Avalanche (AVAX) has opened 2023 with a bang, rising nearly 55% in the first two weeks. And now, a mix of technical and fundamental indicators hints that the token will keep rallying into March.

AVAX price breakout underway

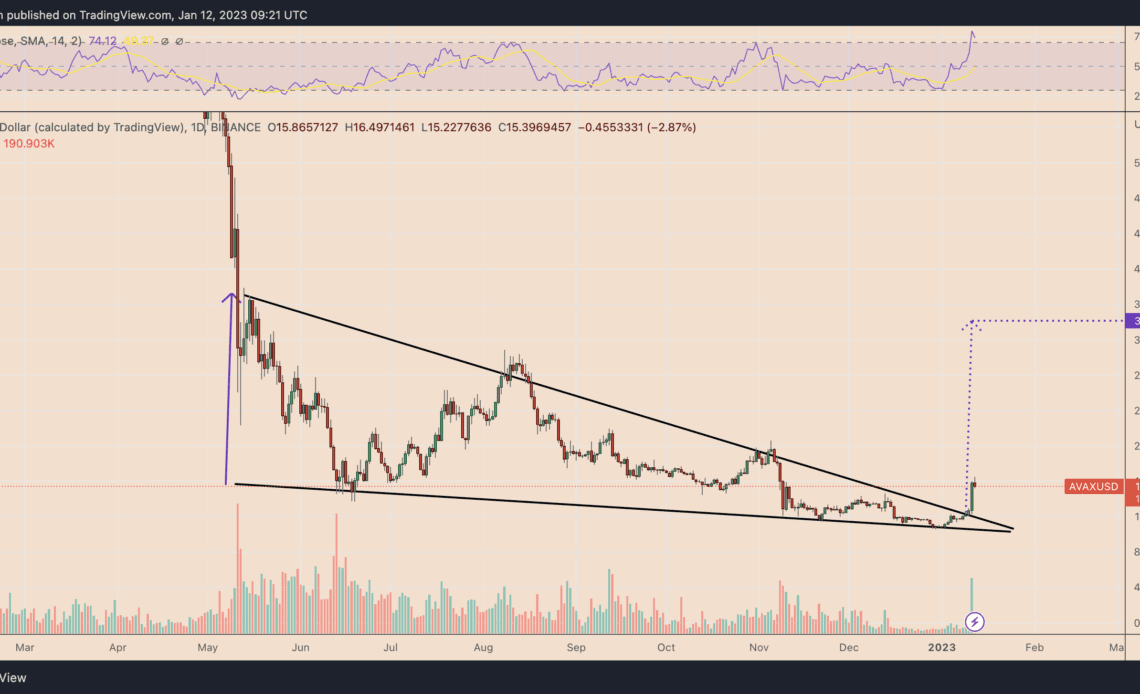

The AVAX/USD pair appears to have been forming a falling wedge pattern since May 2022 and has now entered the breakout stage of this pattern.

A falling wedge forms when the price trends lower inside a range defined by two converging, descending trendlines. The pattern resolves after the price breaks out of its range to the upside and, as a rule of technical analysis, can rise as high as the distance between its upper and lower trendlines.

Applying the theory on AVAX’s falling wedge pattern brings the token’s breakout target at around $34, up approximately 115% from current price levels.

Avalanche’s Amazon partnership

AVAX’s bullish setup appears as Ava Labs — the developer of the Avalanche network — becomes an official blockchain solution provider to Amazon Web Services (AWS).

Notably, the firm will implement new features that make it easier for developers to run an Avalanche node through the AWS Marketplace. In addition, developers will be able to create Avalanche subnets with a few clicks.

The partnership will increase Avalanche’s utility among enterprises and governments in a perfect scenario, which, in turn, could boost demand for AVAX tokens. These prospects have helped the Avalanche token rise nearly 30% on a 24-hour adjusted timeframe.

Amazon partnership should get us this pump. Are you ready ? pic.twitter.com/6fCBZ6rbXo

— Crypto Bull ( Until 5th Sep 2025 ) (@holdersignals) January 11, 2023

Macro boosts bullish scenario

AVAX’s bullish falling wedge setup emerges also amid an improving macroeconomic fundamentals for riskier assets, which may benefit the crypto market on the whole in the coming months.

Notably, economists are unanimously positioned for a drop in the U.S. consumer price index (CPI), according to a Bloomberg survey. Ideally, lowering inflation may prompt the Federal Reserve to stop its interest rate hikes, which leaves investors with excess cash to invest in riskier markets.

The next CPI report will come out on Jan. 12. JPMorgan & Chase sees the S&P 500 index rising by 3-3.5% if the December inflation comes to be 6.4%, a 20% probability. The index could rise 1.5-2% if the inflation reading comes inside the 6.4%-6.5% range, a scenario…

Click Here to Read the Full Original Article at Cointelegraph.com News…