[the_ad id="1637"]

[ad_1]

Effective regulations are one of the key gateways to cryptocurrency’s mainstream adoption. Due to greater compliance, crypto businesses saw broader acceptance from regulators worldwide. While the crypto ecosystem was awarded countless operational licenses and exposure to new markets, the fall of Terraform Labs, FTX and Celsius, among others, had a negative impact on the industry’s reputation with investors and regulators alike.

As we look back on 2022 and all it brought for the cryptocurrency industry, we’re highlighting how the regulatory landscape has changed for cryptocurrencies and the blockchain industry as a whole.

North America

China’s blanket ban on crypto mining and trading from late 2021 positioned the United States as the torchbearer for crypto disruption by default. The U.S. is not only home to the biggest crypto ATM network, but is also is the highest contributor to the Bitcoin (BTC) hash rate.

Out of all crypto sub-ecosystems, nonfungible tokens (NFTs) took center stage in U.S. politics. What can be considered as a clear win for crypto, the Federal Election Commission (FEC) permitted the use of NFTs for political campaign fundraising incentives.

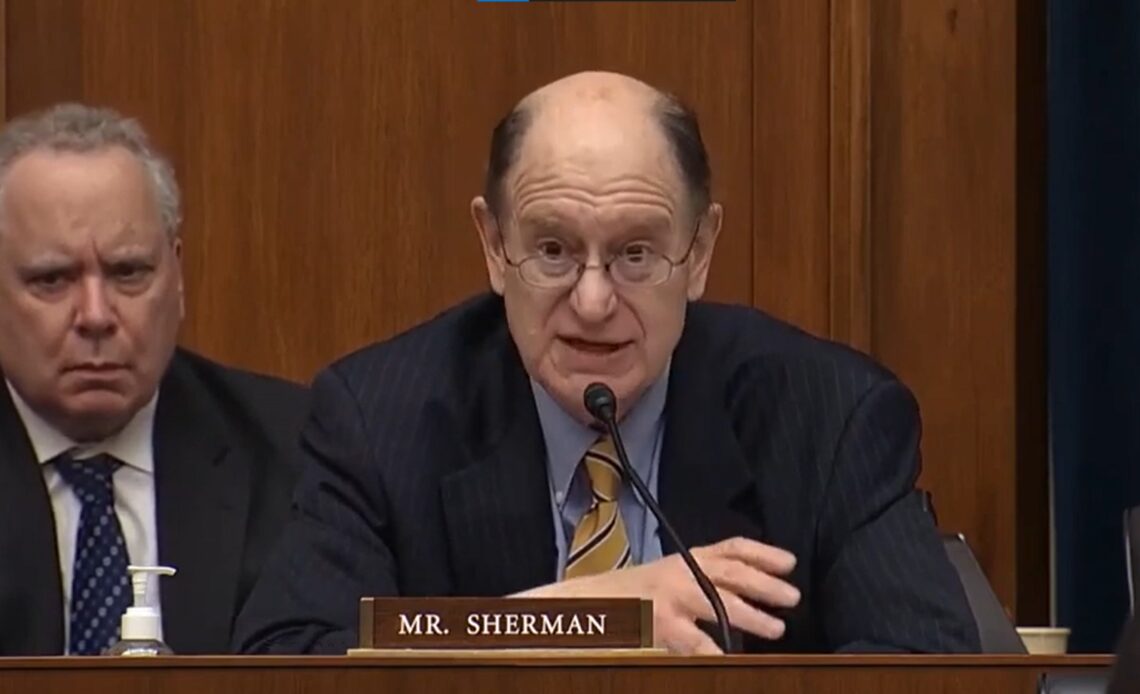

For many regulators, the collapse of FTX and the arrest of former CEO Sam Bankman-Fried were perceived as a representation of the wrongdoings of the entire crypto community. As a result, it helped recement anti-crypto sentiment among many U.S. politicians, such as Representative Brad Sherman. However, Representative Tom Emmer sided with the crypto community as he pointed out the community’s contribution to tracking Bankman-Fried’s illegal activities.

Citing the FTX collapse, the Canadian Securities Administrators — an umbrella group of securities regulators across Canada — banned crypto leverage and margin trading to protect investors. In addition, Canadian energy provider Hydro-Québec rolled out plans to reallocate energy supplied to crypto mining firms, citing the high energy demands anticipated during the harsh Canadian winter.

Similarly, U.S. regulators introduced the Crypto-Asset Environmental Transparency Act to direct the Environmental Protection Agency to report on the energy use and environmental impact of crypto miners.

Central and South America

Farther south, El Salvador still retains its position as the most significant contributor to mainstreaming Bitcoin worldwide….

Click Here to Read the Full Original Article at Cointelegraph.com News…

[ad_2]

[the_ad id="1638"]