Bitcoin (BTC), Ether (ETH) and even nascent altcoins are a solid “buy,” a previously risk-off investor says.

In a blog post released Feb. 8, industry stalwart Arthur Hayes announced a U-turn on his current crypto investment plans.

Hayes changes tune on “risky assets”

Current macroeconomic conditions stemming from the United States Federal Reserve previously made Arthur Hayes keen to avoid what he calls “risky assets.”

As inflation slows and the Fed’s rate hikes with them, multiple new storms are brewing in the U.S., and the Fed, as well as Congress and the Treasury, will all steer the economy as they see fit, he says.

The problem is guessing how these events will play out over the course of the year. For Hayes, 2023 could well be split into two halves, with H1 being an ideal investment environment for crypto.

This runs contrary to a previous thesis from mid-January, in which the former BitMEX CEO said that he was staying on the sidelines for fear of a Fed-induced capitulation event hitting risk assets.

“My concerns about this potential outcome, which I handicapped would most likely happen later in 2023, has led me to keep my spare capital in money market funds and short-dated US Treasury bills,” he now explained.

“As such, the portion of my liquid capital that I intend to eventually use to purchase crypto is missing out on the current monster rally we’re seeing off of the local lows. Bitcoin has rallied close to 50% from the $16,000 lows we saw around the FTX fallout.”

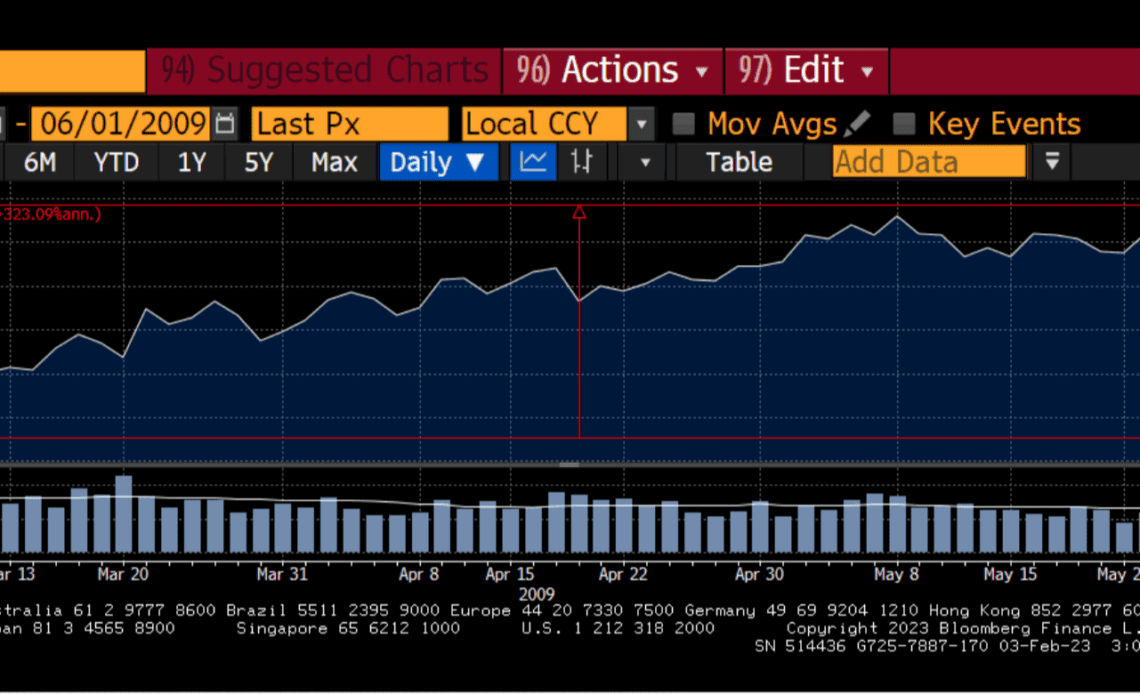

Hayes continued that Bitcoin is likely far from done with its rebound despite 40% gains in January alone, comparing the risk asset environment to that of 2009 and the start of quantitative easing (QE).

This year, the picture is complex — QE has given way to quantitative tightening (QT), where liquidity is removed from the U.S. financial system at risk assets’ expense.

H1, however, looks to be providing some relief — until Congress votes to raise the debt ceiling in Summer, which Hayes and others argue is inevitable, some liquidity is actually returning to avoid the debt ceiling hitting too soon.

Cash in the Treasury General Account (TGA) will be emptied to the tune of $500 billion, canceling the $100 billion monthly in liquidity that the Fed is removing.

“The TGA will be exhausted sometime in the middle of the year. Immediately following its exhaustion, there will be a political circus in the US…

Click Here to Read the Full Original Article at Cointelegraph.com News…