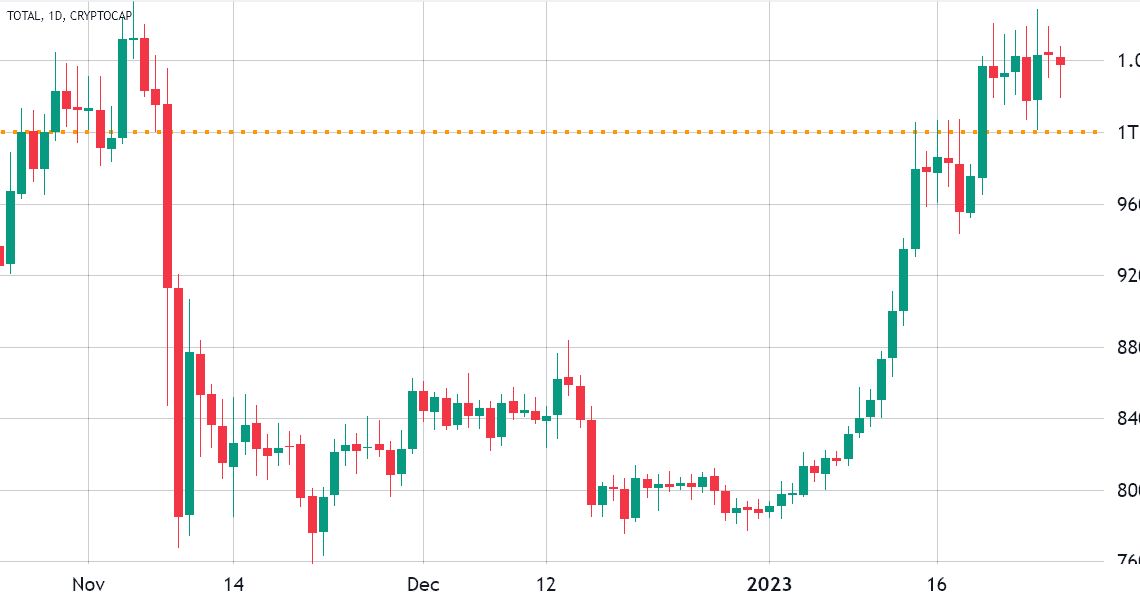

Despite the recent negative crypto and macroeconomic newsflow, the total cryptocurrency market capitalization broke above $1 trillion on Jan. 21. An encouraging sign is that derivatives metrics are not showing increased demand from bearish traders at the moment.

Bitcoin (BTC) price gained 8% on the week, stabilizing near the $23,100 level at 18:00 UTC on Jan. 27 as the markets weighed the potential impact of Genesis Capital’s bankruptcy on Jan. 19.

One area of concern is Genesis Capital’s largest debtor is Digital Currency Group (DCG), which happens to be its parent company. Consequently, Grayscale funds management could be at risk, so investors are unsure if the Grayscale Bitcoin Trust (GBTC) assets could face liquidation. The investment vehicle currently holds over $14 billion worth of Bitcoin positions for its holders.

A United States appeals court is set to hear the arguments relating to Grayscale Investment’s lawsuit against the Securities and Exchange Commission (SEC) on March 8. The fund manager questioned the SEC’s decision to deny their asset-backed exchange-traded fund (ETF) launch.

Regulatory concerns also negatively impacted the markets after South Korean prosecutors requested an arrest warrant for Bithumb exchange owner Kang Jong-Hyun. On Jan. 25, the Financial Investigation 2nd Division of the Seoul Southern District Prosecutor’s Office sentenced Kang and two Bithumb executives on charges of conducting fraudulent illegal transactions.

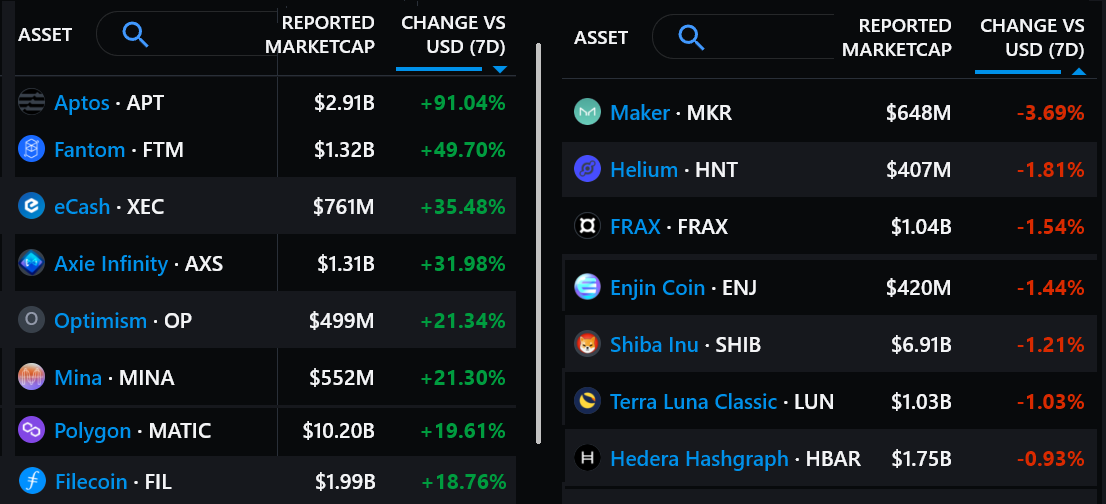

The 7% weekly increase in total market capitalization was held back by Ether’s (ETH) 0.3% negative price move. Still, the bullish sentiment significantly impacted altcoins, with 11 of the top 80 coins gaining 18% or more in the period.

Aptos (APT) gained 91% after the smart contract network total value locked (TVL) reached a record-high $58 million, fueled by PancakeSwap DEX.

Fantom (FTM) rallied 50% after the announcement of its new database system, Carmen, and a new Fantom Virtual Machine, Tosca.

Optimism (OP) faced 21% gains after a sharp increase in transaction volumes during an NFT incentive program called Optimism Quest.

Leverage demand slightly favors bulls

Perpetual contracts, also known as inverse swaps, have an embedded rate usually charged every eight hours. Exchanges use this fee to avoid exchange risk imbalances.

A positive funding rate indicates that longs (buyers) demand more…

Click Here to Read the Full Original Article at Cointelegraph.com News…