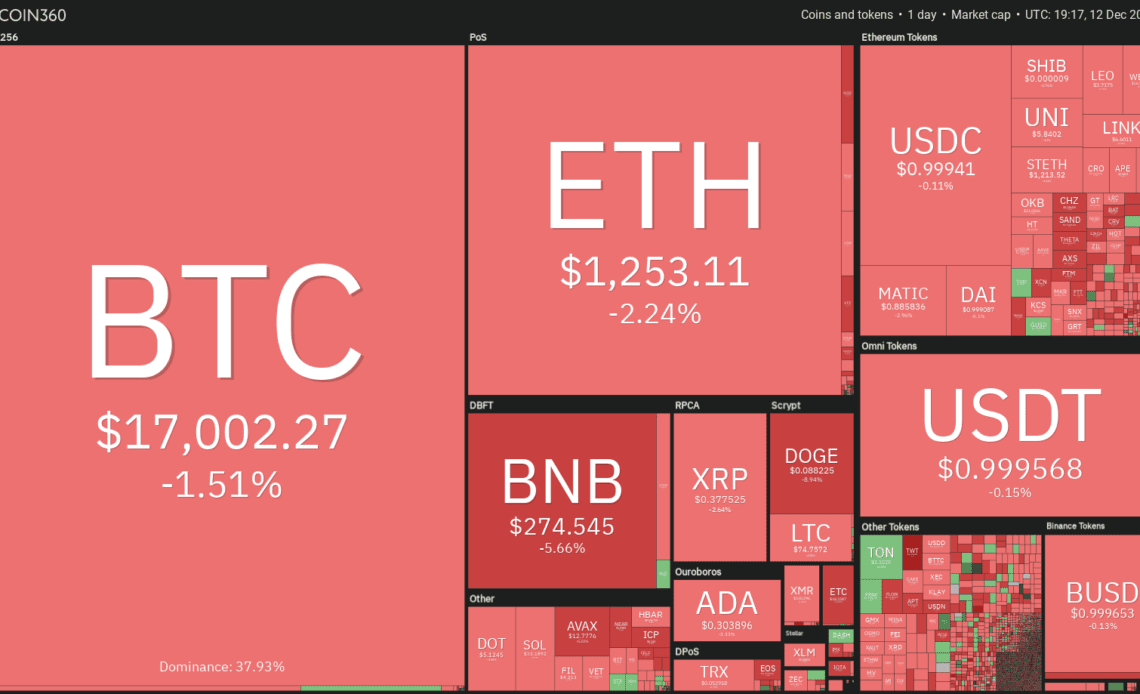

It has been a tumultuous year for the crypto investors who have witnessed the total crypto market capitalization tumble from about $2.2 trillion at the beginning of 2022 to about $850 billion in December. The sharp erosion in valuation was caused due to several high-profile bankruptcies in 2022.

The entire Terra ecosystem imploded with the collapse of its LUNA token and TerraUSD (UST) stablecoin. The failure of Three Arrows Capital followed this black swan event, and the final blow came as FTX underwent a bank run and imploded. These back-to-back events triggered a liquidity and credit crunch and appear to have caused the most damage to the crypto industry.

A prolonged bear market tends to test investors’ patience, but it offers one of the best opportunities to buy fundamentally sound cryptocurrencies at lower levels. Smart investors who can go against the herd and invest during periods of panic tend to benefit the most when the trend eventually turns.

While a bear market is a great time to build a portfolio, traders tend to make the mistake of buying the coins that have fallen the most in the hope that they will recover to their previous glory. Most times that does not happen because every bull market has a new set of leaders. Generally, the ones that are resilient during the fall or recover quickly from the bottom tend to lead on the way up.

Let’s look at five cryptocurrencies that are showing promise for 2023.

BTC/USDT

The broader cryptocurrency market is unlikely to start a new bull phase until Bitcoin (BTC) stages a turnaround. Although Bitcoin has been in a strong downtrend for the past several months, the relative strength index (RSI) is forming a positive divergence, indicating that the bearish momentum may be weakening.

However, a positive divergence must have favorable price action to confirm a trend change.

The first sign of strength will be a break and close above the 20-week exponential moving average (EMA) of $19,870. The BTC/USDT pair could rally to $25,211, where the bears may mount a strong defense again.

If the price turns down from this level, then rebounds off the 20-week EMA, it will signal a change in sentiment from selling on rallies to buying on dips. That could increase the possibility of a break above $25,211.

The pair could then rise to the 50-week simple moving average (SMA) of $28,156. This remains the key level for the bears to defend…

Click Here to Read the Full Original Article at Cointelegraph.com News…