[the_ad id="1637"]

[ad_1]

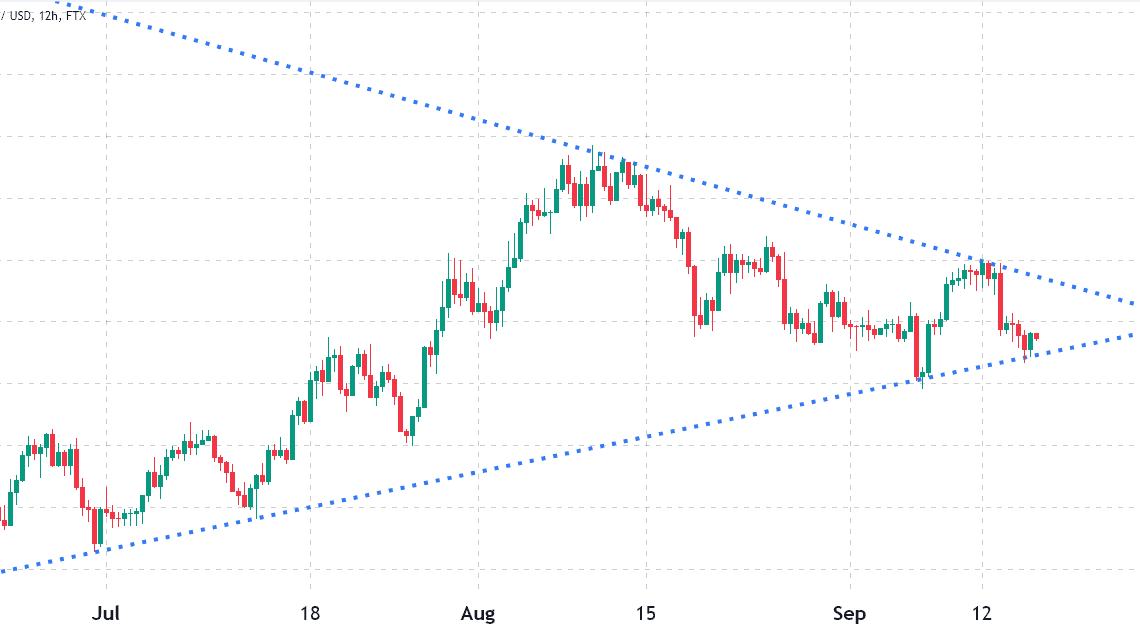

BNB, the native token of Binance’s BNB Chain, entered a symmetrical triangle formation on Aug. 10, when it first faced the descending trendline at the $335 resistance. The following five weeks have been a struggle around $280, the exact intersection between the two conflicting ascending and descending patterns.

A decision on whether the symmetrical triangle will break to the upside or downside is expected by Sept. 30, when the trendlines cross. Currently holding a $45 billion total market capitalization, BNB Chain token has outperformed the broader altcoin market by 15% over the past three months.

The latest breakthrough in BNB Chain development was announced on Sept. 7, after the project introduced zero-knowledge (ZK) proof scaling privacy technology. The testnet is expected for November, aiming for faster finality and reduced transaction fees. Ethereum mastermind Vitalik Buterin also wants to implement a similar solution for the Ethereum network and he highlighted the importance of ZK in late 2021.

BNB Chain’s Ethereum-compatible network is fully functional, hosting decentralized applications (DApps), including decentralized exchanges (DEXs), games, collateralized loan services, social networks, yield aggregators and NFT marketplaces.

A decline in price deposits could be a red flag

Despite currently being 60% below its -time high, BNB remains the third largest cryptocurrency by market capitalization ranking, excluding stablecoins. Moreover, the network holds $6.6 billion worth of deposits locked on smart contracts, a term known as total value locked, in the industry.

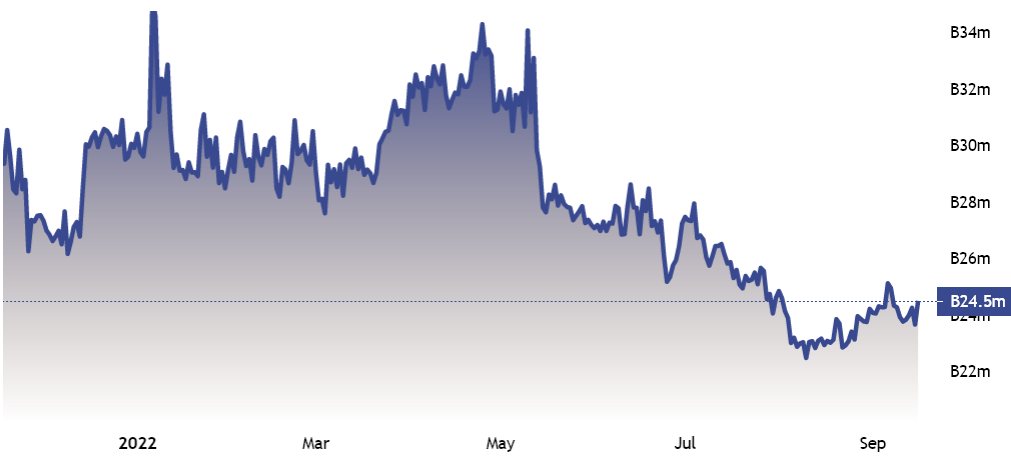

Despite BNB price rallying 26.5% in the past 3 months, the network’s TVL measured in BNB tokens dropped by 12.5% in the same period. Usually, this data would be concerning, but it depends on how other competitors have fared.

In fact, lower smart contract deposits have been the norm across the industry. For example, Solana’s (SOL) TVL declined by 27.5% in 3 months, and Avalanche (AVAX) decreased by 36%. Even Ethereum saw a 29% cut in ETH deposits, down to 24.2 million from 34 million on July 17.

In dollar terms, BNB Chain’s current TVL of $6.6 billion gained 12% in the three months leading to Sept. 16. This figure is vastly superior to other Ethereum competitors, such Avalanche’s $2.2 billion or Solana’s $1.3 billion, according to data from DeFi Llama.

DApp use is on the rise, led by Gameta

To confirm…

Click Here to Read the Full Original Article at Cointelegraph.com News…

[ad_2]

[the_ad id="1638"]