Bitcoin (BTC) price may climb by more than 50% in September, a month otherwise considered ominous for the cryptocurrency due to its poor historical returns.

BTC price double-bottom and then to $30K?

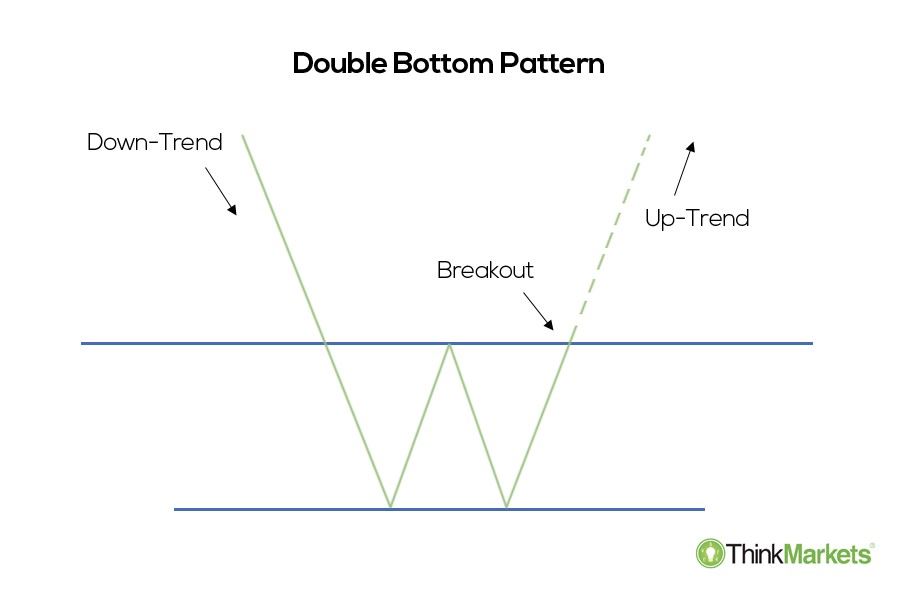

The conflicting upside signal comes from a potential double-bottom pattern on Bitcoin’s longer-timeframe charts against the U.S. dollar. Double-bottoms are bullish reversal patterns that resemble the letter “W” due to two lows and a change in direction from downside to upside.

Bitcoin’s decline below $20,000 in July, followed by a sharp recovery toward $25,000 and a subsequent return to the $20,000-level in August, partially confirms the double-bottom scenario. The cryptocurrency would complete the pattern after rebounding toward $25,000.

A W-shaped price move in an ideal scenario could be followed by another sharp move higher—a double-bottom breakout.

Meanwhile, a double-bottom’s upside target is found after measuring the distance between the pattern’s peak (neckline) and lowest levels and adding the outcome to the breakout point, as illustrated below. In other words, a potential 50% price rally.

As a note of caution, double-bottom setups carry a small degree of failure risks, about 21.45%, according to Samurai Trading Academy’s study of popular charting patterns.

Market slips back into “extreme fear”

Bitcoin’s bullish reversal scenario occurs amid general price depreciation across the risk-on markets.

Originally, BTC’s descent to $20,000 started after Federal Reserve Chairman Jerome Powell reasserted his hawkish stance on inflation at Jackson Hole last week. It further prompted the Bitcoin market sentiment to fall into the “extreme fear” category, per the popular Fear and Greed index, or F&G.

The market is not enjoying $BTC hanging around $20k. Back into Extreme Fear today.

Live chart: https://t.co/Jr5151zN7I pic.twitter.com/UnztrZP7FP

— Philip Swift (@PositiveCrypto) August 31, 2022

But to Philip Swift, creator of Bitcoin data source LookIntoBitcoin, the market sentiment is not as fearful as it was in June due to a “huge amount of forced selling” at now-defunct crypto hedge fund Three Arrows Capital and the stablecoin project Terra.

“The F&G score is nowhere near as intensely fearful as it was back when the score dropped to as low as 6; it is currently at 23,” Swift explained, adding:

“There was blind panic back then,…

Click Here to Read the Full Original Article at Cointelegraph.com News…