[the_ad id="1637"]

[ad_1]

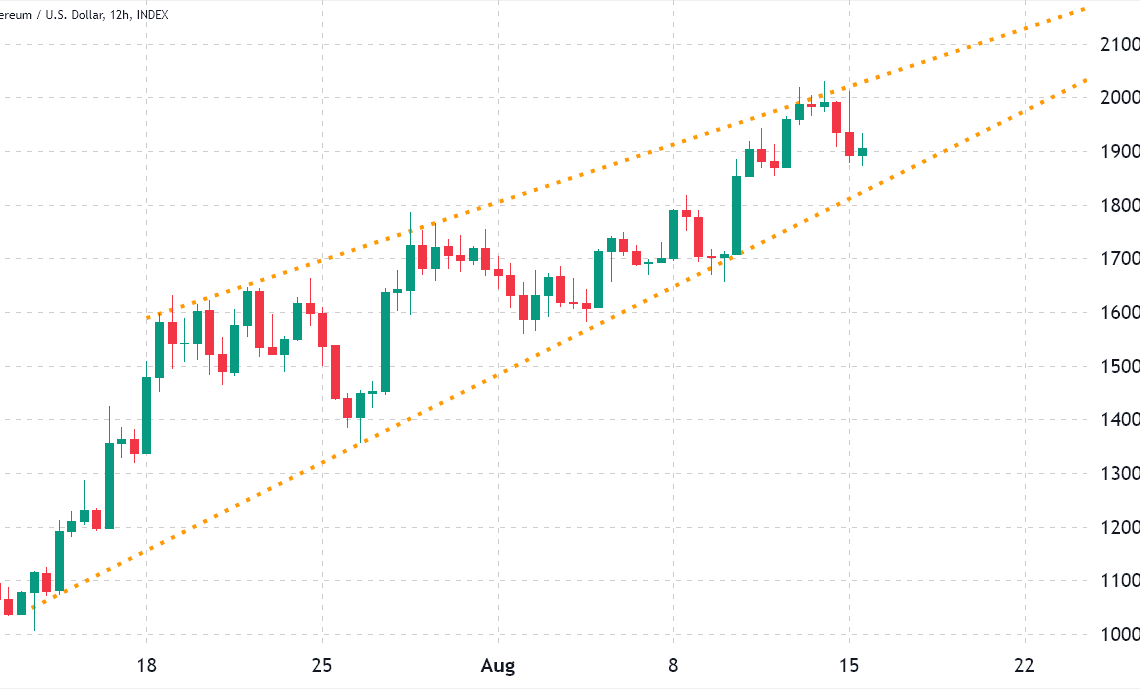

Ether (ETH) rejected the $2,000 resistance on Aug. 14, but the solid 82.8% gain since the rising wedge formation started on July 13 certainly seems like a victory for bulls. Undoubtedly, the “ultrasound money” dream gets closer as the network expects the Merge transaction to a proof-of-stake (PoS) consensus network on Sept. 16.

Some critics point out that the transition out of proof-of-work (PoW) mining has been delayed for years and that the Merge itself does not address the scalability issue. The network’s migration to parallel processing (sharding) is expected to happen later in 2023 or early 2024.

As for the Ether bulls, the EIP-1559 burn mechanism introduced in August 2021 was essential to drive ETH to scarcity, as crypto analyst and influencer Kris Kay illustrates:

~ 11% of all $ETH supply now staked.

~ 2% of all $ETH supply now burned

~ 100% of $ETH is ultra-sound money

+=

few

— Kris Kay | DeFi Donut (@thekriskay) August 15, 2022

The highly anticipated move to the Ethereum beacon chain enjoyed a lot of criticism, despite eliminating the need to support the expensive energy-intensive mining activities. Below, “DrBitcoinMD” highlights the impossibility for ETH stakers to withdraw their coins, creating an unsustainable temporary offer-side reduction.

Anyone still putting their faith behind the gangly Russian pseudointellectual and the Ethereum ponzi deserves what’s coming to them. pic.twitter.com/gjxHXdzuSK

— Doc (@DrBitcoinMD) August 11, 2022

Undoubtedly, the decreased amount of coins available for sale caused a supply shock, especially after the 82.8% rally as Ether has recently undergone. Still, these investors knew the risks of ETH 2.0 staking and no promises were made for instant transfers post-Merge.

Option markets reflect dubious sentiment

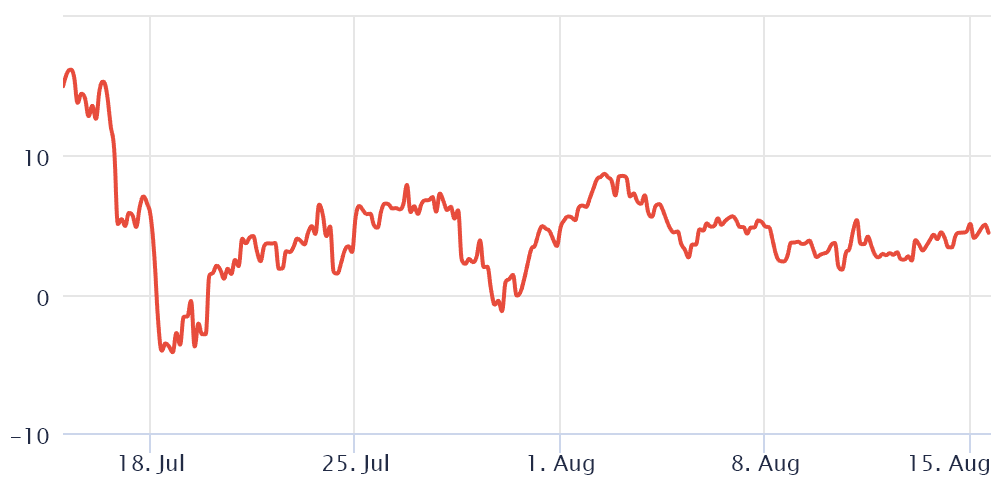

Investors should look at Ether’s derivatives markets data to understand how whales and arbitrage desks are positioned. The 25% delta skew is a telling sign whenever traders overcharge for upside or downside protection.

If those market participants feared an Ether price crash, the skew indicator would move above 12%. On the other hand, generalized excitement reflects a negative 12% skew.

The skew indicator remained neutral since Ether initiated the rally, even as it tested the $2,000 resistance on Aug. 14. The absence of improvement in the market sentiment is slightly concerning because…

Click Here to Read the Full Original Article at Cointelegraph.com News…

[ad_2]

[the_ad id="1638"]