Crypto traders’ urge to create leverage positions with Bitcoin (BTC) appears irresistible to many people, but it’s impossible to know if these traders are extreme risk-takers or savvy market-makers hedging their positions. The need to maintain hedges holds even if traders rely on leverage merely to reduce their counterparty exposure by maintaining a collateral deposit and the bulk of their position on cold wallets.

Not all leverage is reckless

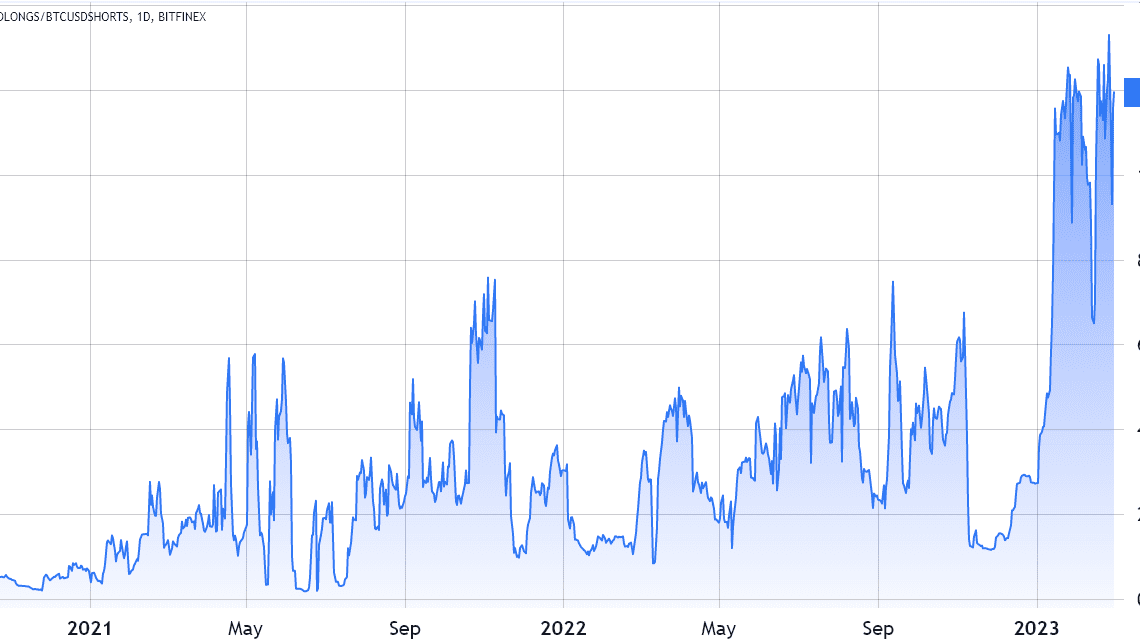

Regardless of the reason for traders’ use of leverage, currently there is a highly unusual imbalance in margin lending markets that favors BTC longs betting on a price increase. Despite this, so far, the movement has been restricted on margin markets because the BTC futures markets remained relatively calm throughout 2023.

Margin markets operate differently from futures contracts in two main areas. Those are not derivatives contracts, meaning the trade happens on the same order book as regular spot trading and, unlike futures contracts, the balance between margin longs and shorts is not always matched.

For instance, after buying 20 Bitcoin using margin, one can literally withdraw the coins from the exchange. Of course, there must be some form of collateral, or a margin deposit, for the trade, and this is usually based on stablecoins. If the borrower fails to return the position, the exchange will automatically liquidate the margin to repay the lender.

The borrower must also pay an interest rate for the BTC bought with margin. The operational procedures will vary between marketplaces held by centralized and decentralized exchanges, but usually the lender gets to decide the rate and duration of the offers.

Margin traders can either long or short

Margin trading allows investors to leverage their positions by borrowing stablecoins and using the proceeds to buy more cryptocurrency. When these traders borrow Bitcoin, they use the coins as collateral for short positions, which means they are betting on a price decrease.

That is why analysts monitor the total lending amounts of Bitcoin and stablecoins to understand whether investors are leaning bullish or bearish. Interestingly, Bitfinex margin traders entered their highest leverage long/short ratio on Feb. 26.

Historically, Bitfinex margin traders are known for creating margin positions of 10,000 BTC or higher quickly, indicating the participation of whales and large arbitrage desks.

As the above chart indicates, on…

Click Here to Read the Full Original Article at Cointelegraph.com News…