditions still,” a further post on Twitter commented about the likely U.S. macroeconomic policy path going forward.

“Probably one more hike. May data needs to confirm interest rate hike shock in order the FED to actually consider a pause in the hiking cycle.”

Related: Crypto audits and bug bounties are broken: Here’s how to fix them

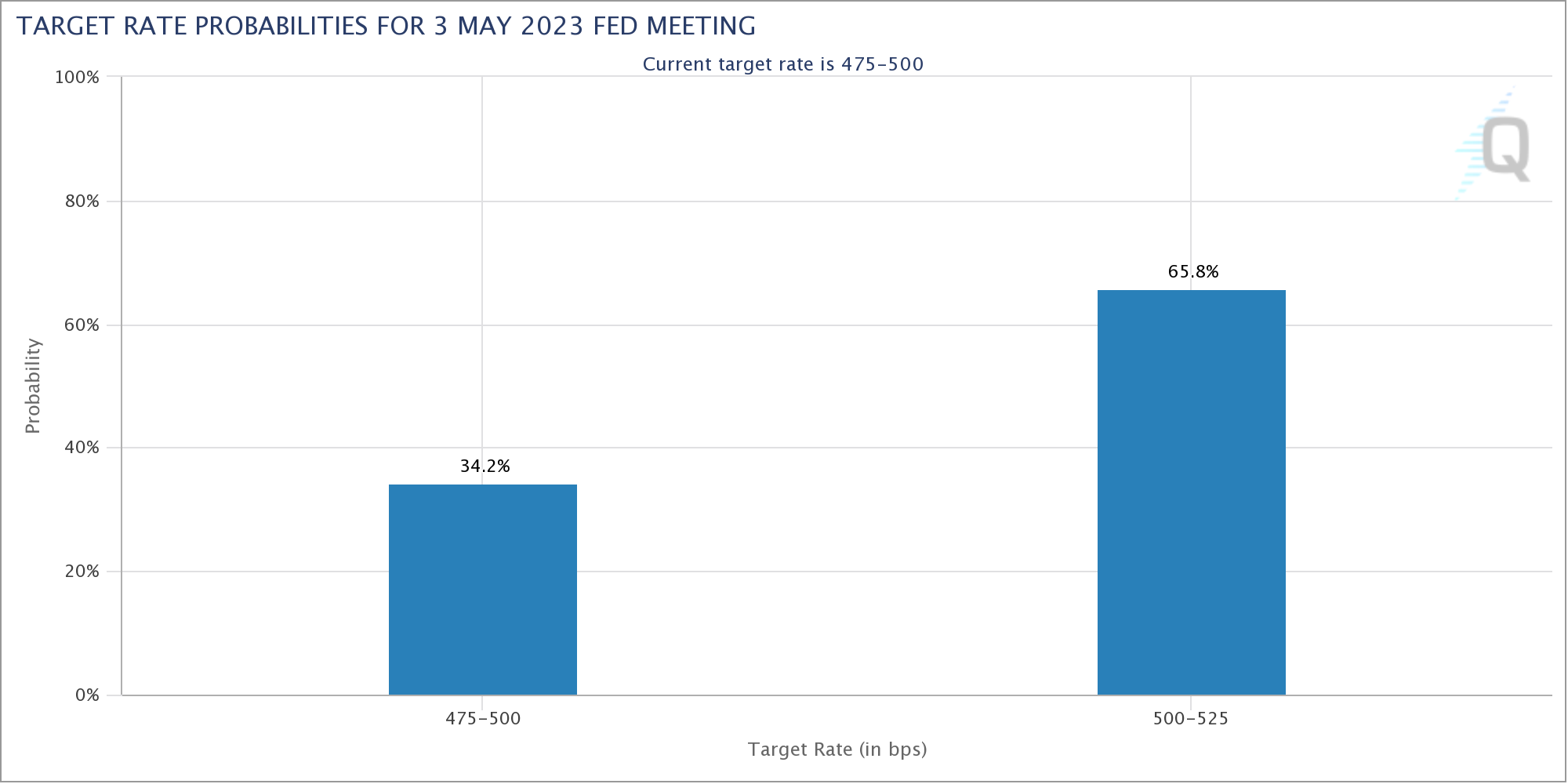

Market expectations on rate hikes moved only modestly despite the improvement in CPI data.

According to CME Group’s FedWatch Tool, there remained a 65% chance of a hike taking place at the next Federal Open Market Committee (FOMC) meeting in three weeks’ time, down from 75% before the release.

Bitcoin bulls gain confidence in long-term trend

The latest BTC price action meanwhile further bolstered longer-timeframe bets that Bitcoin had conducted a break of its bear market.

Related:

Click Here to Read the Full Original Article at Cointelegraph.com News…