Bitcoin (BTC) briefly broke above $25,000 on Aug. 15, but the excitement lasted less than an hour and was followed by a 5% retrace in the next 5 hours. The resistance level proved to be tougher than expected, but may have given bulls false hope for the upcoming $335 million weekly options expiry.

Investors’ fleeting optimism reverted to a sellers’ market on Aug. 17 after BTC dumped and tested the $23,300 support. The negative move took place hours before the release of the Federal Open Markets Committee (FOMC) minutes from its July meeting. Investors expect some insights on whether the Federal Reserve will continue raising interest rates.

The negative newsflow accelerated on Aug. 16 after a federal court in the United States authorized the U.S. Internal Revenue Service (IRS) to force SFOX cryptocurrency broker to reveal the transactions and identities of customers who are U.S. taxpayers. The same strategy was used to obtain information from Circle, Coinbase and Kraken between 2018 and 2021.

This movement explains why betting on Bitcoin price above $25,000 on Aug. 19 seemed like a sure thing a couple of days ago, and this would have incentivized bullish bets.

Bears didn’t expect BTC to move above $24,000

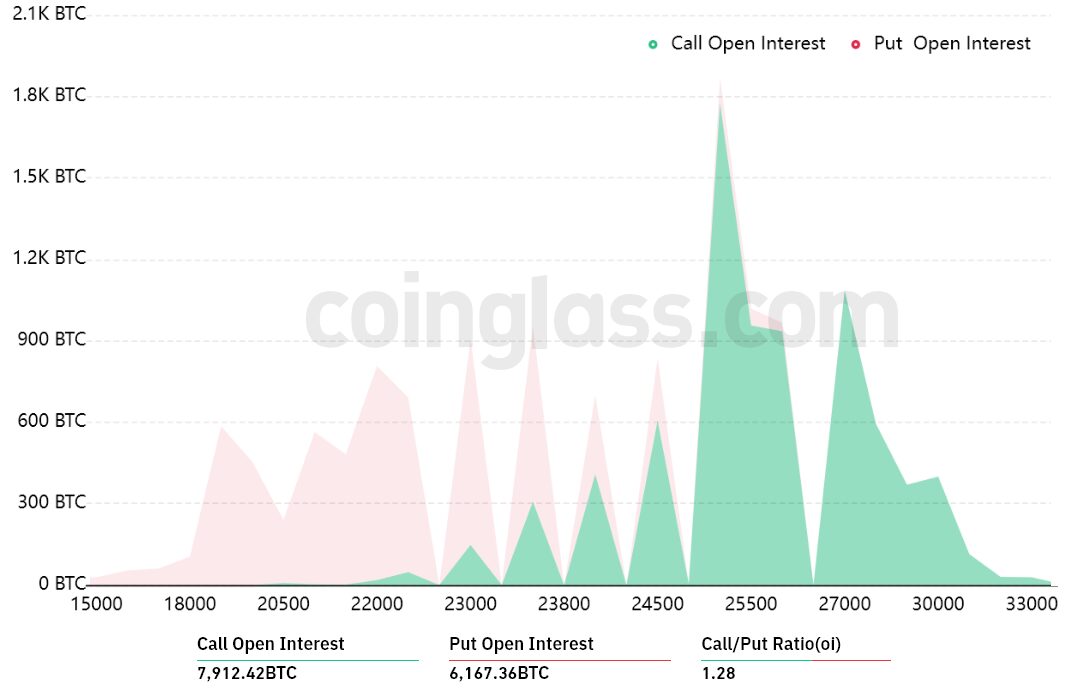

The open interest for the Aug. 19 options expiry is $335 million, but the actual figure will be lower since bears were overly-optimistic. These traders might have been fooled by the short-lived dump to $22,700 on Aug. 10 because their bets for Friday’s options expiry extend down to $15,000.

The 1.29 call-to-put ratio shows the difference between the $188 million call (buy) open interest and the $147 million put (sell) options. Currently, Bitcoin stands near $23,300, meaning most bullish bets are likely to become worthless.

If Bitcoin’s price moves below $23,000 at 8:00 am UTC on Aug. 19, only $1 million worth of these call (buy) options will be available. This difference happens because a right to buy Bitcoin at $23,000 is useless if BTC trades below that level on expiry.

There’s still hope for bulls, but $25,000 seems distant

Below are the three most likely scenarios based on the current price action. The number of options contracts available on Aug. 19 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $21,000 and $23,000: 30 calls vs. 2,770 puts. The net result favors the put…

Click Here to Read the Full Original Article at Cointelegraph.com News…