The rally in cryptocurrency markets started in early January with a spike in heavily-shorted altcoins and Ethereum (ETH) liquid staking derivative (LSD) tokens due to the upcoming network upgrade in March. Soon gains started to show across the board as buyers started to play catch up.

The improving macroeconomic conditions, such as reduced inflation and a stable job sector in the United States, provided additional tailwinds for the positive rally. Bitcoin (BTC) is en route to its most impressive closing for January since 2013. Its price has gained 40% year-to-date from the opening value of $16,530.

Another important catalyst for January 2023’s rally was a short squeeze across the crypto market. After the FTX debacle and the lack of bullish narratives for the niche space, most investors expected growth to slow down in 2023.

There are unresolved issues such as potential a Digital Currency Group fallout, geopolitical tension between Russia and Ukraine, and recession risks due to Fed’s aggressive quantitative tightening policies. Thus, most traders didn’t expect strong price rallies so early into the year.

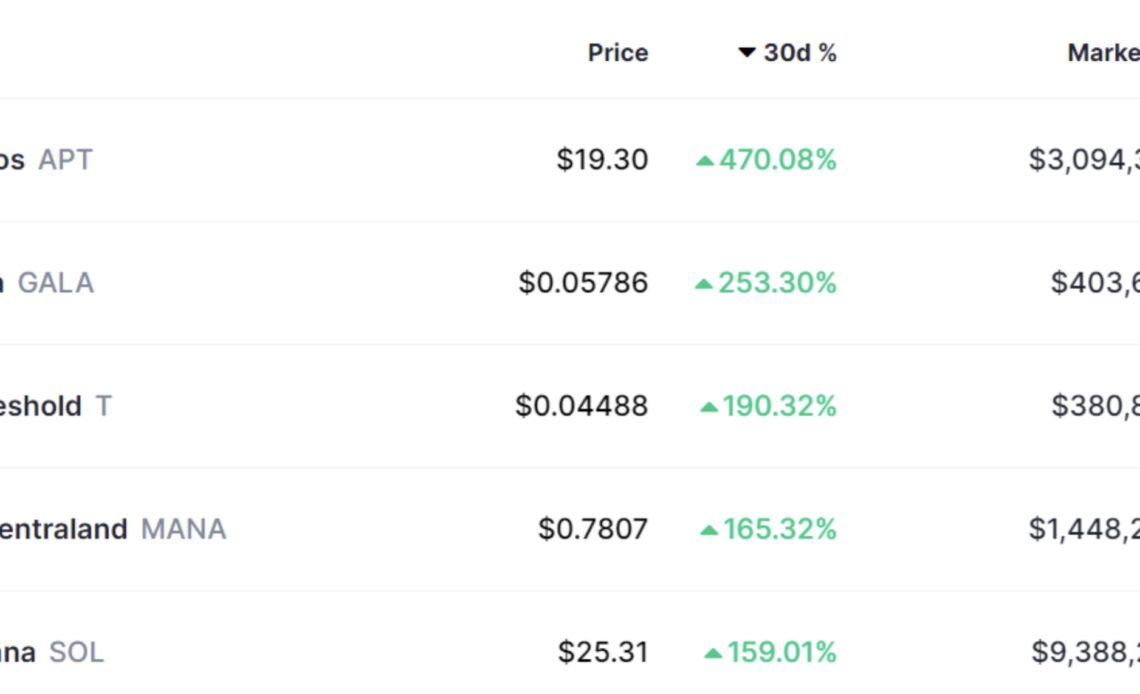

As it turns out, negative sentiment and crowded positions in the futures market continued to fuel more upside. There’s a strong chance of a pullback soon after steep gains. It remains to be seen if the pullback levels are attractive enough for buyers to turn it into a medium-to-long-term bullish trend. Let’s take a look at the top performing cryptocurrencies for January.

Aptos (APT)

Launched in October 2022, Aptos is a relatively new blockchain in the space which leverages the technology of Facebook’s (Meta) discarded project, Libra. It carries significant face value based on its executive team, composed of former Meta engineers, who also built the Move programming language to make the chain scalable and decentralized.

While the project carries much reputation, its fundamentals do not justify the price. The disbelief among investors is part of the reason behind the APT price rally. A market capitalization of $3 billion for a four-month-old project has surprised many onlookers. There’s also suspected market manipulation in the APT/KRW pair on Upbit, giving rise to the Kimchi premium. It is difficult to pinpoint a specific factor driving its demand in South Korea.

APT/USD broke above its previous peak of around $10, recorded around its launch. Technically, the token is in price discovery…

Click Here to Read the Full Original Article at Cointelegraph.com News…