In his latest blog post released on Jan. 19, Arthur Hayes, the former CEO of BitMEX exchange predicted a “global financial meltdown” thanks to future United States economic woes.

Hayes: Crypto will “get smoked” in Fed pivot

Bitcoin’s current rally should likely not be taken as the start of a new bull run.

That is the opinion of Arthur Hayes, who in a fresh treatise on U.S. macroeconomic policy this week warned that current Federal Reserve behavior would flip from restrictive to liberal, but cause cryptoassets to “get smoked.”

With U.S. inflation easing, the Fed is the focus of practically every crypto analyst this year as they estimate the likelihood of a policy “pivot” away from quantitative tightening (QT) and interest rate hikes to flat and then decreasing rates, and potentially even quantitative easing (QE).

This essentially involves a move away from draining the economy of liquidity to injecting it back in, and while that practice led to new all-time highs for Bitcoin beginning in 2020, the same phenomenon would not be plain sailing next time around, Hayes believes.

“If a removal of half a trillion dollars in 2022 created the worst bond and stock performance in a few hundred years, imagine what will happen if double that amount is removed in 2023,” he wrote.

“The reaction of the markets when money is injected vs. withdrawn is not symmetrical — and as such, I expect that the law of unintended consequences will bite the Fed in the ass as it continues to withdraw liquidity.”

As such, rather than a smooth transition away from QT, Hayes is betting on extreme circumstances forcing the Fed to act.

“Some part of the US credit market breaks, which leads to a financial meltdown across a broad swath of financial assets,” he explained.

“In a response similar to the action it took in March 2020, the Fed calls an emergency press conference and stops QT, cuts rates significantly and recommences Quantitative Easing (QE) by purchasing bonds once more.”

This in turn means “risky asset prices crater.”

“Bonds, equities, and every crypto under the sun all get smoked as the glue that holds together the global USD-based financial system dissolves,” the blog post continues.

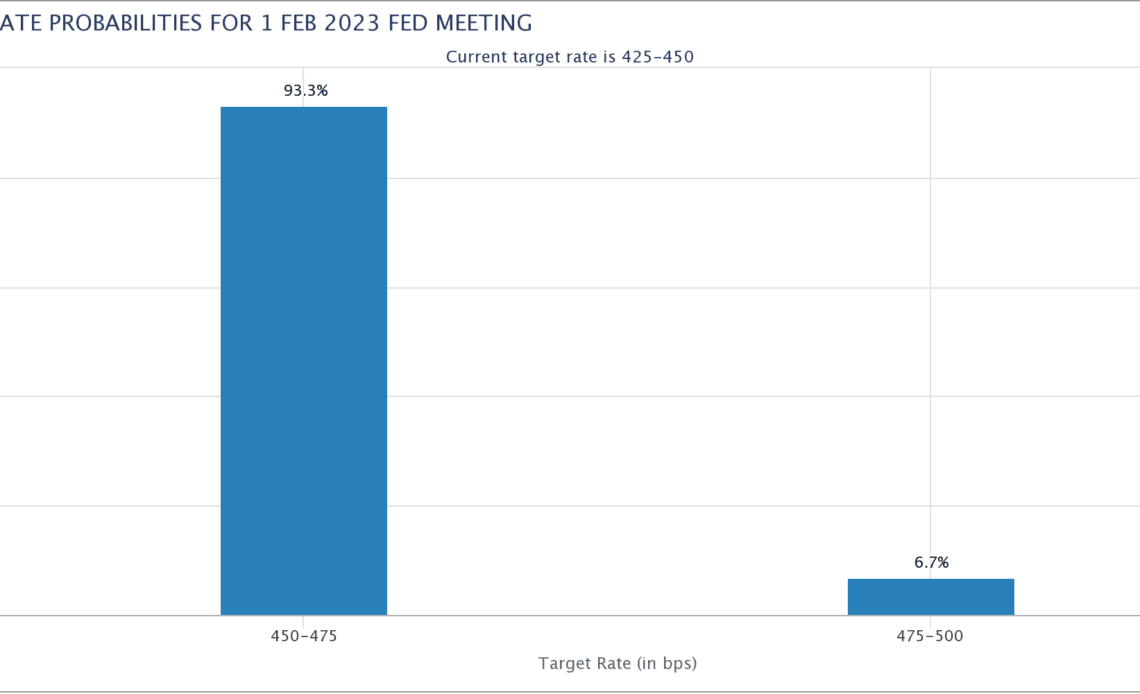

Current estimates, as shown by CME Group’s FedWatch Tool, overwhelmingly favor the Fed lowering the pace of rate hikes at its next decision on Feb. 1.

Planning a March 2020 rerun

Hayes is far from alone in being…

Click Here to Read the Full Original Article at Cointelegraph.com News…