On Friday, August 19, the total crypto market capitalization dropped by 9.1%, but more importantly, the all-important $1 trillion psychological support was tapped. The market’s latest venture below this just three weeks ago, meaning investors were pretty confident that the $780 billion total market-cap low on June 18 was a mere distant memory.

Regulatory uncertainty increased on Aug. 17 after the United States House Committee on Energy and Commerce announced that they were “deeply concerned” that proof-of-work mining could increase demand for fossil fuels. As a result, U.S. lawmakers requested the crypto mining companies to provide information on energy consumption and average costs.

Typically, sell-offs have a greater impact on cryptocurrencies outside of the top 5 assets by market capitalization, but today’s correction presented losses ranging from 7% to 14% across the board. Bitcoin (BTC) saw a 9.7% loss as it tested $21,260 and Ether (ETH) presented a 10.6% drop at its $1,675 intraday low.

Some analysts might suggest that harsh daily corrections like the one seen today is a norm rather than an exception considering the asset’s 67% annualized volatility. Case in point, today’s intraday drop in the total market capitalization exceeded 9% in 19 days over the past 365, but some aggravants are causing this current correction to stand out.

The BTC Futures premium vanished

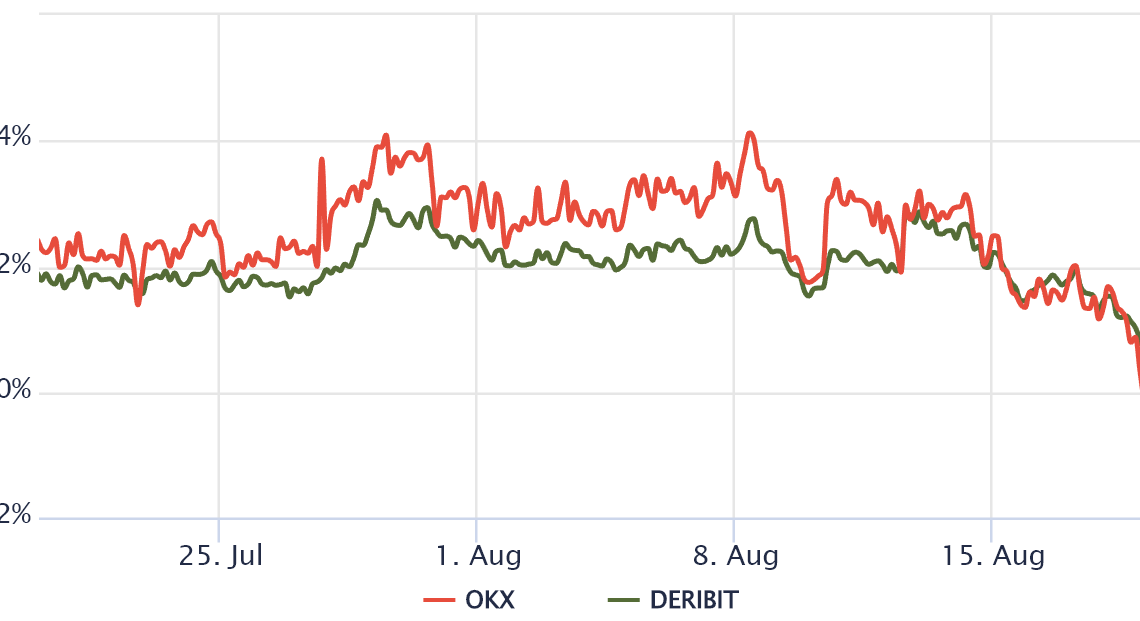

The fixed-month futures contracts usually trade at a slight premium to regular spot markets because sellers demand more money to withhold settlement for longer. Technically known as “contango,” this situation is not exclusive to crypto assets.

In healthy markets, futures should trade at a 4% to 8% annualized premium, which is enough to compensate for the risks plus the cost of capital.

According to the OKX and Deribit Bitcoin futures premium, the 9.7% negative swing on BTC caused investors to eliminate any optimism using derivatives instruments. When the indicator flips to the negative area, trading in “backwardation,” it typically means there is much higher demand from leveraged shorts who are betting on further downside.

Leverage buyers’ liquidations exceeded $470 million

Futures contracts are a relatively low-cost and easy instrument that allows the use of leverage. The danger of using them lies in liquidation, meaning the investor’s margin deposit becomes insufficient to cover their positions. In these cases, the…

Click Here to Read the Full Original Article at Cointelegraph.com News…