Markets are scary right now, and while the situation is likely to worsen, it doesn’t mean investors need to sit out and watch from the sidelines. In fact, history has proven that one of the best times to buy Bitcoin (BTC) is when no one is talking about Bitcoin.

Remember the 2018–2020 crypto winter? I do. Hardly anyone, including mainstream media, was talking about crypto in a positive or negative way. It was during this time of prolonged downtrend and lengthy sideways chop that smart investors were accumulating in preparation for the next bull trend.

Of course, nobody knew “when” this parabolic advance would take place, but the example is purely meant to illustrate that crypto might be in a crab market, but there are still great strategies for investing in Bitcoin.

Let’s take a look at three.

Accumulation via dollar-cost averaging

It’s helpful to be price agnostic when it comes to investing in assets over the long term. A price agnostic investor is immune to fluctuations in value and will identify a few assets that they believe in and continue to add to the positions. If the project has good fundamentals, a strong, active use case and a healthy network, it makes more sense to just dollar-cost average (DCA) into a position.

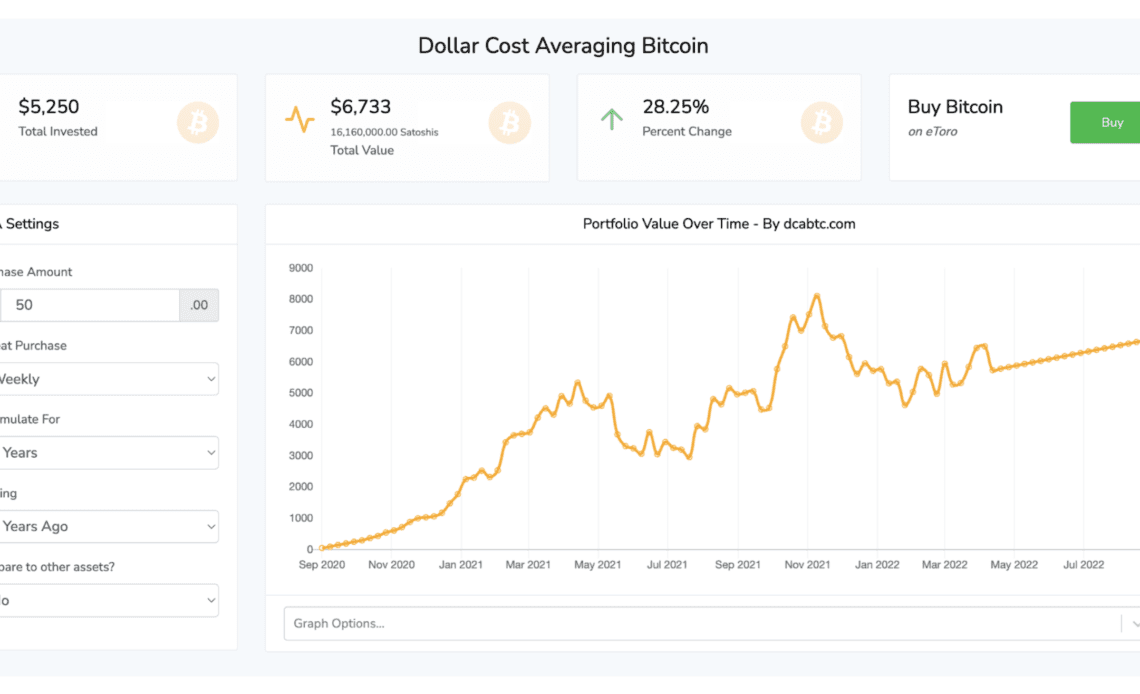

Take, for example, this chart from DCA.BTC.

Investors who auto-purchased $50 in BTC weekly over a two-year span are still in profit today, and by DCA, there is no need to make trades, watch charts, or subject oneself to the emotional stress that is associated with trading.

Trade the trend and go long off extreme lows

Aside from steady, reasonably sized dollar-cost averaging, investors should be building a war chest of dry powder and just sitting on their hands waiting for generational buying opportunities. Entering the market when it’s deeply oversold and all metrics are in extreme is typically a good place to open spot longs but with less than 20% of one’s dry powder.

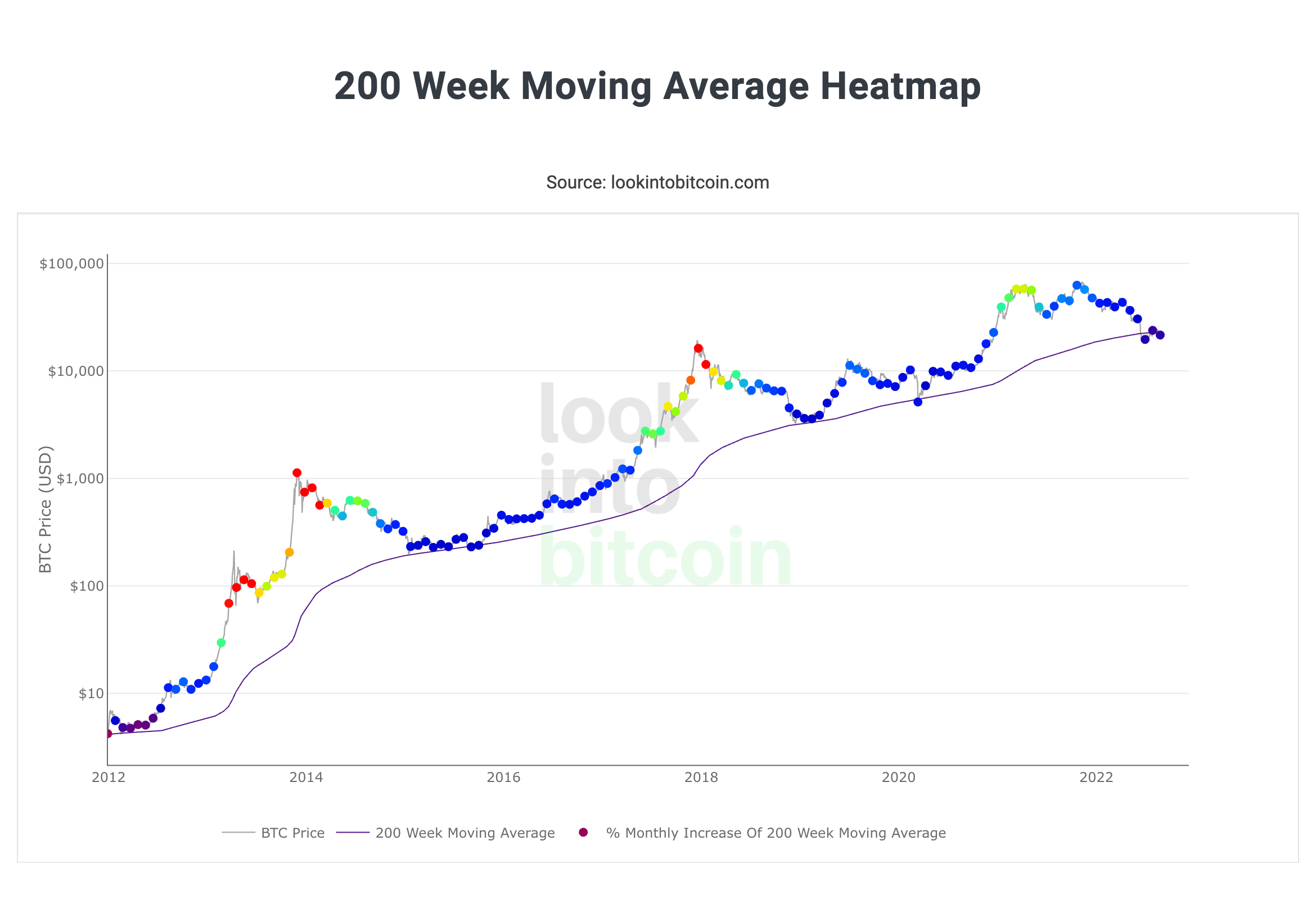

When assets and price indicators are two or more standard deviations away from the norm, it’s time to start looking around. Some traders zoom out to a three-day or weekly time frame to see when assets correct to higher time frame support levels or previous all-time highs as a sign to invest.

Others look for price to flip key moving averages like the 118 DMA, 200 WMA and 200 DMA back to support. On-chain fanatics…

Click Here to Read the Full Original Article at Cointelegraph.com News…