As November begins, analysts are busy dissecting the major market movements that occurred in October. While Bitcoin (BTC) stayed relatively unchanged with only 5.89% growth in October, Arcane Research senior analyst, Vetle Lunde mapped out the direction the market might take in the next few months.

“Uptober,” a reference to Bitcoin’s bullish historical performance in the month of October, was a common theme across many threads on crypto Twitter and according to Lunde it appears to have happened. Data shows BTC and exchange tokens outperformed the large caps index up until Oct. 26.

Elon Musk’s Twitter takeover helped push the large caps index above Bitcoin with a staggering 20% monthly gain. Dogecoin (DOGE) helped cement the large-cap strength by producing a 144% gain in the last seven days.

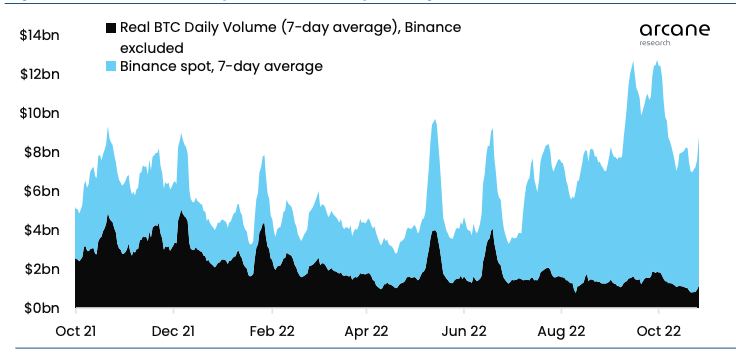

October’s Bitcoin spot market was driven by increased volume and lower volatility, while benefiting from a short squeeze that briefly invigorated the market. According to Lunde, the last week of October saw the largest short liquidation volume in crypto since July 26, 2021.

While this activity helped push Bitcoin up by 6%, Ether (ETH) and Binance Coin (BNB) saw more substantial gains at 18% and 19% respectively.

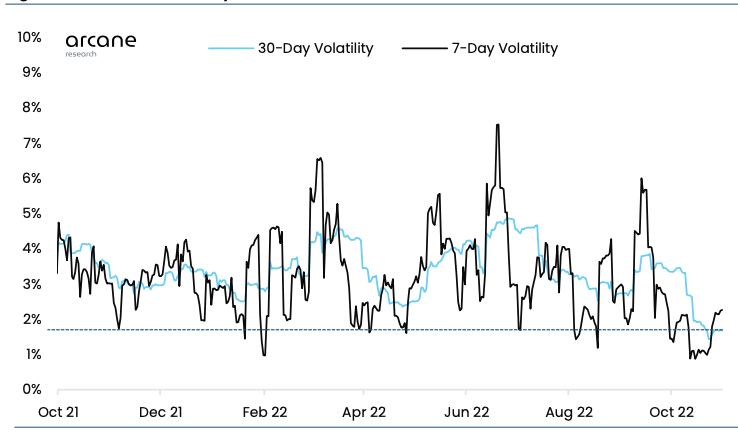

The short squeeze helped give an overall boost but Lunde concluded that the momentum did not create a substantial change in BTC price. BTC spot volume is up 46% in the last seven days and the 30-day volatility index is at a 2-year low. Furthermore, the 7-day volatility index is sitting at 2.2%, whereas the yearly average is 3%.

When comparing volatility to a previous short squeeze to the recent short squeeze, Lunde said:

“The July 26 squeeze saw a daily high-low variation of 15% as markets hastily moved up, whereas the October 25 and October 26 moves saw daily high-low variations of 5% and 6%, respectively. Further, momentum has stopped, indicating that traders should brace for longer consolidation.”

While Bitcoin is priced attractively, the best approach to this market is to dollar cost average in the short-term rather than using leverage, according to Lunde. Bitcoin has been experiencing uniquely low volatility and follows the US equities market closely so it is important to track Q3 earnings reports.

Fed policy will continue to…

Click Here to Read the Full Original Article at Cointelegraph.com News…