The ongoing cryptocurrency winter and massive collapses in the industry do not mean that digital assets like Bitcoin (BTC) are doomed to fail, according to a major European asset manager.

Despite BTC failing to protect investors against rising inflation in 2021 and 2022, Bitcoin’s limited supply may still attract more attention if inflation remains above the central banks’ targets, according to investment executives at Paris-based investment manager Amundi.

Amundi’s chief investment officer Mortier Vincent and macroeconomist Perrier Tristan on March 2 released a thematic paper analyzing the state and the perspectives of the crypto market. The exec argued that Bitcoin has failed to serve as an inflation hedge over the past two years due to “dramatic rises in policy and market interest rates,” that pressured “all asset classes.”

According to the paper’s authors, nominal interest rates are likely to stop surging or may even fall in case the inflation is high, but not rising. Such a situation would potentially lead to a bull market for Bitcoin, Amundi investment execs said, stating:

“This is a much more favorable environment for an asset whose supply is finite and that has a long duration in essence, as its main attraction is its future potential rather than its current status.”

The analysts also provided five reasons on why the recent setbacks in the crypto industry — including collapses of firms like FTX or Celsius — may not mean the end of cryptocurrencies.

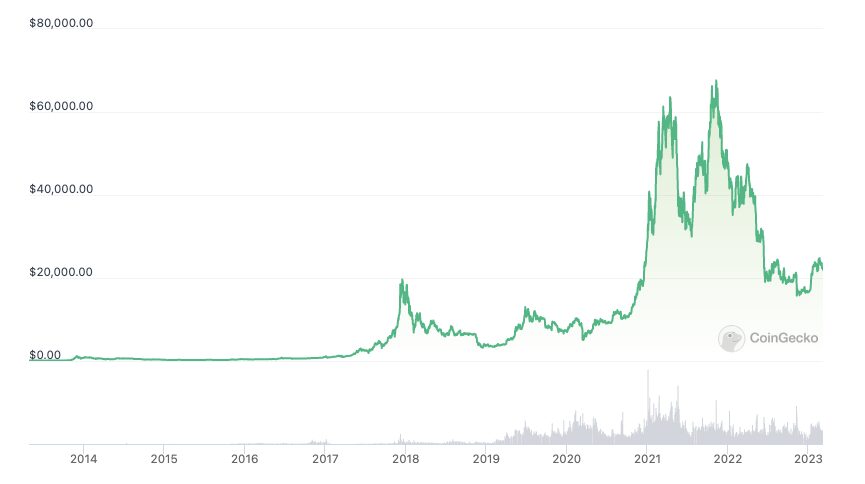

The recent crisis is likely to bring more realistic expectations from the industry and “separate the wheat from the chaff,” Amundi execs said. They compared crypto to blue-chip tech stocks, which also experienced wild price collapses before starting to thrive. The analysts also noted that the current market downturn still comes in line with Bitcoin’s historical price cycles.

Vincent and Tristan mentioned Ethereum’s successful shift to a proof-of-stake blockchain, highlighting the industry’s capabilities in reducing energy consumption. The execs also noted that the key value propositions of crypto like decentralization and immutability of transactions have not been touched by the crisis.

Another reason is that prominent companies in financial and other industries have not stopped expressing their interest in crypto entirely, with heavyweights like Blackrock acquiring a stake in Circle in 2022.

Related: France on the verge of…

Click Here to Read the Full Original Article at Cointelegraph.com News…