[the_ad id="1637"]

[ad_1]

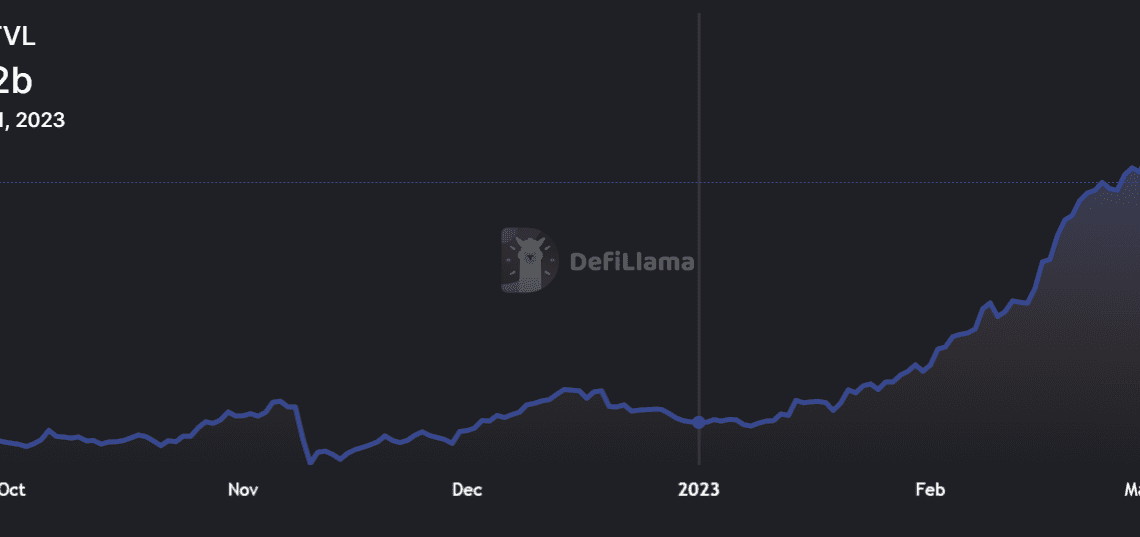

The total value locked (TVL) in DeFi applications on the Arbitrum, a layer-2 Ethereum network blockchain, has doubled since the start of 2023.

While investors’ hope of an ARBI token airdrop is a major factor attracting activity to the Ethereum layer-1 network, the ecosystem’s DeFi growth is also showing robust growth.

Arbitrum has become a major hub for decentralized derivatives trading and offers high yields for crypto yield hunters, reminiscent of wild west DeFi days of 2020.

GMX and Gains Network takeover decentralized derivatives trading

GMX is the leading DApp on Aribitrum, which comprises 25% of the network’s total TVL. The perpetual swap trading platform pits traders and liquidity providers against one another. The liquidity providers own GLP tokens, an index of cryptocurrencies and stablecoins that act as trader counterparties. Meanwhile, stakers of GMX token earn 30% of the protocol’s fees, the platform offers real yields without diluting the token’s supply.

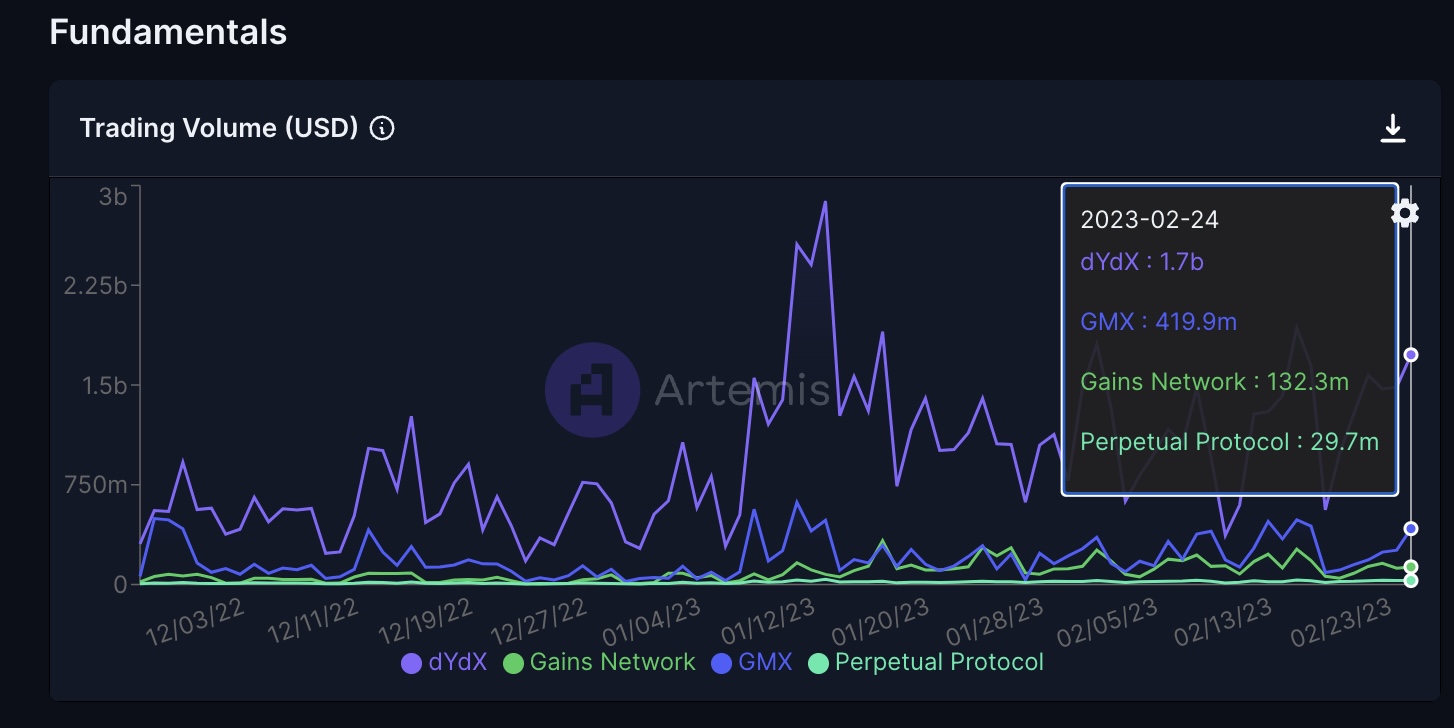

While the trading volume of GMX is nearly five times less than the leading decentralized exchange dYdX, it has started to threaten dYdX’s lead. Interestingly, despite having larger trading volumes, the TVL of dYdX is half of GMX, possibly due to dYdX inadvertently incentivizing wash trading through DYDX token emissions.

Currently, the GMX platform is limited by the number of tokens traded on the platform, which includes only BTC, ETH, UNI and LINK. Whereas dYdX offers perpetual swaps in 36 cryptocurrencies. This will change after the launch of synthetic tokens on GMX, enabling synthetic mints for numerous tokens.

GMX also offers spot trading for specific pairs, making it ideal for integration across other platforms that want to use leverage trading or exchange liquidity. For instance, JonesDAO recently deployed a liquidity provider vault by leveraging GMX’s design.

Gains Network, a synthetic, paper trading platform originally on Polygon, added its platform to Arbitrum on Jan. 31, 2022. Since then, the trading activity on Gains has spiked significantly, possibly due to the numerous assets available for trading, including various cryptocurrencies, stock market indices and gold.

Crypto analytics firm Delphi Digital recently found that Gains Network is close to reaching parity with GMX in terms of the trading volume. The feat is commendable because, similar to GMX, Gains Network does not incentivize trading activity through token emission. Instead, the platform follows a real yield…

Click Here to Read the Full Original Article at Cointelegraph.com News…

[ad_2]

[the_ad id="1638"]