Over the last 14 years, investors got attracted to Bitcoin (BTC) for many reasons— from fixing a flawed fiat economy and reaching the unbanked to diversifying portfolios. However, a large portion of the general public sees Bitcoin as a gateway to financial freedom amid growing fiat inflation and geopolitical uncertainties.

Traditional banking systems have, time and again, served as a tool for centralized governments to dictate financial access, especially during dire situations. Most recently, the Ukraine-Russian war served as a case study for how cryptocurrencies helped the displaced and the unbanked access funds for basic necessities.

As intended by the creator Satoshi Nakamoto, Bitcoin aims to bring power back to the people. This means that no amount of regulations, sanctions or bans can stop one from using Bitcoin as money. Beyond that, a calculated investment in Bitcoin has the potential to bring one closer to attaining their dream of financial freedom. But how does one do that?

Hodl

The massive volatility of cryptocurrencies coupled with the restlessness of an investor is a recipe for an instant loss. What many fail to understand is that Bitcoin — unlike cryptocurrencies — is a long-term investment. Hence, Bitcoin veterans recommend holding the asset during bull markets and buying the dips during bear markets.

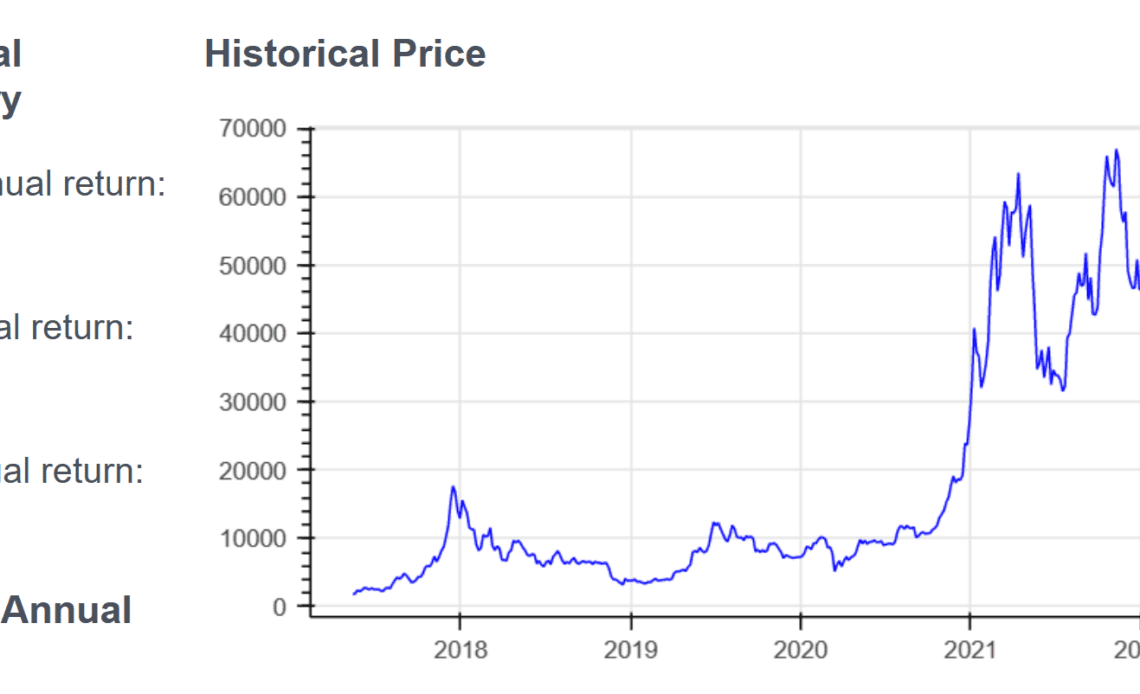

Setting aside a few off years, Bitcoin holders witnessed a mean annual return of 93.8%, which at its best-performing year, spiked to 302.8%, reveals data from UpMyInterest.

As simple as it sounds, hodling (a crypto lingo for holding assets) has proved to be a difficult feat for investors. Some of the factors that trigger abrupt Bitcoin selling include an ongoing FUD (fear, uncertainty and doubt) and price movements.

While it makes sense in the short-term to earn profits off Bitcoin’s volatility, zooming out the price chart reveals there’s a long-term greater incentive in holding. Moreover, investors owning Bitcoin will always have the option to utilize this spending across geographical boundaries without losing value.

Dollar-Cost Averaging (DCA)

Considering Bitcoin as a viable long-term investment option, many investors tend to implement the dollar-cost averaging (DCA) strategy. This involves setting aside a predetermined dollar amount from a regular income to be reinvested in Bitcoin every month.

While El Salvador was initially criticized for adopting Bitcoin as a legal…

Click Here to Read the Full Original Article at Cointelegraph.com News…