Litecoin (LTC) has rebounded by 130% to almost $100 after bottoming out near $40.50 in June 2022. The primary reasons include broadly improving risk-on sentiment and euphoria around the Litecoin halving in August 2023.

However, technicals suggest that LTC may wipe out most of these gains in the coming months.

LTC price paints giant bear flag

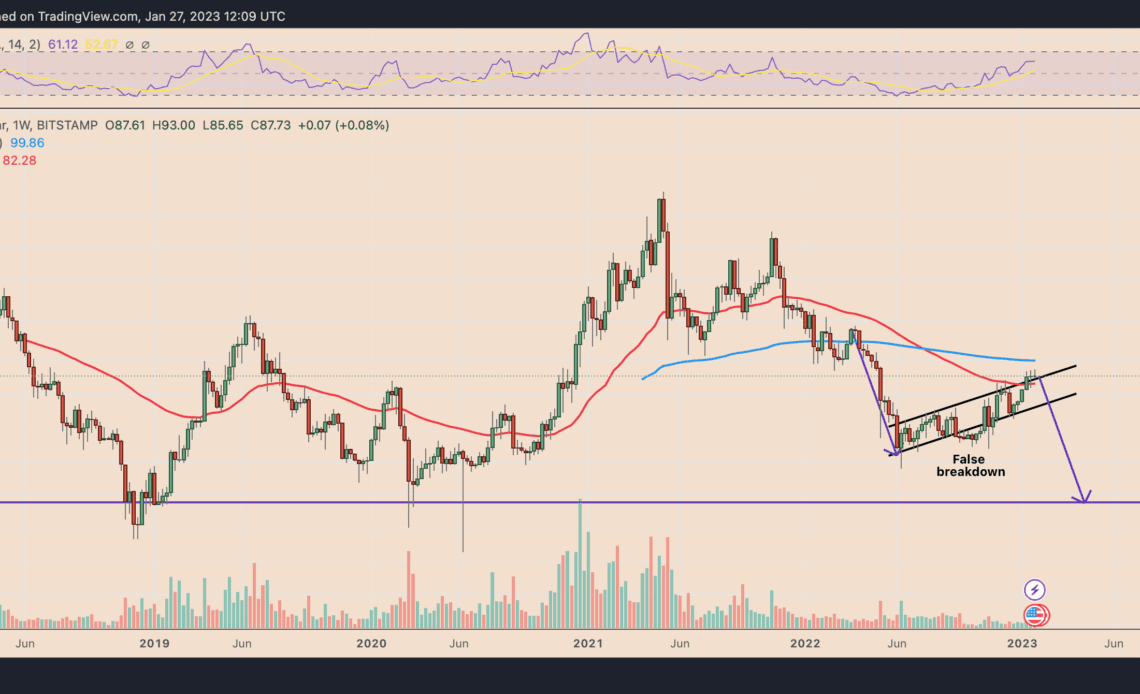

Litecoin stands to pare its gains mainly due to a giant bear flag on the weekly char.

A bear flag is a bearish continuation pattern that occurs when the price consolidates inside an ascending, parallel channel after undergoing a strong downtrend. It resolves after the price breaks below its lower trendline with a rise in trading volumes

Litecoin has been painting a similar pattern since early June 2022. Previously, the LTC/USD pair had undergone a 70% price correction from $130 to $40.50. Thus, from the technical perspective, it would resume its downtrend course if its price breaks below the lower trendline.

As a rule, a bear flag breakdown move prompts the price to fall by as much as the previous downtrend’s length. Applying the same setup to Litecoin brings its bear flag downside target to nearly $30.50, or 65% lower than current LTC price.

Litecoin price “head fake”?

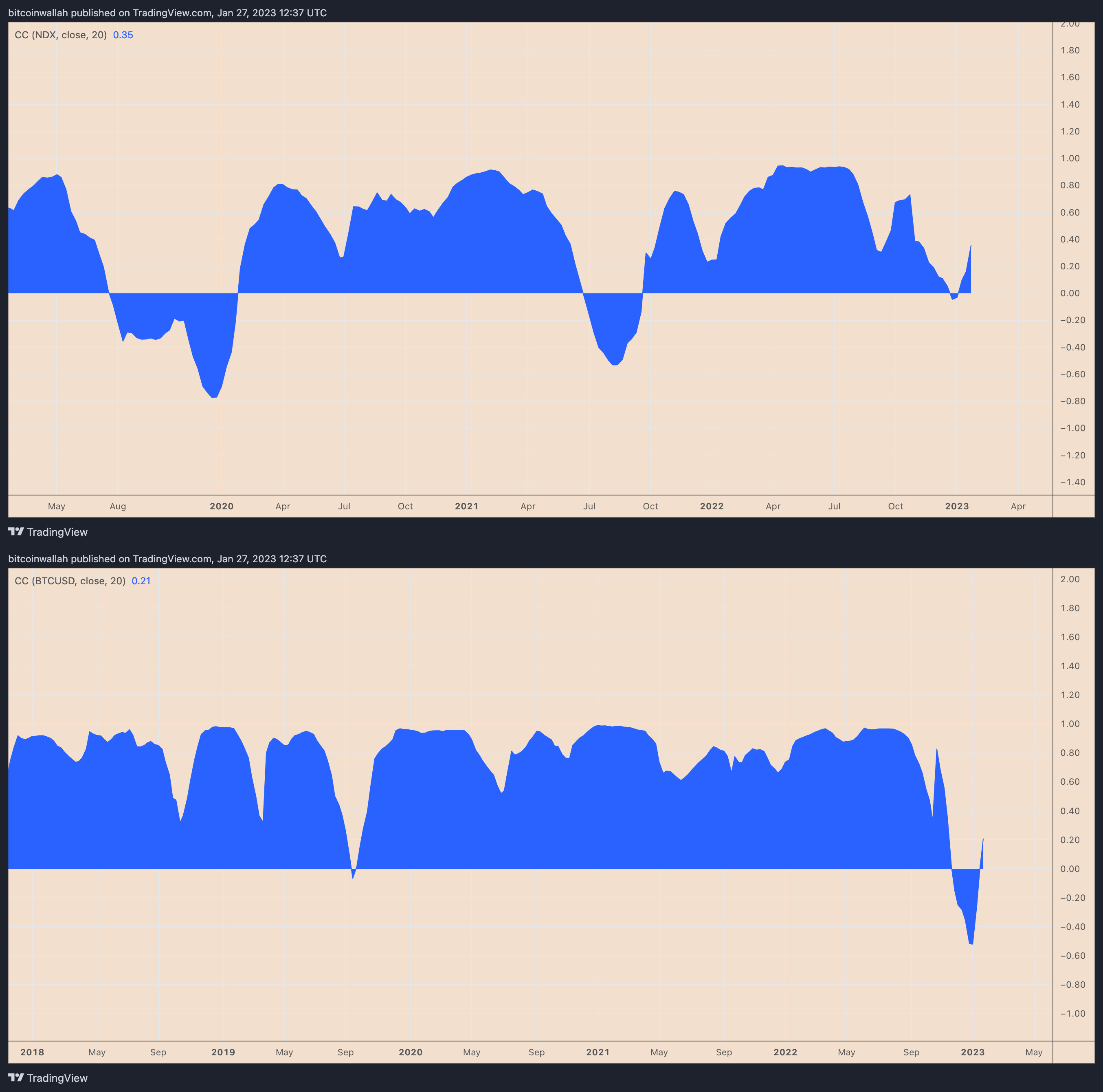

As said earlier, Litecoin’s price recovery has primarily occurred in line with similar moves across the risk-on market due to cooling inflation.

For instance, the Nasdaq-100 stock market index has risen approx. 15.50% between October 2022 and January 2023. Similarly, Bitcoin (BTC) has rallied by more than 50% since its November 2022’s low of around $15,500.

The weekly correlation coefficient between Litecoin and Nasdaq-100 has been mostly positive at 0.35 on Jan. 27. Similarly, correlation between Litecoin and Bitcoin is now around 0.21.

But many analysts, including Mark Haefele, the chief investment officer at UBS Global Wealth Management, have noted that the ongoing risk-on rally could be a “head fake.” In simple words, the ongoing Litecoin rally, under the influence of its risk-on counterparts, could be short-lived.

Independent market analyst Capo of Crypto also agrees, noting:

“The way the upward movement is happening, the way [higher-timeframe] resistances are being tested… it clearly looks manipulated, no real demand. Once again, the biggest bull trap I’ve ever seen.”

Bullish…

Click Here to Read the Full Original Article at Cointelegraph.com News…