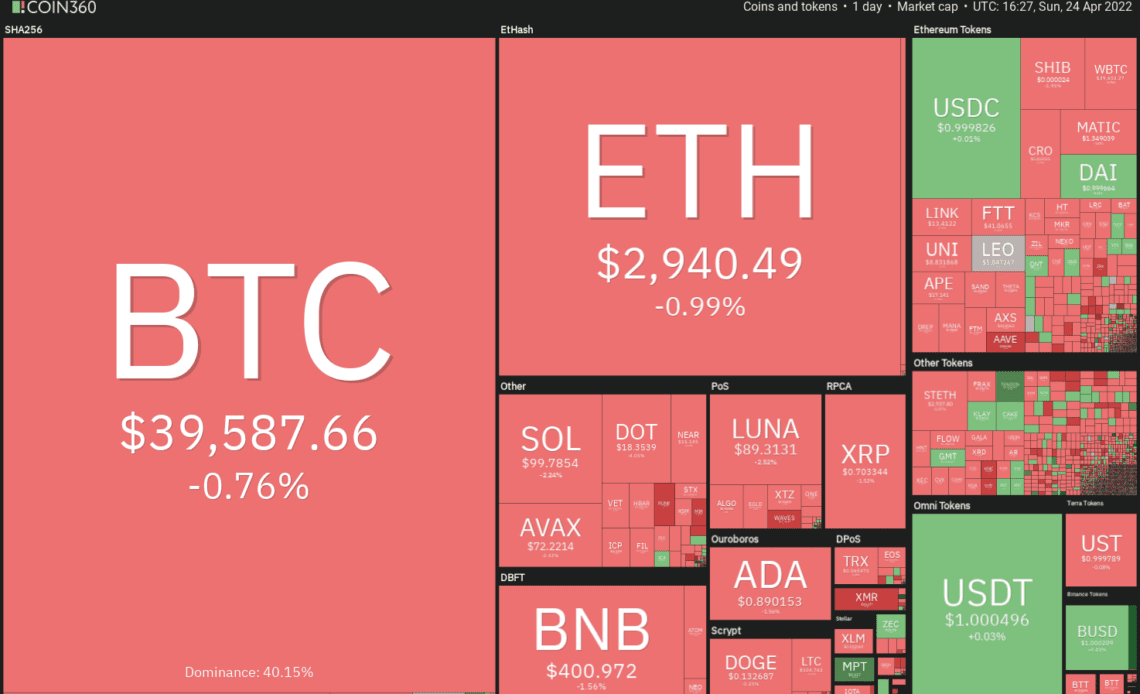

Bitcoin (BTC) and several altcoins are trading in a tight range during the weekend, suggesting that investors are undecided about the next directional move. Traders may be waiting for Wall Street to open before placing large directional bets because Bitcoin has been tightly correlated with the S&P 500 in the past few days.

The sharp fall in the United States equity markets on April 22 suggests that investors are increasingly nervous about the hawkish stance of central banks. The market expects a 250 basis points rate hike by the U.S. Federal Reserve in 2022. In addition, the European Central Bank is expected to raise rates for the first time since 2011, according to a Reuters source.

Coinglass data showed that funding rates across crypto derivatives exchanges remained negative during the weekend, signaling a bearish bias. The failure to sustain a recovery has pulled the Crypto Fear & Greed Index back into the “extreme fear” territory.

Could Bitcoin attract strong buying at lower levels? If that happens, select altcoins could outperform to the upside. Let’s study the charts of the top-5 cryptocurrencies that show a positive chart structure.

BTC/USDT

Bitcoin broke below the psychological support at $40,000 on April 22 but the bears have not been able to build upon this advantage. The successive inside-day candlestick patterns on April 23 and April 24 suggest indecision among the bulls and the bears.

The 20-day exponential moving average (EMA) of $41,150 is sloping down and the relative strength index (RSI) is in the negative zone, indicating that sellers have a slight edge. If bears sink and sustain the price below $39,000, the BTC/Tether (USDT) pair could drop to the support line of the ascending channel. The bulls are expected to defend this level with vigor.

If the price rebounds off the support line with force, it will indicate strong demand at lower levels. The bulls will have to push and sustain the price above the 50-day simple moving average (SMA) of $41,993 to indicate that the correction may be over. The pair may then attempt a rally to the 200-day SMA of $47,828.

Alternatively, if the price breaks below the channel, the selling could intensify further and the pair may drop to $34,322 and later to $32,917.

The 4-hour chart shows that the price is stuck inside a tight range between $39,177 and $39,980. This indicates…

Click Here to Read the Full Original Article at Cointelegraph.com News…