Like it or not, for crypto investors, the U.S. Federal Reserve policy on interest rate hikes and high inflation is the single most relevant measure for gauging demand for risk assets. By increasing the cost of capital, the Fed boosts the profitability of fixed-income instruments, but this is detrimental to the stock market, real estate, commodities and cryptocurrencies.

One positive aspect of the Fed’s meetings is that they are scheduled well in advance, so Bitcoin (BTC) traders can prepare for those. Federal Reserve policy decisions historically cause extreme intraday volatility in risk assets, but traders can use derivatives instruments to yield optimal results as the Fed adjusts interest rates.

Another challenge for traders is they face pressure from Bitcoin being highly correlated to equities. For example, the 50-day correlation coefficient versus the S&P 500 futures has been running above 70% since Feb. 7. Although it does not state cause and consequence, it is evident that cryptocurrency investors are waiting for the direction of traditional markets.

It’s also possible that Bitcoin’s low emissions could prove to be a benefit as investors realize that the FED is running out of options to curb inflation. By raising interest rates even further, it could cause the U.S. government’s debt repayments to spiral out of control and eventually surpass $1 trillion annually. This creates a huge incentive for Bitcoin bulls, but extreme caution is needed by those willing to make trades based on interest rate hikes.

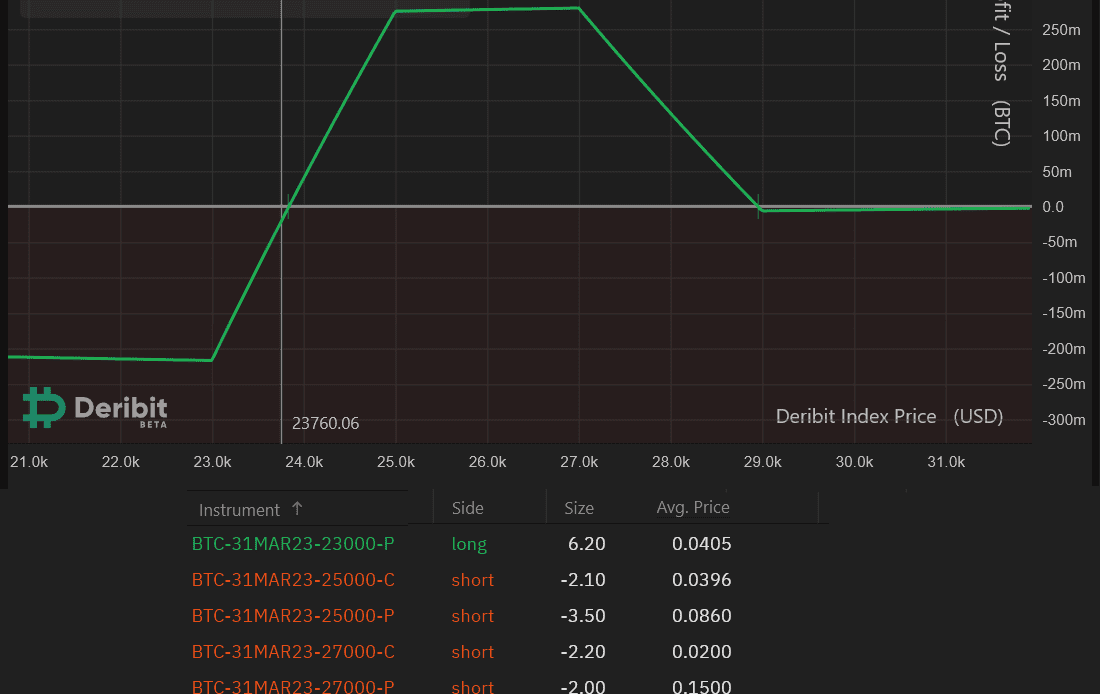

Risk takers could benefit from buying Bitcoin futures contracts to leverage their positions, but they could also be liquidated if a sudden negative price move occurs ahead of the FED’s decision on March 22. For this reason, pro traders are more likely to opt for options trading strategies such as the skewed iron condor.

A balanced risk approach to using call options

By trading multiple call (buy) options for the same expiry date, traders can achieve gains 3 times higher than the potential loss. This options strategy allows a trader to profit from the upside while limiting losses.

It is important to remember that all options have a set expiry date, so Bitcoin’s price increase must happen during the set period.

Listed below are the expected returns using Bitcoin options for the March 31 expiry, but this methodology can also be applied to different time frames. While the costs will vary, the general efficiency will not be affected.

Click Here to Read the Full Original Article at Cointelegraph.com News…