The S&P 500 and the Nasdaq have declined for five consecutive weeks, indicating that traders continue to reduce exposure to risky assets. Bitcoin’s (BTC) close correlation with United States equity markets has resulted in its price remaining under pressure.

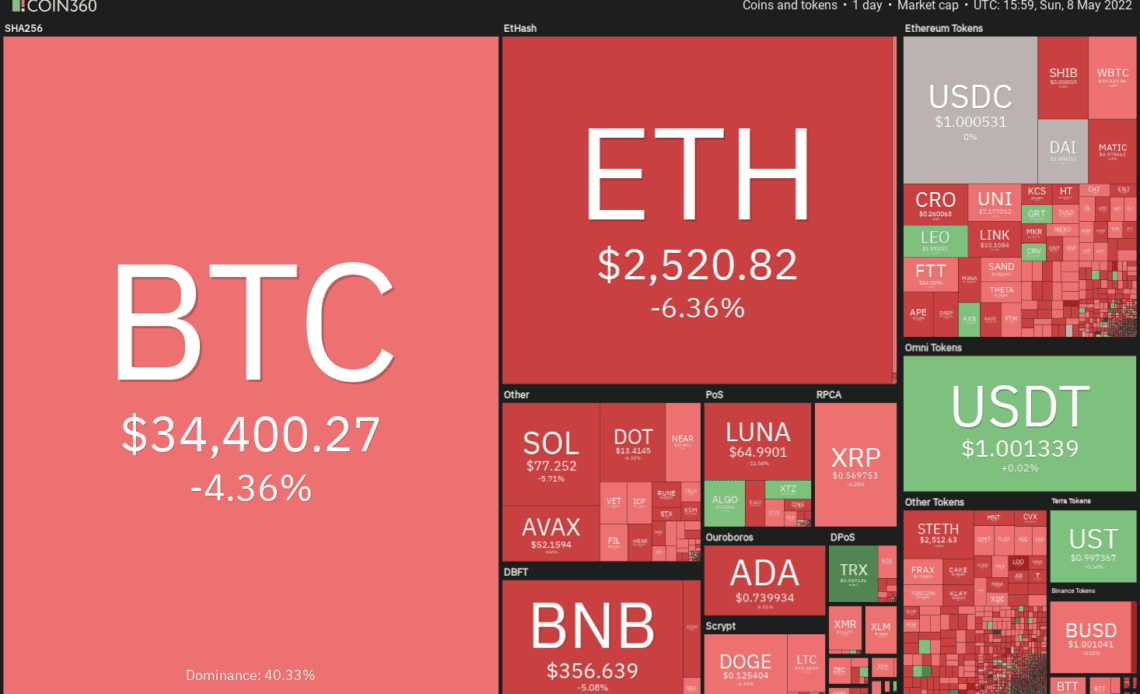

Bitcoin has extended its decline during the weekend and is now on track for its sixth successive weekly loss, the first such occurrence since 2014. The weakness in Bitcoin has pulled down the entire crypto markets, whose market capitalization has dipped below $1.6 trillion.

When the sentiment is bearish, traders sell on every negative news. The depeg of Terra’s U. S. dollar stablecoin TerraUSD (UST) also appears to be increasing sell pressure across the crypto market.

After Bitcoin’s six consecutive weekly closes in the red, is it time for a recovery? Let’s study the charts of the top-5 cryptocurrencies that are showing signs of stabilizing in the near term.

BTC/USDT

Bitcoin turned down from the 20-day exponential moving average (EMA) of $38,268 on May 5 and plummeted below the support line of the ascending channel. This move also invalidated the positive divergence on the relative strength index (RSI).

The moving averages have started to turn down and the RSI is nearing the oversold zone, signaling that bears are in control.

The BTC/Tether (USDT) pair has a minor support at $34,322 but if bulls fail to defend this level, the decline could extend to $32,917. This is a crucial level to keep an eye on because if it cracks, the pair could witness panic selling and the next stop may be $28,805.

If the price turns up from $34,322, the recovery could face selling near the 20-day EMA. If the price turns down from this level, it will suggest that the sentiment remains negative and traders are selling on rallies. That could enhance the prospects of a resumption of the downtrend.

This negative view could invalidate in the short term if the bulls push and sustain the price above the 20-day EMA. If that happens, the pair could rise to the 50-day simple moving average (SMA) of $41,466.

The downsloping moving averages indicate that bears are in command but the oversold levels on the RSI suggest that a relief rally or a consolidation is possible in the near term. If the recovery fails to rise above the 20-EMA, the bears may maintain the selling pressure and the pair could drop to…

Click Here to Read the Full Original Article at Cointelegraph.com News…